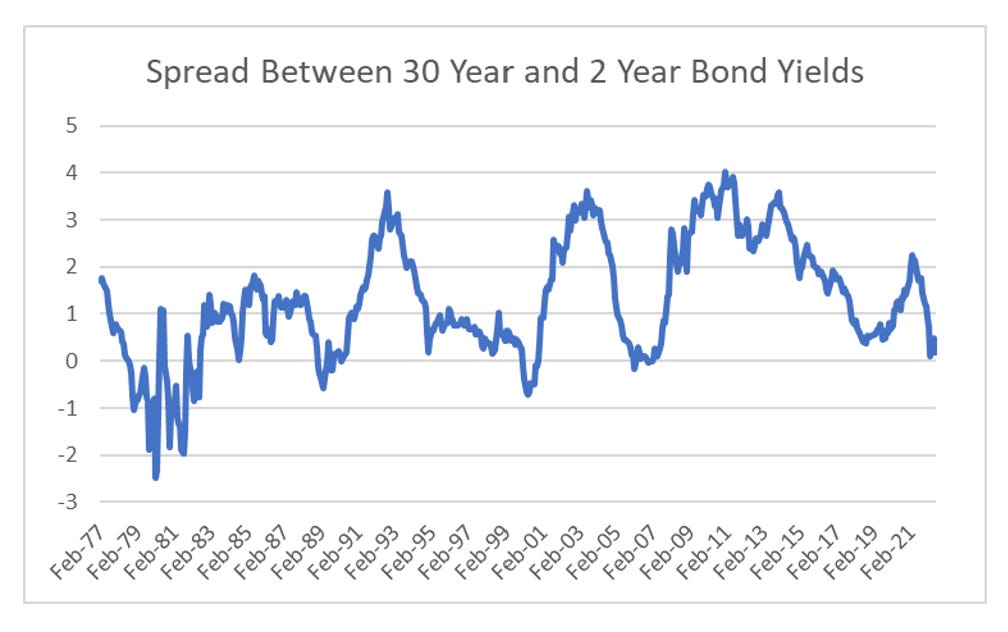

US Treasuries have been in a 40 year bull market. While short term bond yields move up and down on the basis of real or perceived Federal Reserve policy hawkishness, the 2 year yield on treasuries has rarely passed above the 30 year treasury yield. Looking at the below chart, it would seem like the right time to be buying long dated bonds.

Or to put it another way, when the spread between the 2 year and 30 year bond get close to zero you have been rewarded with buying bonds. Looking at current spreads, that would be about now. Buy bonds, wear diamonds as people like to say.