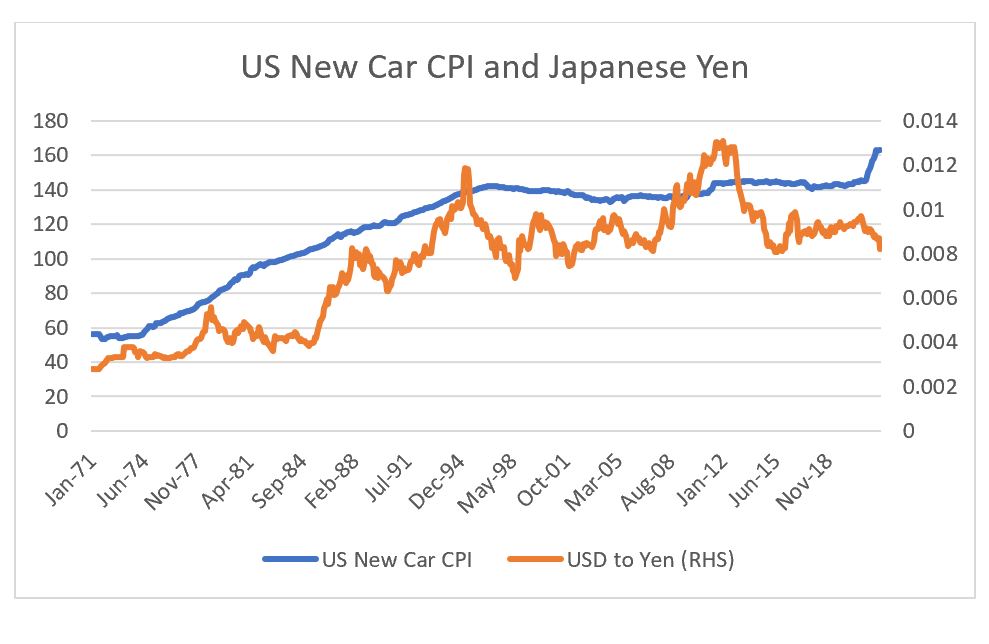

Japan has benefited massively from the free trade world that the US conjured into existence 40 years ago. Japanese industry and particualrly its auto industry benefitted hugely from access to the US auto market. For this reason, I expected US new car CPI moved higher (car prices rising after years of stagnation) that this would be Yen bullish. Instead the Yen has weakened considerably.

From a macro and micro perspective, the idea of a stronger Yen with surging automobile prices makes sense. However, from a political point of view, I think this is probably wrong. Japan has for many years had a huge imbalance in auto markets with the US. Nissan, Toyota and Honda all have huge operations in the US, but you barely see a US auto brand in Japan.

