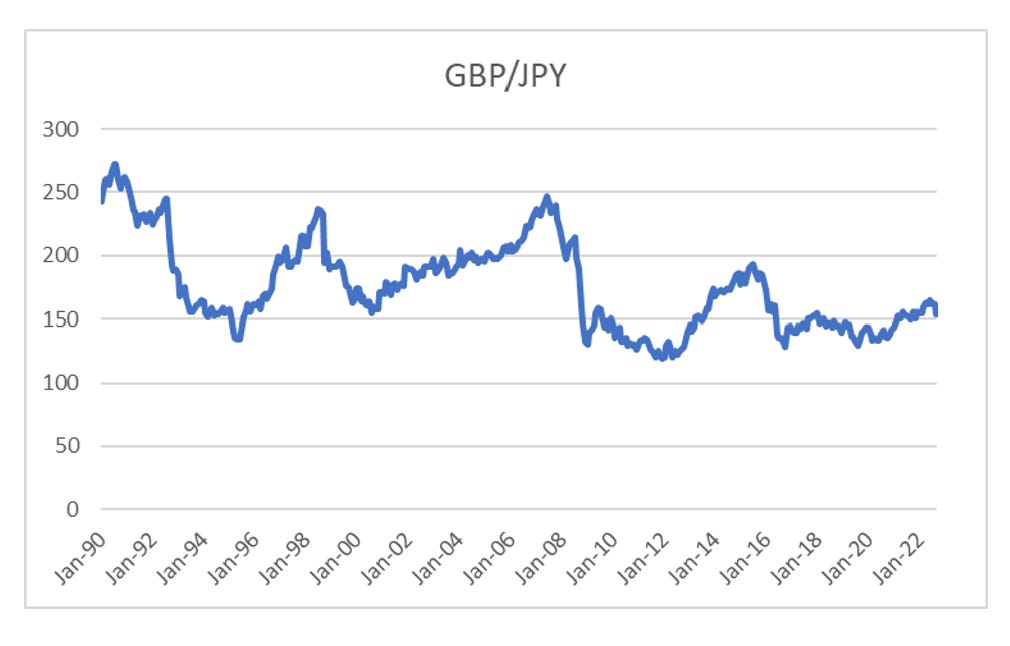

Outside of Australia, the UK and Japan are the two countries I have spent the most time in. Japan is a country that is remarkably cheap these days. While the UK is a country where prices seem to inevitably rise. Sterling has a long glorious history of rapidly losing value versus the Yen, typically when the business cycle turns.

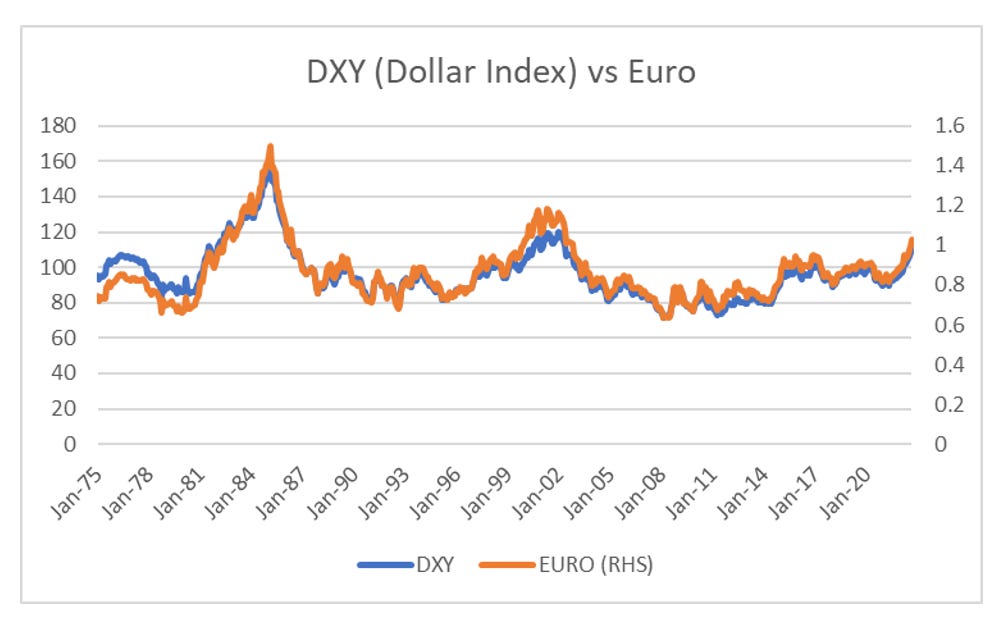

Given differences in inflation over the last 20 years, for me a move to 100 on GBP/JPY seems reasonable to me. The BOJ seems determined not to allow the Yen to strengthen in any way, so this seems to imply that Sterling need to make the adjustment. This gives a Sterling exchange rate 0.70 to the dollar. That implies a super strong USD as EUR and Sterling tend to move in the same direction, although the Euro has a mild appreciation bias against sterling over the years.

