One thing I have learnt managing money is that there is always one great trade, and you need to get on it early, and if you are good enough, short it on the other side. Long Nikkei in 1980s, short for the next 20 years. Long tech in 1990s, short for the next 10 years. Long emerging markets in 2000s, short for the next 10 years. You get the idea. But here is the big problem, sometimes you only know what the big trade was after it blows up. A good example is the emerging market trade in 2000s. At the time I thought the trade was driven by a rising China and commodity super cycle - which was partly true. But it was also been driven by a huge credit cycle. In 2001, Argentina devalued and defaulted on debt, and market feared Brazil would do the same. 1998 had seen the Asian Financial Crisis, and with the Federal reserve running tight monetary policy, USD emerging market bonds were paying 10% (1000 point spread) over treasuries. And then from 2002, there was a huge credit spread tightening. 2007 was a definitive peak in emerging markets, even if commodity cycle did not peak out until 2011.

As discussed in recent posts, I don’t believe the mega trend has been a US or tech focused trend for the last 10 years. It has been a “private equitization” of the stock market trade - or share buy back trade. And the two best market have been the markets that have embraced that trend - the US and Japan.

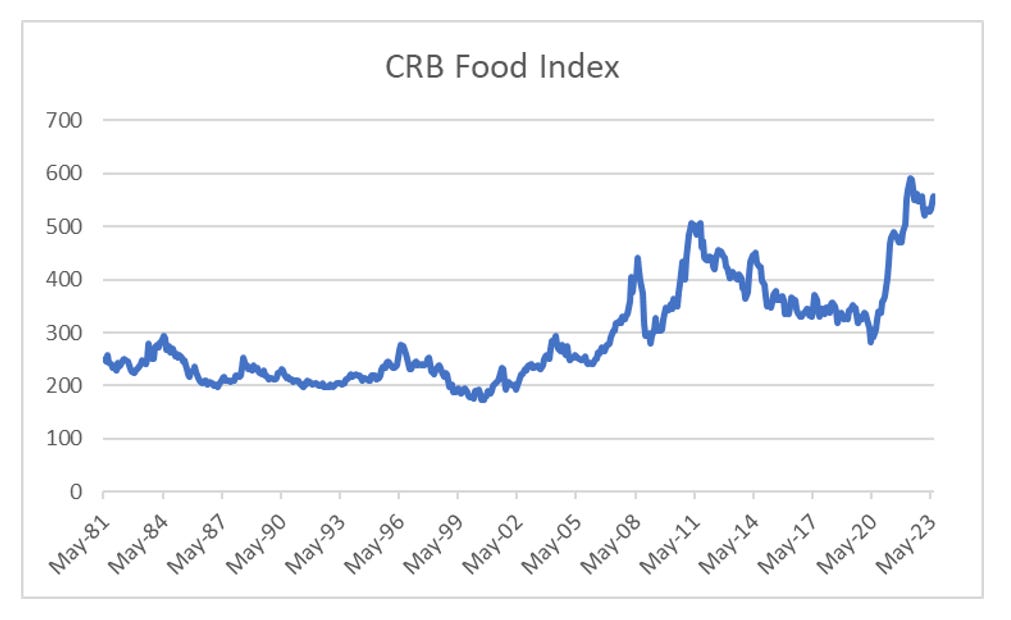

Plainly, I did not get on this trade when I was managing money, but I was always thinking that catching the other side of this trade offered a huge fund management business opportunity (just as shorting EM from 2011 onwards was a great business opportunity). So coming into 2021, I could see a food spike was coming - which played out well.

And I took a view that this would cause central banks to tighten monetary policy. This has been true except in Japan, who has done the bare minimum.

For me, listed private equity should provide a good lead on whether the private equitization trade was unwinding or not. Blackstone for example has been weak - but is still well above the Covid lows.