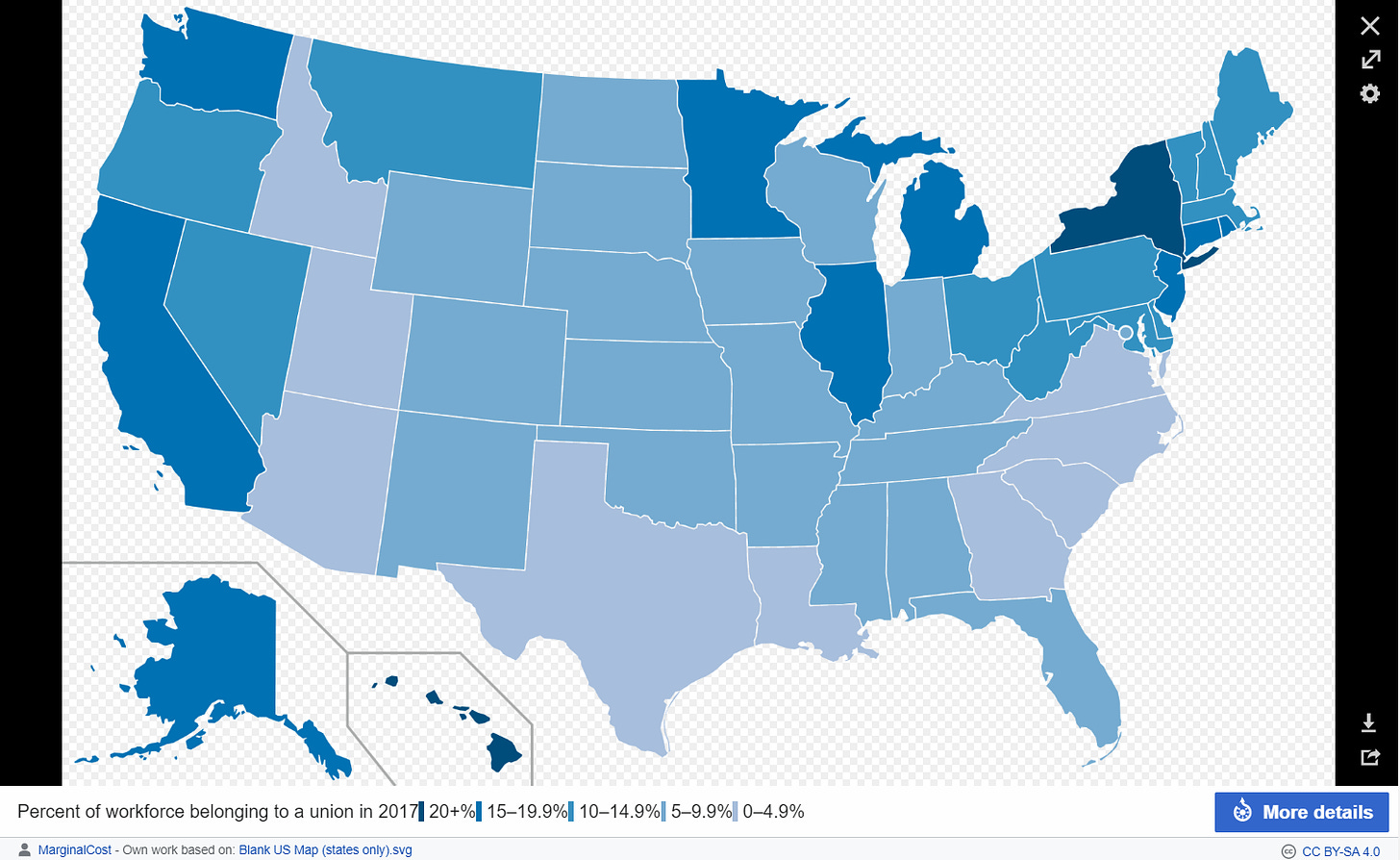

In a competitive democracy like the US, how could politicians possibly be elected pushing policies that expose domestic labour to foreign competition? I suspect after the inflationary 70s, politically there seems to me to be a coalition of consumers who wished to see inflation tamed, as well as business and capital owners that wanted to see union power crushed. Allowing first Japanese, and then other producers destroy the unionised US auto makers was a political win. That is the Japanese automakers were the spear tip of a policy to destroy US unions.

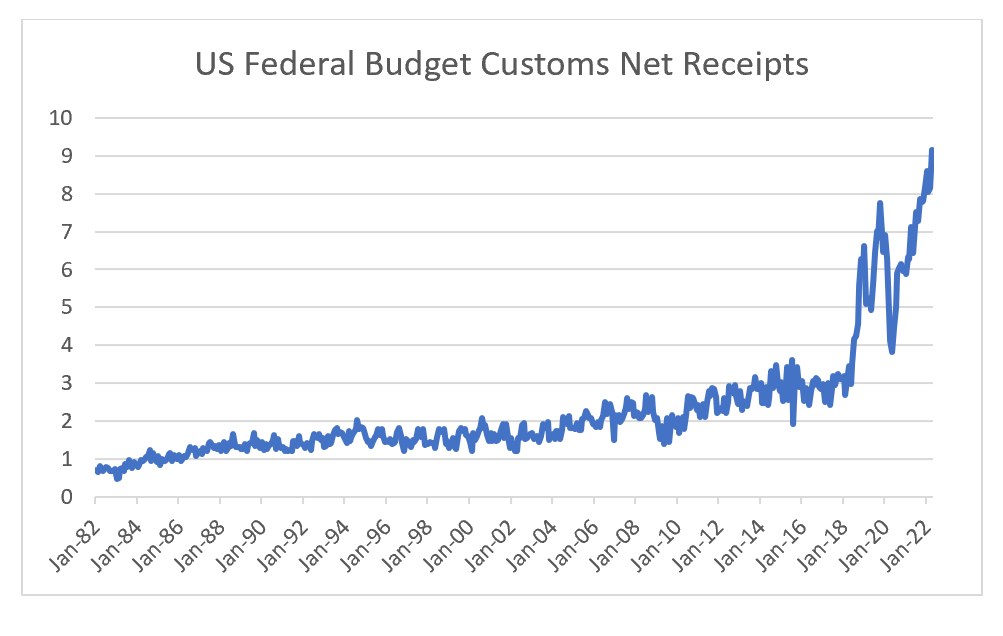

However, the rise of “populism” everywhere in the West has shown is that the electorate has tired of “pro-capital” policies. For someone my age, pro-capital policies, or Washington Consensus policies were implemented by governments of all stripes, regardless of any political promises that were made. And I learned to ignore politics when investing, but 2016 I think has changed that calculation. Perhaps the best graph I can find to show the political change manifesting in real world change is US tax collections from Customs (ie tariffs). This is still a small number, but the political implications are huge. The US now cares when its imports come from, after decades of not caring, and will use tariffs to achieve political ends.