So Sterling moving to 0.70, would probably imply a similar move for the Euro. Recently Bloomberg has added a long dated version of the Euro, even though it did not exist before 1999, but in essence the Euro and the Dollar Index are identical. Yen weakness is therefore implying a return to peak dollar strength seen in 1984. (Note Euro is inverted here)

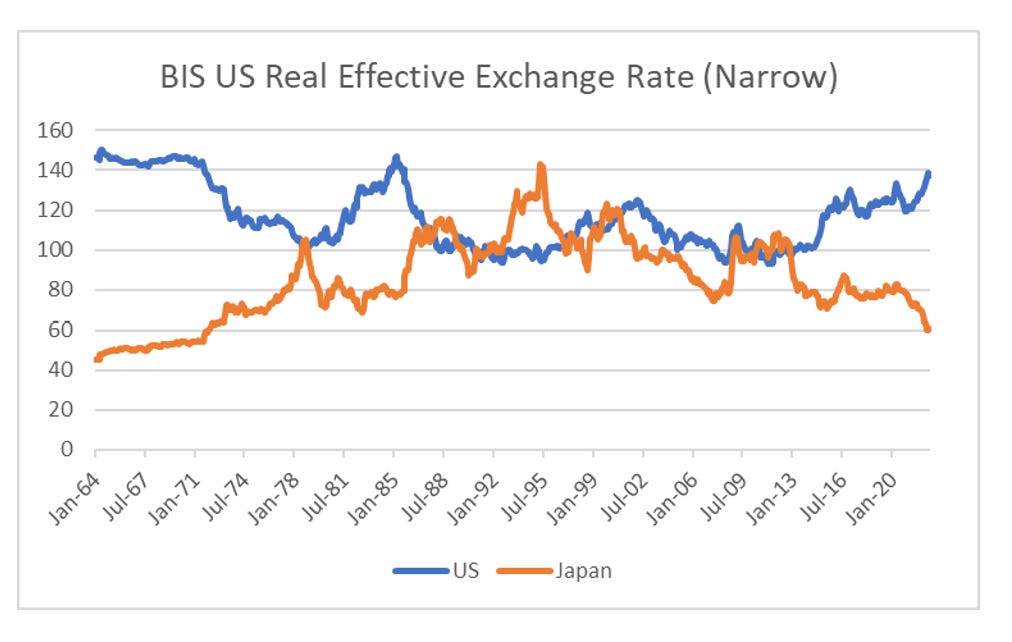

The better question to ask then, is when do we buy Yen? Looking at currency pairs is dangerous, as you need to incorporate inflation differentials, as well as currency strength or weakness of neighbours to get a good idea of whether a currency is strong or weak. Fortunately, the BIS does this for us, with the Real Effective Exchange Rate Indices. When we look at the long dated indices for Japan and the US, we can see that Japan was super cheap in the 1960s, expensive in 1980s and is cheap again.

One of the things that this chart says to me, is that from 1980 onwards, with the movement to market based exchange rates, it was very hard for a country to become too cheap or too expensive. The movement of capital and labour would quickly arbitrage away any excess. However from 2016, as we have had China close its capital account, the US begin to use tariffs and politics move from centralist to populist (both left and right) the ability for governments and central banks to “choose” their exchange rate seem to have grown.

