ONCE YOU GET TO FOREIGN RESERVE STATUS DOES MONETARY AND FISCAL POLICY NO LONGER MATTER?

Rising food and energy prices seem only to affect countries that have NOT achieved foreign reserve status

Food prices have spiked in 2021. Previous spikes have been associated with financial crises. A spike in 1996 happened prior to the Asian Financial Crisis, 2007 before the GFC and 2011 before the Eurocrisis.

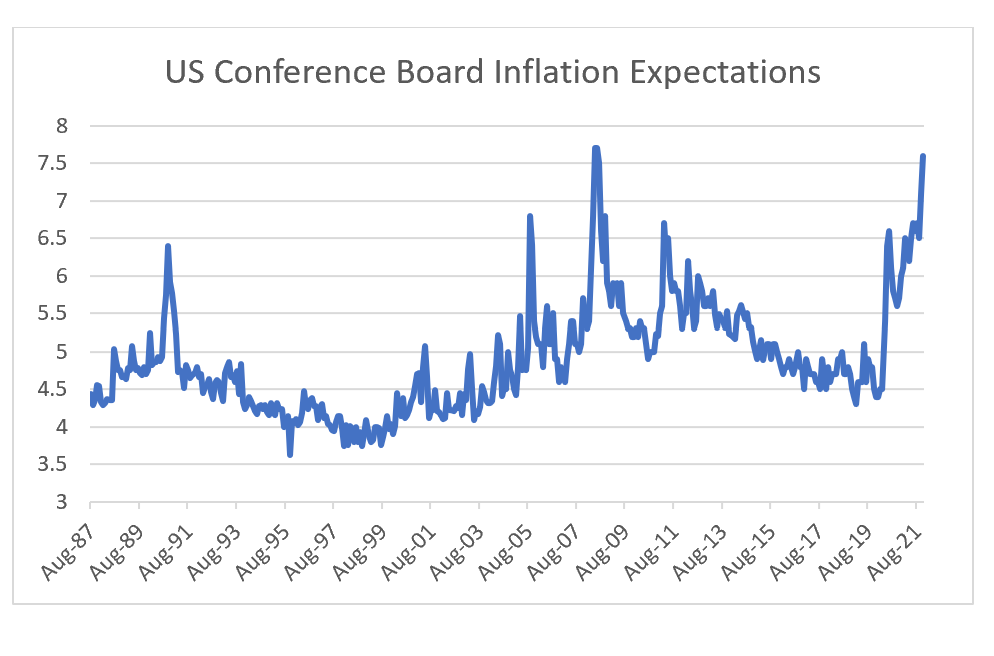

Even in the US, where food expenditure makes up a relatively low percentage of total spend, we have seen inflation expectations spike.

While the US has just started to taper its bond purchases, other countries such as Brazil, Turkey and Korea have been raising interest rates to counter food inflation. Brazil has raised rates from 2% to nearly 8%.

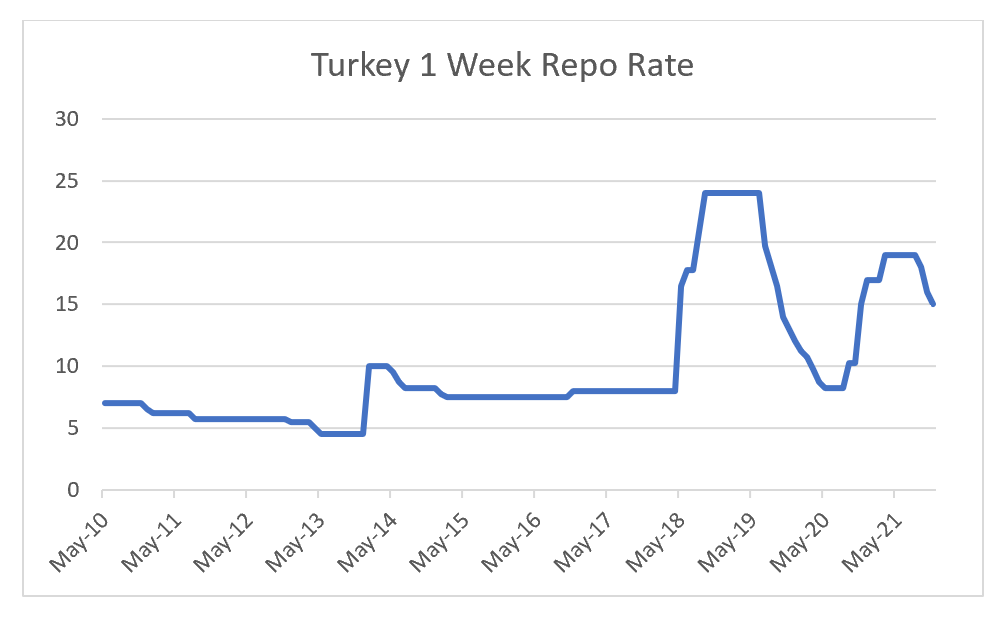

Turkey has also raised rates, although in a slightly haphazard way, and with a lot of noise.

South Korea, which has a far more advanced industrial base than either Turkey or Brazil, has also raised interest rates.

What is noticeable is that Brazil, Turkey and Korea have all seen their currencies weaken in 2021, despite raising interest rates, with Turkey being very weak indeed. When I originally looked at Japan, in 1990s and 2000s, I thought the reason it could have very low interest rates and no inflation was due to its huge capital surplus, which was unlike any other country. However as low interest rates have spread to the US, UK, Australia and Europe, this explanation no longer suffices. One possible answer is that once a country reached reserve currency status, its bonds and currencies will be bought regardless of policy. Foreign reserve holdings of USD, Euro, Yen and Sterling have not shown any particular sign of falling despite their efforts at radical monetary and fiscal policy (COFER data). That Sterling remains a reserve currency highlights how difficult it is to lose reserve currency status.

COFER data which is complied from a survey of foreign reserve holders begins to break out data for Chinese Yuan, Australian Dollar and Canadian Dollar in recent years. Here too, we only see foreign reserve holdings rise.

If this analysis is correct, then with Chinese Yuan being treated as reserve currency, then fears of an emerging market style crisis in China are overdone, if only because it has become too big to fail. If that is the case, then Chinese assets look attractive.