IS IT TIME TO SHORT?

Probably

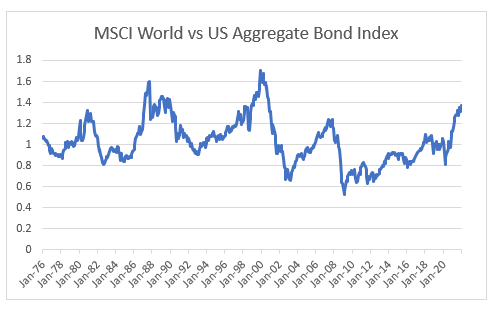

Over the years, I have collected various measures to gauge an idea of where we are in market cycles. One of my favourites compares the MSCI World (equities) to the performance of the Bloomberg Aggregate Bond Index, which measure the performance of all bonds trading in the US. This has many advantages. It is long dated, so includes part of the 1970s, its has a nice mean reverting feature. It also explicitly compares performance of equity to bonds, so should offer some guidance even in the days of QE. This model suggest equities are finally expensive versus bonds.

This is the relative performance of equities versus bonds, so if you think equities are going to underperform bonds like they did in 2000s or 2008, you could buy bonds. The problem of course is that bonds do not look great. During the equity rallies seen from 1994 to 2000 or from 2003 to 2007, US government finance improved. During the equity rally from 2016, US government finances have deteriorated.

2020 and 2021 were unusual in that high yield corporate debt yields fell even as inflation expectations rose. It is possible that inflation expectations fall from here, but should they not fall, the rise in bond yields needed to just cover inflation imply a substantial rise in yields.

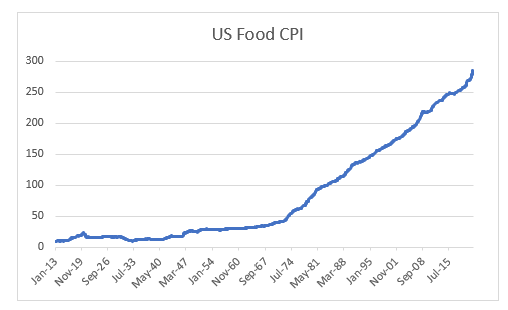

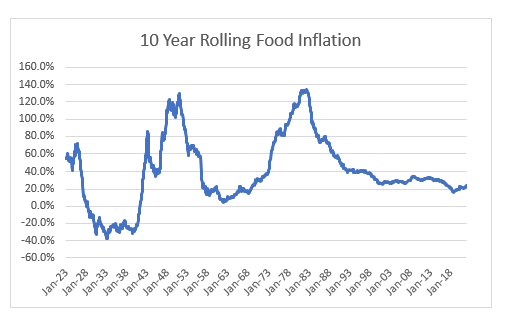

Historically speaking, food inflation has normally been a signal for hawkish monetary policy. Food inflation looks like it has begun to inflect higher.

The graph above shows food inflation breaking higher. But on a 10 year rolling basis, we are coming out of an extremely long period of stable food prices. With the US dollar still very strong (which keeps inflation at bay), the chances of acceleration food inflation, as we saw in the 1940 and 1970s are rising.

Why am I only looking at food inflation? Central banking has become highly politicised, and seemingly captured by business interests. Rising income inequality, sky high property prices and other social ills caused by very low interest rates seem to create few political problems for modern central banks. But rising food prices is likely to be very different, given its highly regressive nature (overwhelming negative for the poor). Rising interest rates should be bad for stocks. As shown above, high yield bonds yield are substantially below inflation. Below we show that HYG and S&P 500 have been highly correlated in recent times, that is rising bond yields would be very negative for the S&P 500.

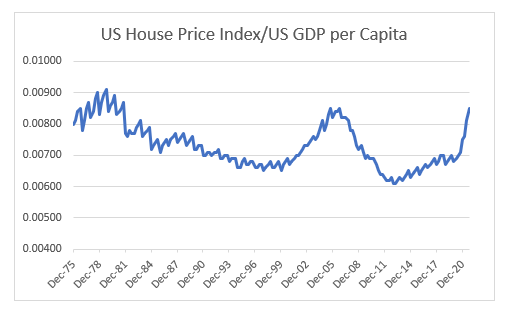

One big difference the US has had to either Europe or Japan since the financial crisis has been a robust housing market. But looking at US house prices versus GDP per capita, we are at levels I would associate with caution.

We have been in a long period of low food inflation, which has allowed governments and central banks to embark on epic stimulus. Unless inflationary dynamics reverse soon, the risk reward in asset markets looks poor. However before placing bearish positions, I recommend reading my next post, will explain why short selling has become so hard.

Looking forward to your next post! From a personal or retail perspective, would it be considered more advantageous to simply attempt to move to cash during these more cautionary periods rather than attempt to short or hedge holdings? It is difficult, since there have been countless times where I was concerned and the market continued higher for years longer. It seems prudence and critical thought are a hindrance to performance in the post-GFC world of investing.

Looking forward to the short selling follow-up article. Thanks!