NIIP AND THE MISSING TRILLIONS

NIIP should balance - but there seems to be three to four trillion US dollars missing.

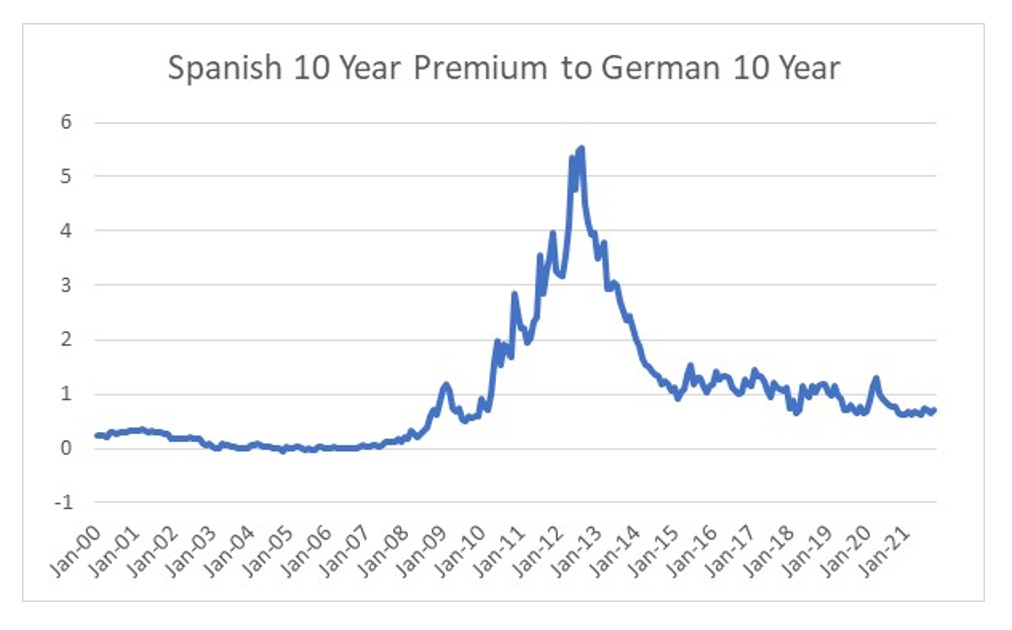

Net International Investment Position (NIIP) is a financial concept that measures net foreign assets versus net foreign liabilities. They have typically had a mean reverting nature, so whenever NIIP has become extreme, they can signal financial market change. For instance, the extreme divergence between Germany and Spain was a good lead signal for the Eurocrisis.

As a rule, a positive NIIP should indicate a currency with an appreciating bias, and a negative NIIP should indicate a currency with a depreciating bias. Within the Eurozone, and a single currency regime, this expresses itself as a premium that Spanish bonds will have over German bonds. A spread that began to manifest in 2008.

Using NIIP analysis has also yielded effective results in Asia. The only issue with using NIIP analysis for Asian nations is that foreign reserves need to be removed from the NIIP analysis. I call this private sector NIIP or adjusted NIIP. The adjusted NIIP has tended to highlight the negative position of Korea versus Japan.

One upshot of this difference in adjusted NIIP is that in periods of stress, the Korean won weakens and the Yen strengthens, such as in 1998 and 2008, causing sudden spikes in the relative exchange rate.

China does not have such a long history of NIIP data, but again the adjusted NIIP showed the potential for China to suffer from devaluation pressure in 2014/5.

Adjusted NIIP seemed to also work with the US, at least until recently. In 2000, at the top of the dot com bubble, the US adjusted NIIP shifted in to deficit, marking a top in both the US dollar and in the equity markets. However in recent years the US private sector NIIP has far exceeded the extremes seen in 2000.

The extremeness of the US NIIP position suggests that potentially NIIP numbers are wrong? As noted in a recent post, Chinese foreign reserves are no longer growing with trade surpluses. The numbers imply that USD 4 billion of outflows from China since 2015.

However, if China has had near USD 4 trillion of outflows over the last 4 years, then that should imply a large improvement in private sector NIIP, much like we have seen in Korea in recent years. One possible reason is that the outflows have been unreported, and hence Chinese NIIP is understated. If that is the case then we should find that world NIIP should show an in increasing discrepancy. Theoretically, global NIIP should sum to zero. But just like current account deficits and surpluses should also sum to zero, this rarely happens. However when we spilt NIIP into surplus and deficit nations, we can see that the gap has been widening since 2017.

If the missing USD 4 trillion of NIIP is in fact hidden Chinese money, it would imply that the Chinese Yuan will have a tendency to strengthen rather than weaken, particularly against the US dollar.