In case you have not being reading the papers, strikes have returned to the US economy. Old school strikes by the United Auto Workers union looks to be on the cards. While the SAG AFTRA strike continues to disrupt the film and television industry. The Bureau of Labour Statistics provides annual strike data which we can normalise by using days of idleness as percent of working time. The most recent data point is August 2023, which shows the uptick in striking.

Given the centrality of the US auto sector to the US unions, you would think that the prevalence of strikes would have been a problem for General Motors in the 50s and 60s. But GM stock performed well during this period.

What really seems important was employment. Rising unemployment naturally led to less strikes, but was also naturally bad for consumer facing companies like GM. GM stock peaking out in 1965 was signalling a peak in US employment, and the end of the road for pro-labour policies. The rising unemployment of the 1970s heralded a political change of more choice. Businesses could choose workers, and consumers could choose which products to buy. One obvious feature was structurally higher unemployment

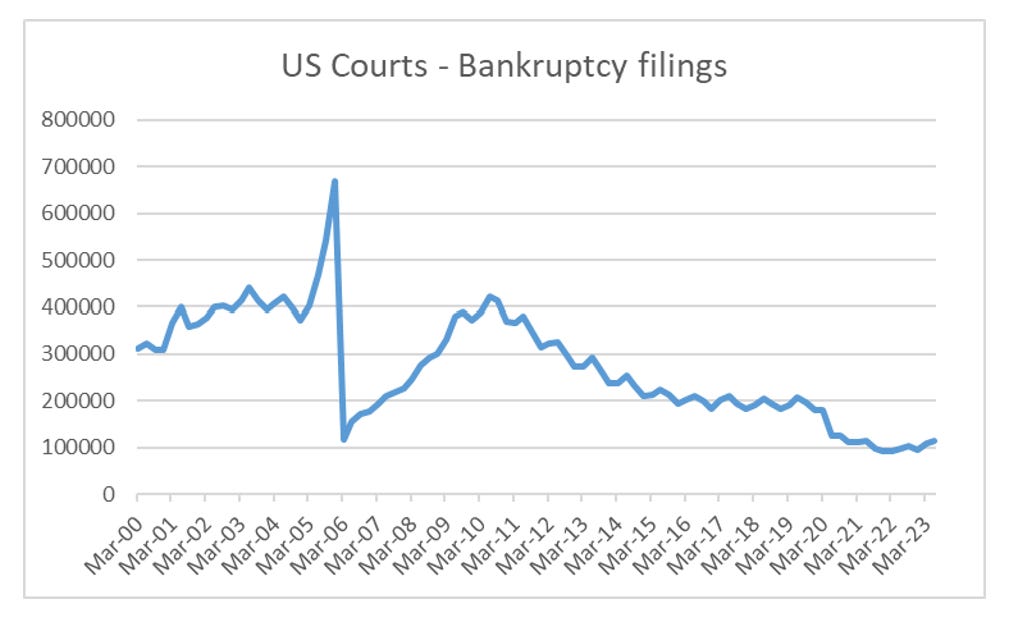

Another feature was that for businesses, bankruptcy became more likely. But after the GFC, governments have worked hard to keep bankruptcy to a minimum. Using data from the American Bankruptcy Institute, bankruptcies rose through most of the 1990s into the early 2000ss, before staging a huge fall in 2005, and then rise into the GFC, before collapsing again.

More timely quarterly data is not really showing any spike in total bankruptcies. In face we seem to be continuing at low trends. Pro-labour is also in many ways, pro-stability. I do not expect bankruptcies to increase.

This seems to be borne out by credit spreads, which remain at very tight levels.

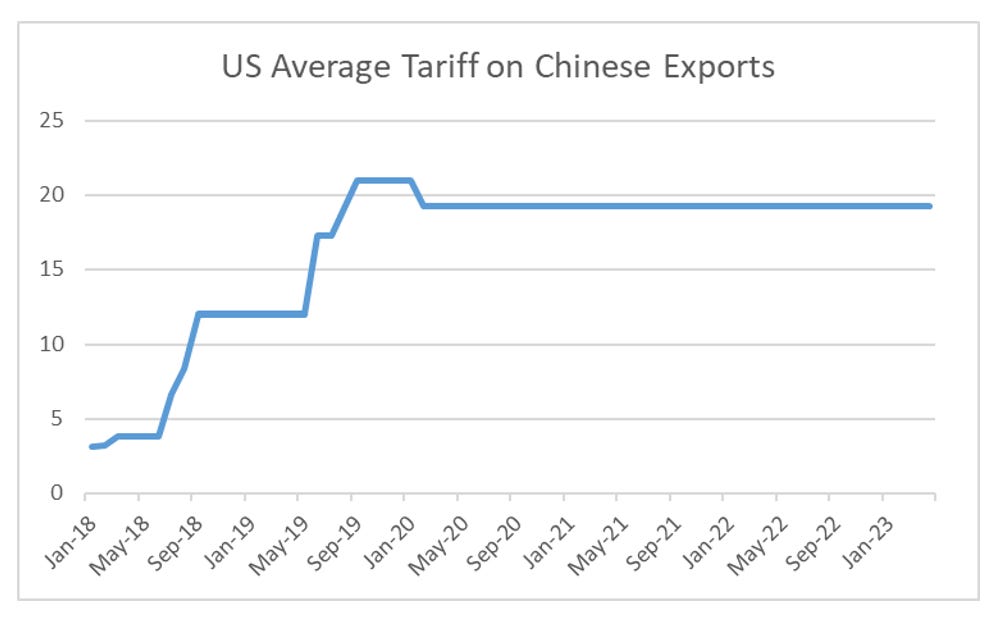

The problem of these policies are already becoming apparent. One of the features of the post World War II era was that protectionism drove the rise of various national champions. The US is using tariffs to try and weaken Chinese competitors. Many US government subsidies require products to be made in the US.

For old guys like me, I remember the laziness of national champions. The first car my family owned was a 1969 Holden EK, which I was still driving in the early 1990s. It weighted at least two tonnes, needed to be refilled every day, and an oil top up twice a month. Holden was an Australian brand, owned by General Motors, and was manufactured in Australia.

Only 14 years later in 1983, we bought a Japanese made Toyota Corolla, which was better in ever way (except maybe styling). I am trying to make two points here. Firstly, the pro-labour era also limited consumer choice, even as it increased wages. And the pro-capital era, allowed more competition.

When I look at the current world, I see Apple is trying to sell me essentially the same phone they made 5 or 6 years ago. Huawei and SMIC have managed to build a 5G phone that is using a Chinese processor. I think Chinese phone offer competition not only on the hardware, but also take a smaller cut from the app store at around 15% compared to 30% from Apple and Google. Another Apple supplier, Broadcom has achieved success through cutting R&D expenditure as much as possible, and using the cash flow for share buybacks or capital returns. Texas Instruments likewise. The end game for all these companies is that their cashflow no longer flows to shareholders. In a pro labour world, it will either flow to employees, or the government (taxes). And then when competition returns, ultimately to R&D or bankruptcy. There are many US corporates which to me look at risk from such a shift, including companies like McDonalds. So equities look problematic to me. For me, the pro-labour trade that I like the most is long GLD/short TLT.

Well as GM shows above, in the short term the boost from higher wages and protectionism is not necessarily bad, but at some point rising wages and rising interest rates will eat into corporate America’s profits. For me, short bonds remains the core trade.