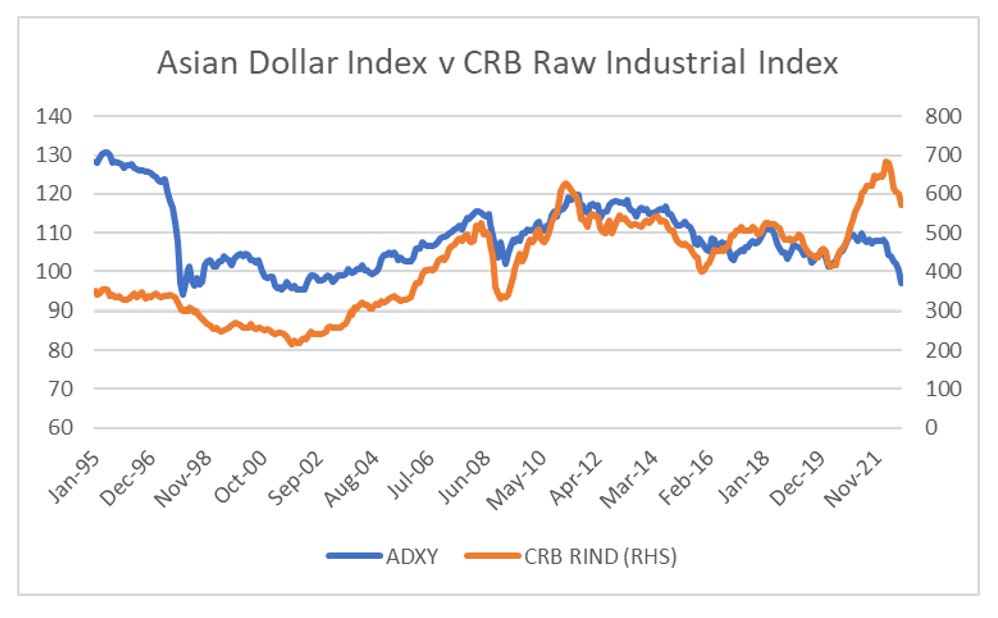

What that means is that from 2016 onwards, the relationship of currencies to macro economics has broken down. The close relationship of ADXY to commodities has broken down last few years.

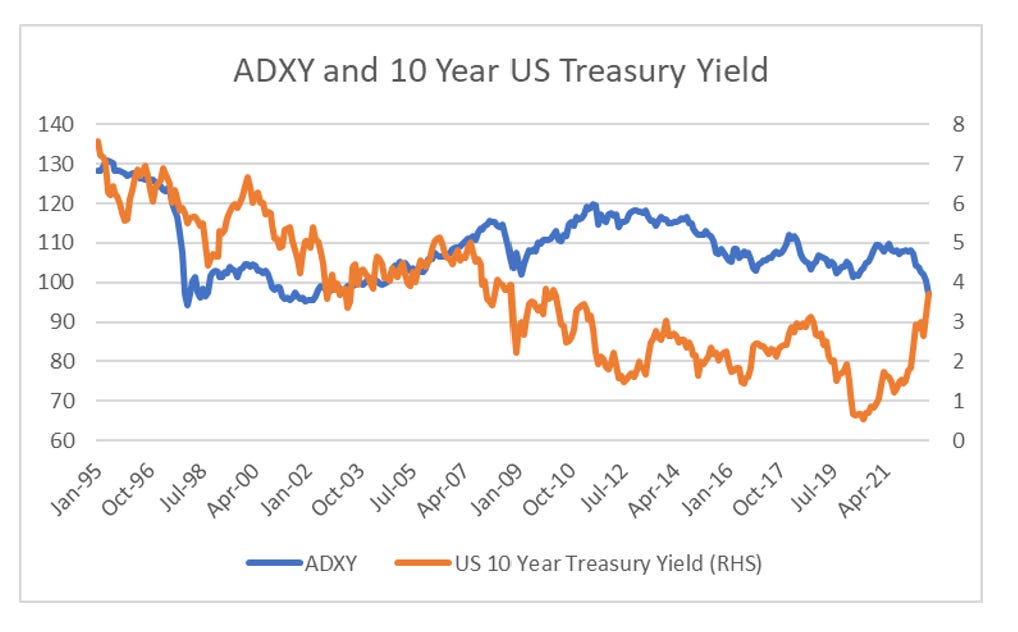

The relationship between US treasury yields and ADXY has also broken down. Falling Asian currencies were seen as deflationary, but now has no effect on the Treasury market.

Putting it all together, what does this say about Sterling or any other currency? Cheap is no longer good enough to buy a currency. The question to ask now is whether the government and central bank are committed to keeping the currency strong? The market has decided that both the Japanese and UK governments would continue to prefer weak exchange rates. Of the two, I suspect Japan is closest to acting so strengthen its currency, but until it does, dollar strength and sterling weakness is likely to stay.

IS IT TIME TO BUY STERLING?