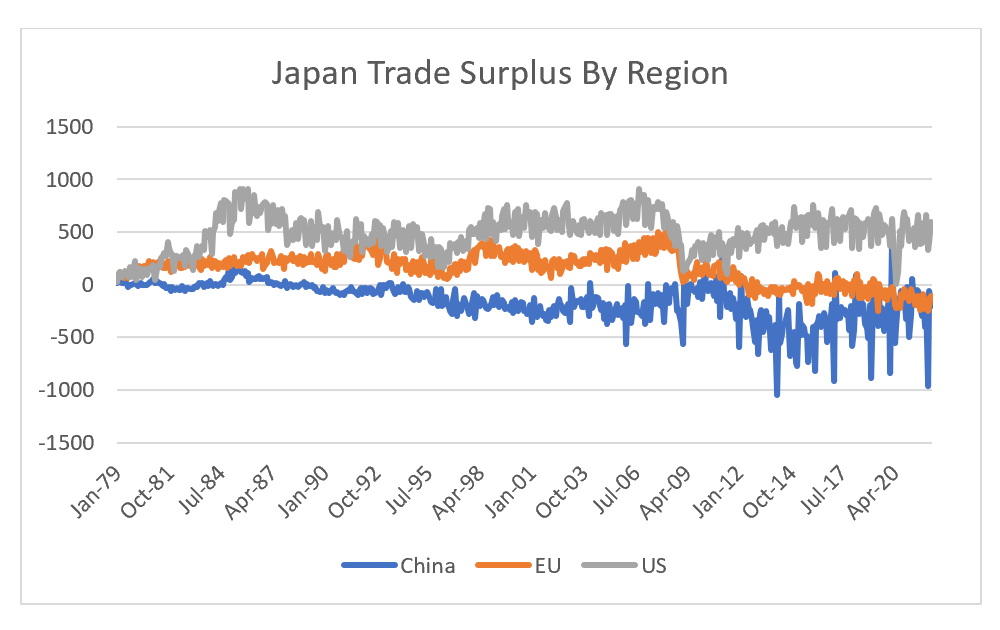

Why is this a negative for Japan? Well of the three big economic blocs, Japan only runs a trade surplus with the US.

At what point do political calculations, lets say for Candidate Trump, move to the idea of supporting US unionised workers in electorally competitive North East? As this map of unionisation in the US shows, unions members are more prevalent in the north east and California. Republicans candidates running on socially conservative issues, while protecting US businesses from foreign competition looks like an election winner to me, as it has been in the UK.

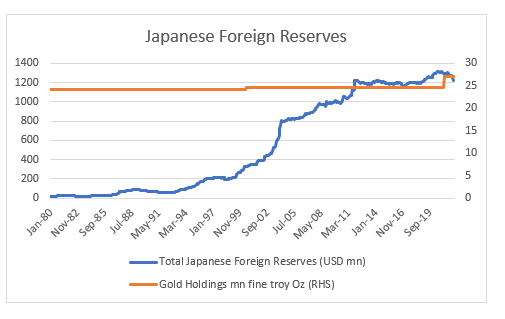

On this analysis, Japan has real problem. The market it generates its trade surplus with looks to be changing politically. The current economic policy of weak yen and export lead growth looks to be an economic and politically dead end to me. The question is whether Japan will change policies? The biggest possible change they could embrace would be to come to a détente with China. The biggest sign that such a change was in the offing would be Japan beginning to build up gold reserves instead of treasuries, as this would allow them to facilitate trade with China, while avoiding any possible US sanctions. Maybe the small increase in gold holdings in Japan are a sign of this change?

Japan is often considered Western, but culturally it is much closer to China than the US. The US/Japan military and economic alliance made Japan Western. If the US is unable to defend the Asia Pacific, which is increasingly likely, and US politics is turning against free trade, Japan is going to have to come to an “understanding” with China. If Japan builds gold reserves instead of treasuries, the financial effects will be profound.

JAPAN PROBABLY NEEDS TO MOVE TO THE PRO-CHINA CAMP