MALL RATS

Volumes of real estate transactions for shopping malls are starting to fall. Last time this happened, rents began to fall a year later.

Shopping mall REITS have been a fantastic investment over the years. Not only have they provided investors with large capital gains, they have also typically offered above market dividend yields. My interpretation of the REIT model is that the operator collects rents from a diverse number of retailers. This is then passed on to the end investors after costs and financing. The REIT manager reduces risk by diversifying the retailers paying rent, and by also spreading the risk geographically. If the REIT manager can acquire more real estate assets at a yield higher than what it needs to pay out as dividend yield, then the REIT can issue more shares and grow indefinitely. Mall REITs have generally done well, except during the financial crisis.

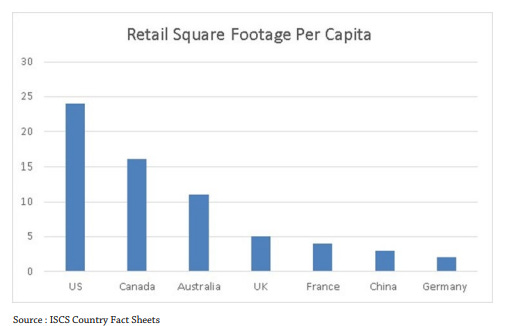

However, it seems to me that North America could well have too many shopping malls. On a per capita basis, the US has twice the space of Australia and 5 times that in the UK.

One source of REITs revenue growth comes from acquiring more malls. Intriguingly we have started to see volumes of real estate transactions for shopping malls fall. This means that the number of transactions to buy or sell properties is beginning to decline. Last time this happened, rents began to fall a year later. Perhaps it’s a sign that buyers believe rents have some downside risk?

Many people in the market are aware of the problems that the large department stores in the US are currently facing, and their resultant plans to retrench. This affects two of the largest shopping mall REITs that have the department stores as tenants. The reality is that the shopping mall REITs charge extremely low rents to the department stores. The large shopping malls use the department stores to lure traffic, and then make their money from higher rents charged to speciality retailers. Often the per square foot rent of the specialty retailer can be 30 times or higher that paid by the anchor tenant. Looking at the top 2 shopping mall operators, they disclose their top rent payers. Recent share prices performance of 8 shared tenants has been poor, and management commentary has seeming implied that they may also be looking to reduce store count.

It should also be pointed out that many tenants have a clause in their lease to reduce rents should an anchor close a store. Thus, even though the loss of rent due to an anchor closing is minimal, the knock-on effect of reduced rents from the remaining tenants is a serious concern for the REITs.

One of the other problems that shopping mall REITs face is that the size that the large department stores take up is more than 400 million square feet. The largest and most successfully specialty retailer is TK Maxx which currently has 100 million square feet. It is difficult to see any single retailer quickly being able to fill the space made vacant by department store closures.

Back in the lead up to the financial crisis we found that the share prices of REITs and their tenants were very closely related. Recently we have seen tenants share price weaken again, but REITS remain relatively strong.

Investors are advised to exercise caution with the shopping mall REITs.