A few weeks ago I wondered if rockets and space could constitute a mega trade. Mega trades for me are obvious trades, that for various reasons the market cannot accept (usually muscle memory). As mentioned in a recent post, when I saw Elon Musk, Jeff Bezos and Richard Branson all launch “space” ventures, my first thought was that we are getting close to a top in the tech cycle. Space investing has been a “blackhole”, with only governments been able to sustain the perennial losses associated with it. Human spaceflight was invented in the late 1950s. We soon learnt that there was little to be gained from sending people to space, and basically human spaceflight numbers have flatlined ever since (data from www.space4589.org).

But the technology that allowed human spaceflight had no strong commercial purpose, the rocket technology did lead to the development of intercontinental ballistic missile (ICBMs), which unlike human space travel continued to thrive. I am taking that the assumption that a country would only grow is nuclear stockpile if I was also growing its ICBM stockpile.

Now as mentioned in a recent post, the advent of Elon Musk’s SpaceX has meant that the satellite industry has entered a period of robust growth. What I find interesting is that Starlink has now proved itself as having a strong military purpose, which means that governments everywhere are going to work hard to copy SpaceX technology, and to launch their own Starlinks. That is the satellite business is going to follow the ICBM trajectory, not the human space flight trajectory, in my view. The evidence is plain to see.

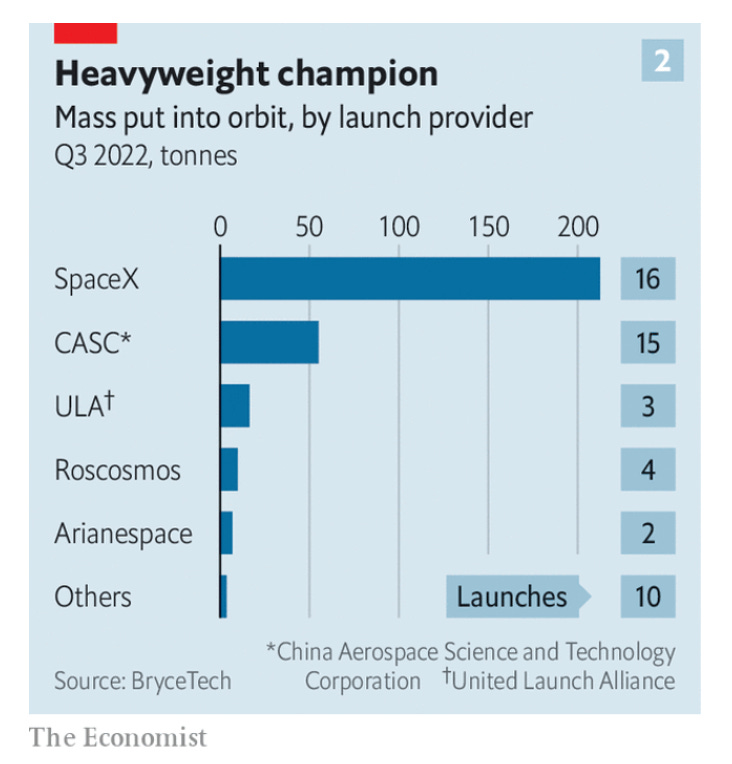

Government funded cheap space launch technology actually makes the possibility of human exploration of the solar system much more plausible. Whenever people have thought about space travel, you have to solve a few very big problems. The energy needed to escape Earth’s gravity is phenomenal. And any ideas of colonisation of the moon or mars requires a phenomenal amount of equipment (i.e. mass) moved from earth to orbit. The problem again was that until SpaceX can along, we were not sending enough mass into space to be able to do that. Again according to Economist figures, SpaceX is increasing the mass launched hugely.