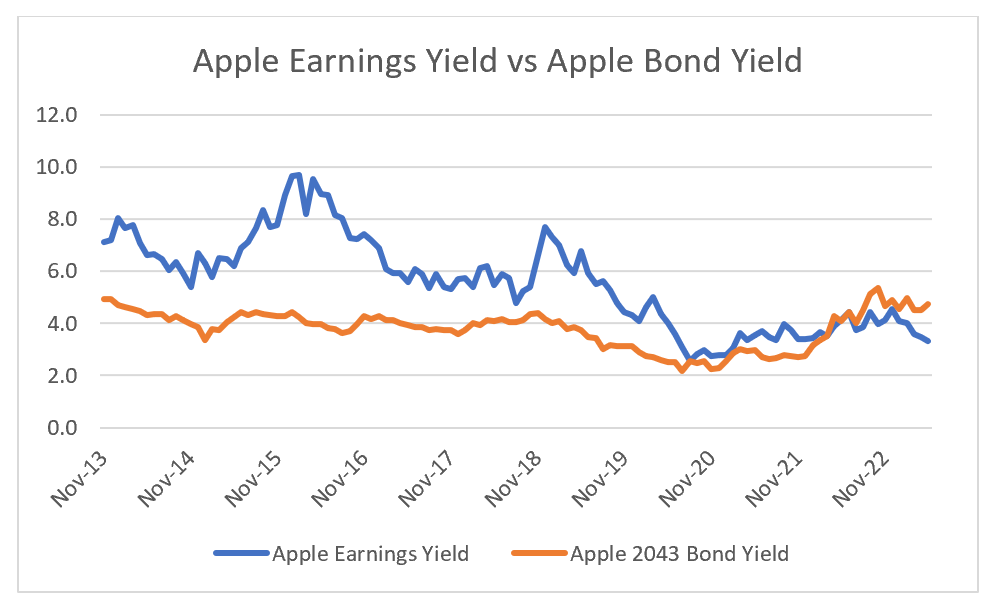

If you followed this analysis, then you should be bearish on US stocks. And yet Nasdaq is up 30% this year. And Apple is at or near all time highs. So what is wrong with the analysis? Well Blackstone is not the master of its destiny. It is subject to inflows and outflows from clients, and has to mark to market. Apple on the other hand, has continued to buy back its shares. From an investment position it makes little sense to me - as Apple now has an earning yield of 3.2%, while its bonds yield 4.7%, or it can get the Fed funds rate of 5%. That is Apple management is now burning cash - but that is their choice. And to be fair, if they have pricing power (and they seem to), perhaps they look at real yields, and say it still makes sense to buy back shares.

There is no question that BOJ has kept policy very loose. This has benefited Japan greatly as the Chinese have run a policy of keeping their currency strong. Yen is trading near 30 year lows against the Chinese Yuan. What has surprised me is that Japanese food inflation is now broken out of trend, and looks to be accelerating. My bet would have been the BOJ would have come under severe pressure to do something about this. I was wrong. In other words, Japanese policy has not turned pro-labour, it remains extremely pro-capital.

The surge in food prices is very much at odds with the performance of monthly wages in Japan. That is the BOJ is indeed making Japanese workers poorer in the worst possible way.

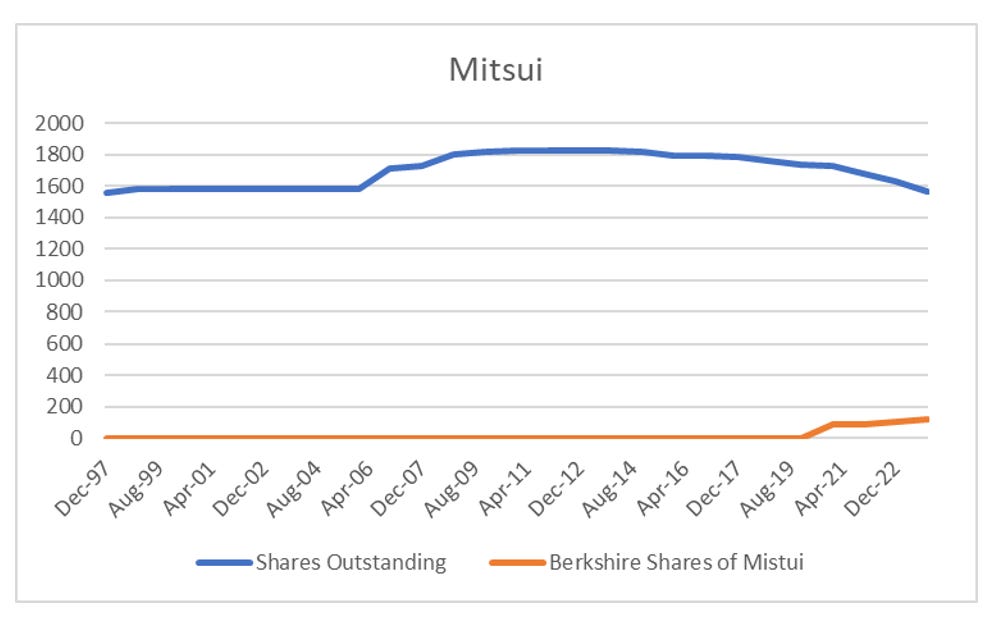

At some point Japanese politics will change - and voters will tire of this, but I don’t know when this will be. But just like with Apple, Buffett has been a master of this private equity style trade. Berkshire has been issuing Yen bonds, and buying the trading houses. I will use Mitsui, but they are all pretty much the same.

Mitsui like all the trading houses were very cyclical stocks. They also have many subsidiaries, and debt, and were generally considered stocks to be traded, not owned. However, Mitsui has begun to taken on the look of a rocket ship.

The biggest change, as we saw with Apple, is that the management of Mitsui no longer sells shares when the share price goes up, but buy back more.

Mitsui and the trading houses are not Apple. They have substantial debt levels already. They also have limited pricing power. But does any of that really matter? Like Apple, the question is are they willing to keep buying shares until the earnings yield is below the level of corporate debt? This type of trade has been tried before in Japan. Short JGBs (sell debt) and buy equities, and typically every cycle has ended badly (LTCM and GFC are just two examples). But to be fair, there is something different about Japan these days. It seems to be running a trade deficit.

The trade looks like it has legs to me. The government seems committed to the strategy, and concerns over income inequality seems to not be an issue. Personally, I would stick to Buffett’s choices rather than look for other candidates. As with Apple, you want a management who keeps buying shares even when it doesn’t make sense anymore. And it seems like Uncle Warren is very persuasive. Just watch out for the BOJ actually caring about falling real wages - but at the moment they don’t seem to care. Or if Uncle Warren decides to sell - he has probably heard that share buybacks are coming to an end.