IS FOOD INFLATION TRANSITORY?

Falling pork prices in China make ongoing food inflation less likely.

Agricultural commodity prices have been very strong in 2020 and 2021.

The reason for this is not hard to find. China is the world’s largest food producer, and its meat production is largely focused on pork. African Swine Flu led to the destruction of nearly half of the Chinese pig herd. As the flu can live on in pork products, culled pigs cannot be used for food consumption, China suddenly had a huge pork shortfall.

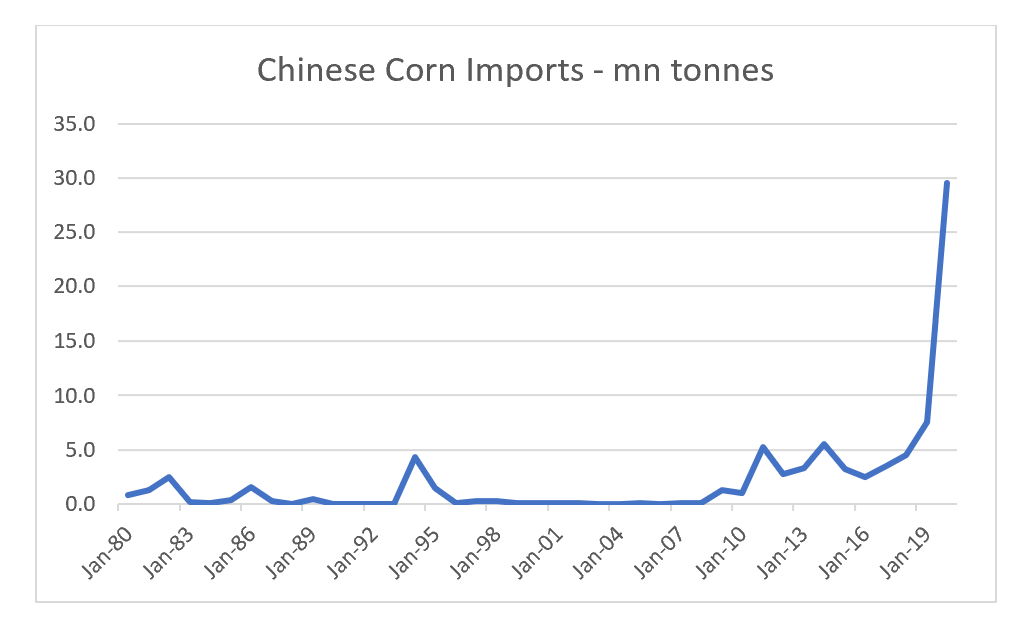

To feed the recovering herd, China, which is a large corn producer in its own right, suddenly became the largest corn importer in the world. In very rough figures, it takes 4 kilograms of corn to produce 1 kilogram of pork, so replacing a lost pigherd requires a large increase in corn usage.

As the pig herd was culled, Chinese pork prices rose significantly, to well over 4 times US prices. But as the pig herd has been rebuilt, Chinese pork prices have fallen back to 2019 levels.

Chinese imports of pork from the US, which overtook Japan in 2020 have fallen back to pre 2019 levels.

Chinese pork prices have fallen, while grain prices have stayed at high levels. This is causing severe losses for pig farmers, as pork costs more than the grain needed to feed them. The pork/corn ratio in China is pointing to very unprofitable conditions for pig farmers in China, and likely lower demand for grain going forward.

The Chinese rebuilding of its pig herd does suggest the worst of food inflation is behind us. However, it does suggest that Chinese supply and demand will determine food prices going forward. There are good structural drivers to assume Chinese food prices stay strong, driven my declining availability of labor, land and water, but at the moment, Chinese pork prices point to food deflation, not inflation.