Making substack my main form of work, has opened my mind to the enthusiasm of all things tech that many investors have. Substack is fantastic product for writing and distributing research, handling client relationships, and helping you monetise your content. And seeing how easy it is to create a viral tech community, I can see why people get so enthusiastic about things like crytpocurrencies. But using substack, has also made me painfully aware of how incentive structures can turn a good product into a problematic one. In my case, I would like my substack to be on the list of top financial substacks, along side other luminaries as Marc Rubinstein, Michael Fritzell and Doomberg (full disclosure - all three have endorsed me at some point, so I am returning the favour!). As far as I can tell, its your total subscribers that is used to rank substack. I show my subscriber growth below.

When you look at how my subscriber numbers have grown, you can see two periods of rapid growth. March and December. The growth in March was driven by my work on clearinghouses, which suddenly became very relevant. The growth in December was purely driven by me adding in email address from my contact list. That is, the subscriber growth in December was mainly driven by me, and was low quality, and the growth in March was driven by the quality of my research, and was high quality. If we looked at paying subscribers, that would be immediately obvious. What surprises me is that there a lot of financial substacks that don’t look like they are that popular to me - relatively few posts, with few comments or “likes” is a sign of poor readership, and yet they still rank above me. My “guess” is that the writers of these substacks have added a lot of “dead” email addresses to pad their free subscriber numbers. Substack is probably also happy to see more and more free subscribers added, as it will be an important metric for their investors. We have seen a similar dynamic play out at Twitter and Facebook. Incentives lead digital organisations to overstate activity, particularly when its hard for outsiders to know the truth.

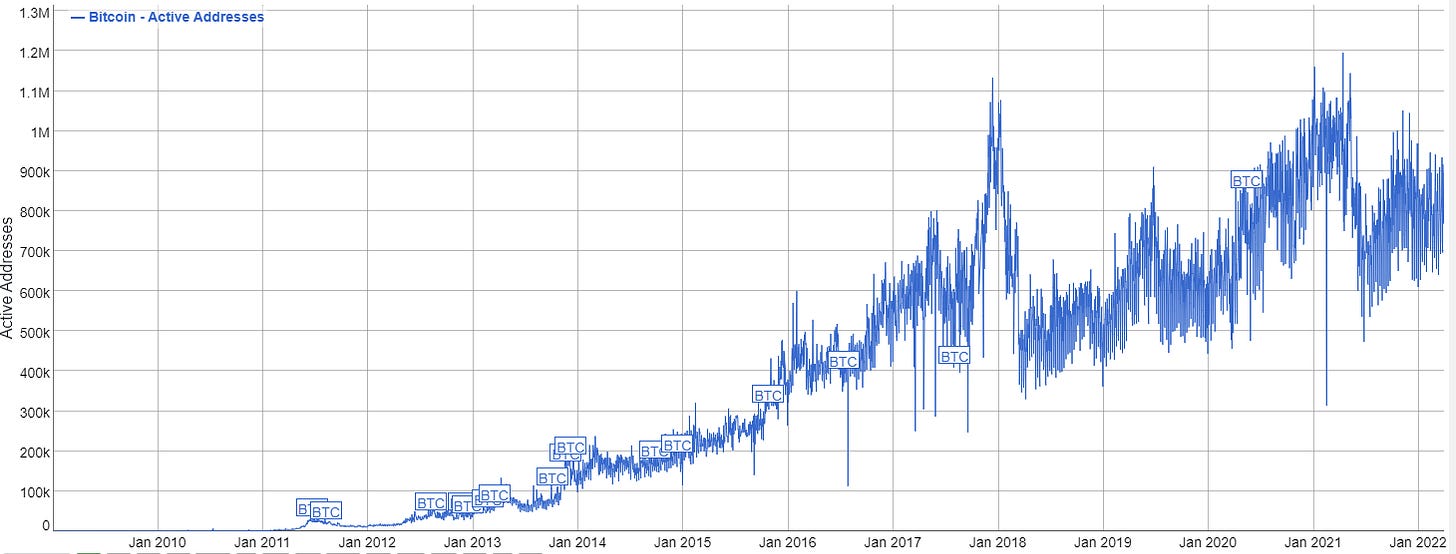

Which leads me on to crypto. So let me start with bitcoin. The way bitcoin is set up is that the more it is used, the more valuable it becomes. And the more users it has, the more likely it will be used. A typical bitcoin analysis will have a chart that show you the number of unique active addresses, which has stagnated a little over the last few years, is still trending up.

