NIIP AND THE MISSING TRILLIONS - PART 2

Closer examination of NIIP numbers suggest China is the source of the discrepancy

The US has the longest history of providing details on Net International Investment Position (NIIP), going back to the 1970s. The NIIP deficit only really began to widen in 1990s, and reached a crescendo at the peak of the dot-com bubble. The current widening of the NIIP is larger than anything seen before.

The initial stage of the US NIIP moving negative was driven by the build up of treasury holdings by Asian nations during the 1990s. To give some context, we separate US NIIP deficit by public (treasuries held as foreign reserves) and private (everything else - equities, corporate bonds, real estate etc.). We then divide by GDP to make it comparable over time. Private NIIP at 35% of US GDP is already 3 times larger than the dot-com bubble and public NIIP at 35% is also at extremely high levels.

So US deficits should turn up at surpluses in other countries. If we look at the other major potential sources of capital, Japan, Europe and China, we do not see a commensurate increase in surpluses.

The Eurozone could potentially be source of the discrepancy. The Eurozone combines nations with large surpluses such as the Netherlands and Germany with large deficit nations like Spain and France as well as nations that are moving from deficit to surplus like Italy. To check with the Eurozone is the problem, we took each individual nation of the EU and summed their NIIP and compared to the NIIP for the Eurozone. We found that even though there is a difference in NIIP, it is consistent over time, so unlikely to explain the growth seen in US deficit.

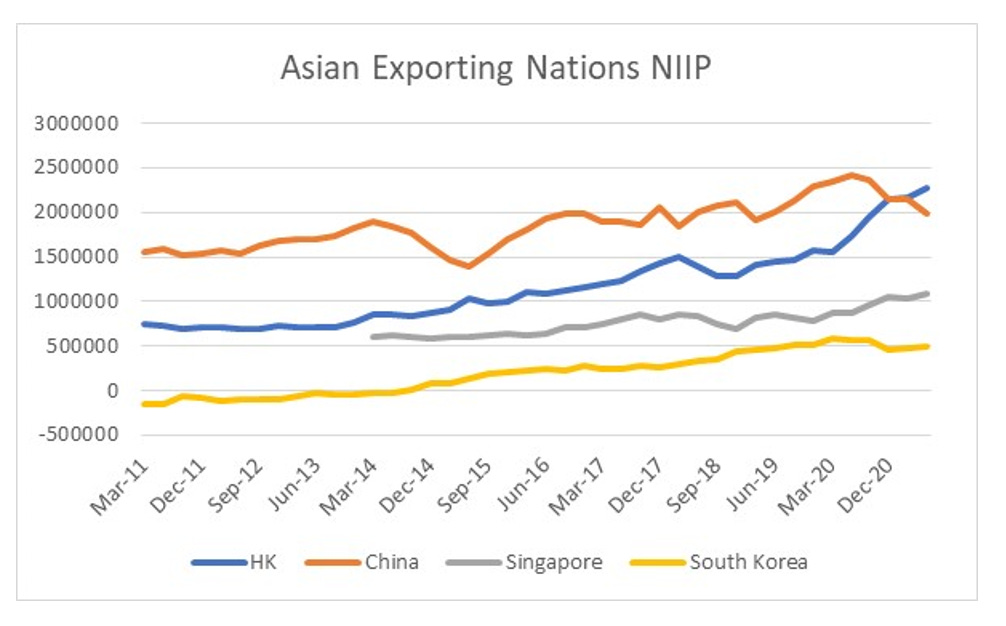

We can compare China’s NIIP position to other export dependent Asian nations, so see whether there is any discrepancy. HK notably now has a larger NIIP surplus than mainland China, and South Korea has seen its NIIP move from deficit to surplus. China has implemented capital controls, and has cracked down on Chinese corporates investing overseas. This would give the Chinese private sector strong incentives to hide foreign assets, leading to the NIIP being depressed.

If China is really understating foreign assets by USD 4 trillion, then it would take it to the largest NIIP surplus nation in the world, far in excess of Japan, which would make China the main capital supplier to the world. This analysis implies that any weakness in the Chinese Yuan should have happened in recent years as outflows increased. Going forward, if outflows turns to inflows then the Yuan could strengthen. The biggest macro question then becomes, what makes China bring its capital home? That answer is more politics than economics unfortunately.