I started as an emerging market analyst in 2002, and my first fund in 2006 was an emerging market fund. I made a lot of money shorting emerging markets from 2011 to 2016. With emerging markets back at 2006 levels, having gone sideways for 16 years, is it time to go long emerging markets?

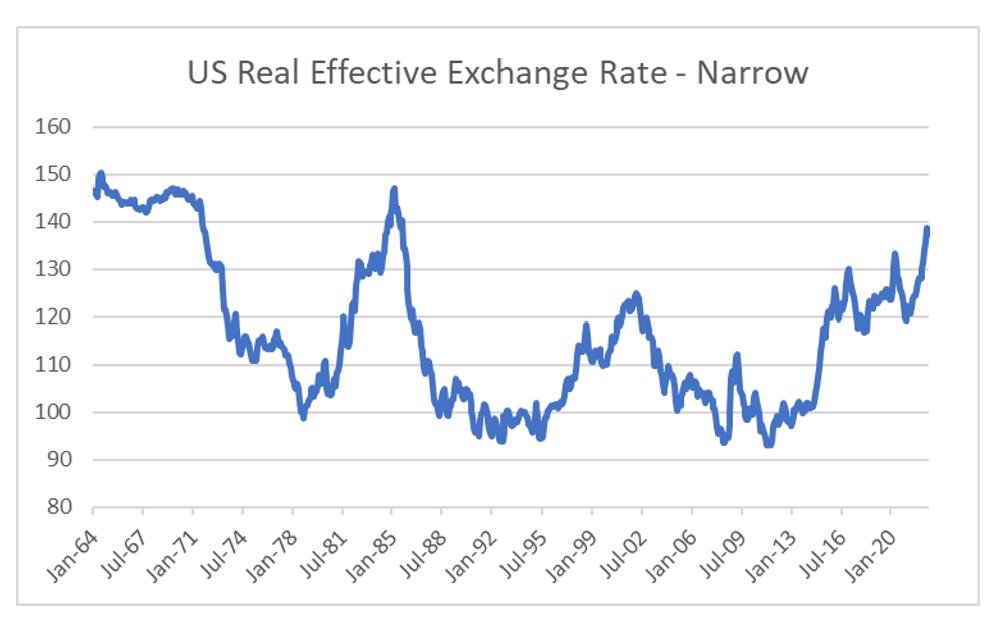

There are a lot of reasons why emerging markets have been so poor, but we are going to stick to big macro reasons for this post. Emerging markets will do much better in a weak dollar environment. This is partly the direct translation of currency gains, and partly the financial conditions of emerging market improves as dollar weakens. Most emerging market corporates will have local currency revenue and US dollar costs, so a falling US dollar is very good for financial conditions. Emerging market bear markets tend to happen in periods of dollar strength and bull markets in periods of dollar weakness. The 2007 peak in emerging markets was in 2007 when the dollar was cheap, and its current weakness is coinciding with the strongest dollar since 1986.

Another way to look at emerging markets from a macro perspective is at credit markets. When I started in emerging markets in 2002, Argentina had just defaulted, and markets were afraid a newly elected Lula would default on Brazilian debt. Coming not long after the Asian Financial Crisis, and Russian debt default, the spread of US dollar denominated emerging market bonds over US treasuries was 10% (1000 bp in the graph below) in 2002, which proved an excellent buying point.

Today the spread is just under 5% and below are peak seen in 2008, but as US yields have risen significantly, the sell off in emerging market bonds has been substantial, and on a par with 2008.

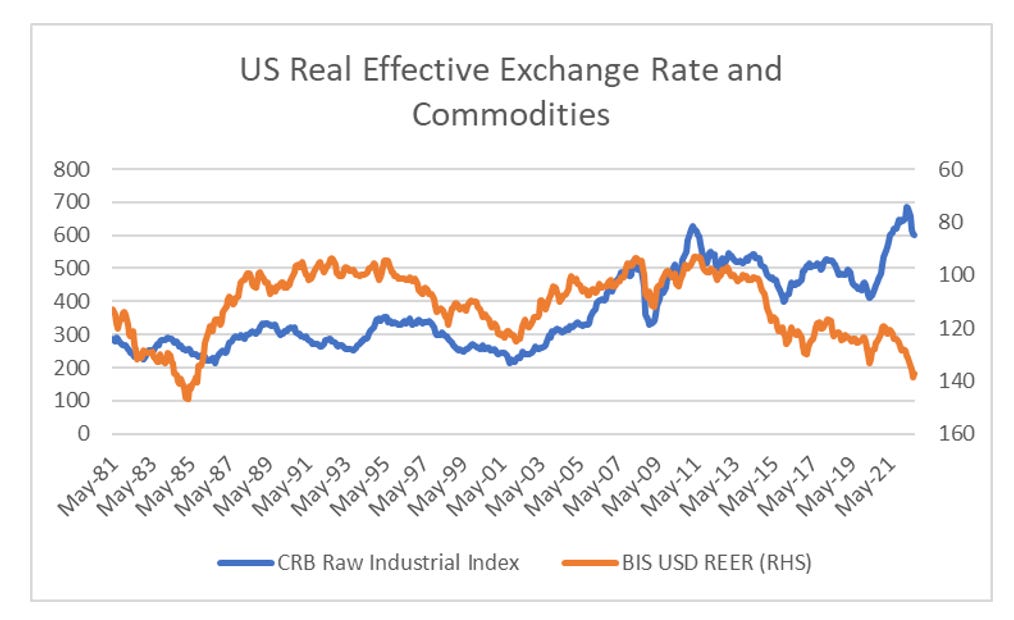

So emerging markets look cheap, US dollar looks expensive, so if you think the US dollar is going to fall, then they offer an attractive entry point. However, things are not that simple. The US dollar used to closely follow commodity prices. That is commodity prices up, US dollar down. Over the last couple of years, this no long seems to hold.

I have three possible reasons for this. One is very bearish for emerging markets, one very bullish and one neutral. The first is that the US is no longer an net importer of oil, and hence the relationship between the US dollar and commodities has changed forever. When we add in products, the US is a substantial exporter of energy. The implication is that we have built a international financial system around US dollar, but the US no longer exports much US dollars (as its a net exporter of energy), which creates a structural shortage of US dollar. This is what I think the “dollar milkshake” theory is trying to say - but I am happy to be corrected here if its not. The implication is that emerging markets will continue to trade poorly, and the US dollar will continue to trade well.

The second theory is that the US dollar is not strong, but that the Japanese Yen is very weak. If we look at commodity currencies in Yen terms, then they are strengthening. The implication is that if and when the BOJ changes policies, then the dollar will weaken substantially. If we take a currency like the Australian dollar, which is a major commodity exporter, is has strengthened back to near 30 year highs against the Yen in-line with the move higher commodity prices. I have a lot of sympathy for this view, as Japan are the biggest saving nation on the planet, and I have often found looking at financial markets from the eyes of Japanese investors illuminating.

The third and final reason for the strength of the dollar is that Chinese interbank rates have been falling over the last year, even as the rest of the world has been suffering from rising rates. China, unlike the rest of the world has been suffering from continues Covid lockdowns, as well as policies designed to cool the housing market. Both Covid and the housing market policies are political driven, meaning that they could both be reversed.

As I pointed out in my “4M Process” post, I think about politics before I think other factors in investing. And on the political front, I think I am picking up change in both China and Japan. I suspect Japan is beginning to move away from super weak yen policy, and China is beginning to move away from its zero covid policy. If I am correct, emerging markets looks very interesting.