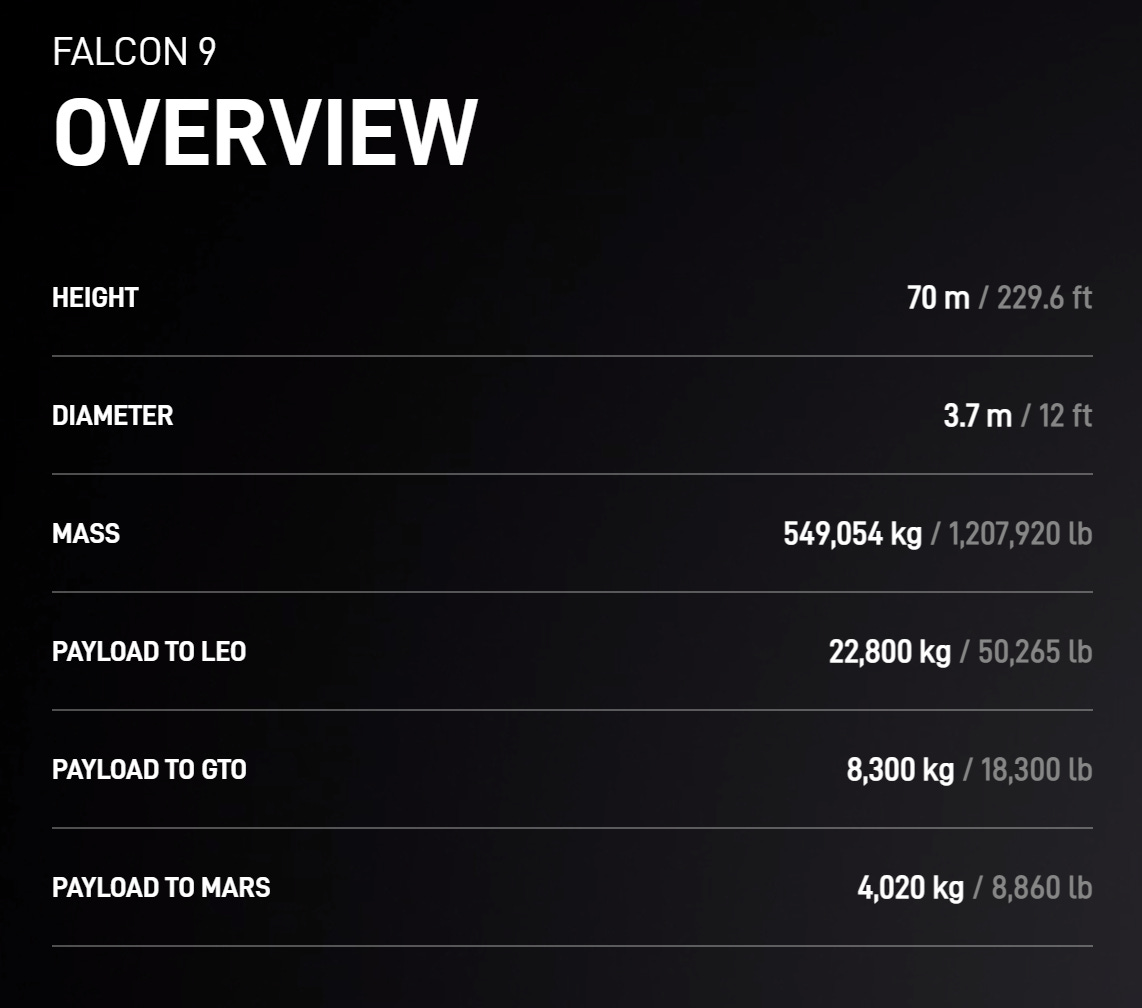

SpaceX has been moving this way for years. However, as far as I am aware, both SpaceX and Starlink are loss making, meaning that if funding conditions changed, you could see space flight drop off again. Now that Starlink is a critical military asset, it it easy for me to see that trends in space travel will follow the ICBM trend - exponential and competitive growth, funded by governments without thought to cost or profit. So I am pretty sure rocket and satellite business is going to see rapid growth. But for this to count as a mega trade, it needs to big enough to move the needle for GDP growth, or at least drive big profit growth in an investible sector? So I am trying to put some numbers together. Some basic data from the the SpaceX website helps. Falcon 9 can launch 22 tonnes of mass to a low earth orbit (LEO), 8.3 tonnes to a Geostationary orbit, or 4 tonnes to an ex-earth orbit.