The incentive structure for early investors into bitcoin, with large amounts of money at stake is to perhaps set up multiple accounts, and trade between them, to give the illusion of growth. Bitcoin is so widely traded these days, this is probably not an issue for this particular cryptocurrency. But when I started to look at some smaller cryptocurrencies, the incentive structure for cheating was incredibly strong. I was reading a report put out by Messari on crypto, and they were talking about their largest position, Axie Infinity (AXS), which had risen an astonishing 24,000% in 2021. So I thought this is as good a place to start.

AXS is used in a game called Axie. Axie itself reminds me of a version of a very high tech version of Pokemon Go. As my now 8 year old son loves Pokemon Go, I know my Pikachu from my Bulbasaur. The financial consideration of Pokemon Go is essentially money for time. You don’t need to pay for anything, if you are willing to spend the time. This is not the case with Axie Infinity, you need some AXS to “breed” your creatures. You also need to buy some Axie to start, which cost around USD 16, up to thousands of dollars. The number of AXS needed for breeding seems to change over time, but an article I found in June 2021, stated 4 was necessary. If that ratio, stayed constant, then you would have needed USD 600 to complete a basic step of the game, compare to USD 4.

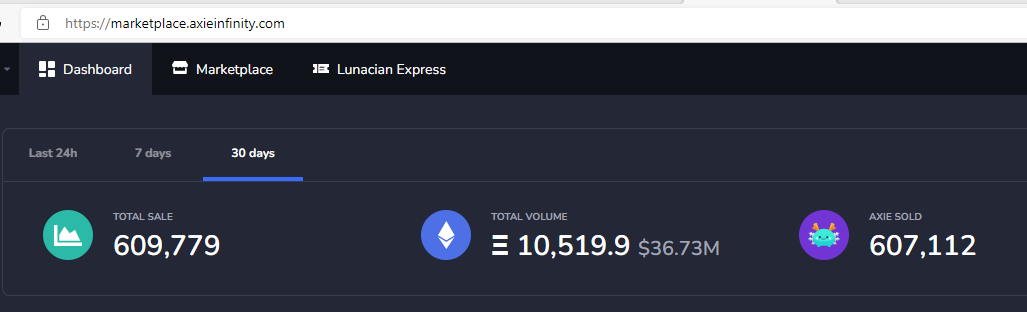

So how popular is Axie Infinity? Well Covalent estimate monthly average users of 8m in November. And Dappradar provide the following data, which is suggestive of 60,000 peak daily users, which is substantial increase from a year ago, but actually quite low. If we use the Steam Database, an all time peak of 60,000 user would place it as the 200th most popular game. If we compare to Zynga, which was recently acquired by Take Two, that would be around 3% of its users at the November peak.

With Axie Infinity, the developers are incentivised by the price of AXS - where they hold 20% of all outstanding stock. AXS currently has a market cap of USD 6bn, and the developers are worth USD 1.2bn. This is quite an accomplishment, as Rovio Entertainment, the developers of Angry Birds only has a market cap of EUR 600m. Or Zynga, which was recently acquired for USD 10 bn, had monthly average users of over 205 mn, compared to 8mn estimate for Axie.

The key feature of Axie Infinity, is that the players own the creatures, and as the price of AXS rises, the value of their creatures also rise. And now you can see the problem. Is Axie Infinity actually popular successful game, with a potentially long lasting franchise? Or is it just a way to speculate on NFTs? And with the developers incentivised to push up the value of AXS, they are motivated to give the illusion of as much activity as possible. If you were cynical, estimates that 40% of player base is from the Philippines would also raise a red flag. Axies Marketplace makes it abundantly clear, the trading of Axies is an important part of the business.

It looks to me like Axie Infinity is a well thought out, well designed game. And the idea of a decentralised system where the developers and players both win from a rising cryptocurrency seems like a good idea. But with a market cap of USD 6bn, and benefitting from the boom in NFT, the incentive structure means that its hard to know how real any of the data is real anymore. If was the developers, I would take my 24,000% return in 2021, and redeploy capital elsewhere… but that’s just me. And as the title suggests - the incentive structure of crypto makes it hard to trust… just like I now dont trust the subscriber numbers of other substacks!

LESSONS FROM SUBSTACK - AND WHY IT IS SO HARD TO TRUST CRYPTO