Once you have escaped Earth’s gravity, the need for fuel rapidly drops. The recent Double Asteroid Redirection Test (DART), basically smashed 610kg into an asteroid to see if it could alter its direction. It travelled 11m km, or 30 times the distance to the moon, or a quarter of the distance to Mars. So outside of satellites, what else could SpaceX launch? Well the next big think is the Lunar Orbital Platform Gateway (LOP-G). The mass of the LOP-G is unknown at the moment, but mass of the international space station is 420 tonnes. So in a mad space race, environment, we could see 4 LOP-G being launched annually (big stretch), we would imply maybe 4 to 5 times increase in current launches, and lets say 2000 tonnes of total payload launch. Assuming it take 20 tonnes of propellant to launch one one, this gets us to 40,000 tonnes of propellant. Is that a lot? The globally oil market is 4bn tonnes of oil annually, so not really. There could be potential is some of the more exotic gases used, such at xenon or liquid oxygen, but its hard to quantify that. DART needed relatively little fuel for repositioning once it left Earth’s orbit.

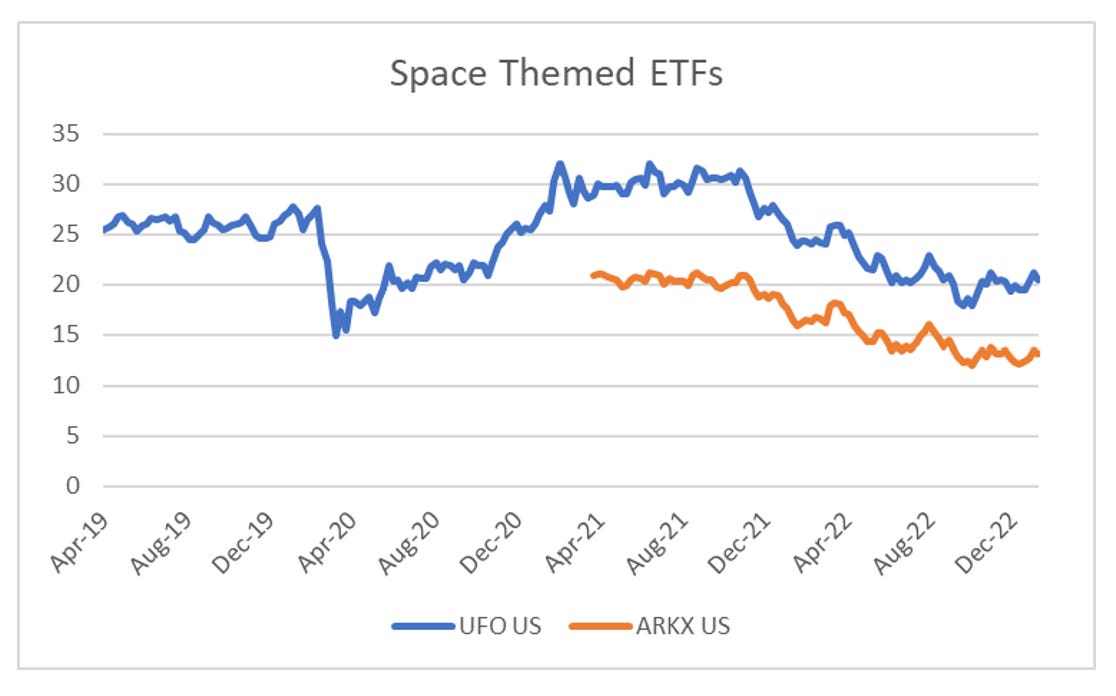

Finally, the best trades tend to see consolidation, and a generally unwillingness or inability of new entrants. This is typically based on a view that the industry is unprofitable, and will be a blackhole for new entrants. On this basis, SpaceX was a great trade 10 years ago. The success of Starlink is probably the worst possible thing for the industry as new entrants are going to cause the industry structure to change massively. This is probably why existing space based ETFs have traded so poorly.

I think space industry is going to see explosive growth, but investing profitably looks hard, and the numbers make it hard to see it making an impact on other industries, except maybe the communication industry. The good news, while researching space, I may have found another trade that does count as a mega-trade. Will post soon.

MEGA TRADE FOLLOW UP : FAILURE TO LAUNCH