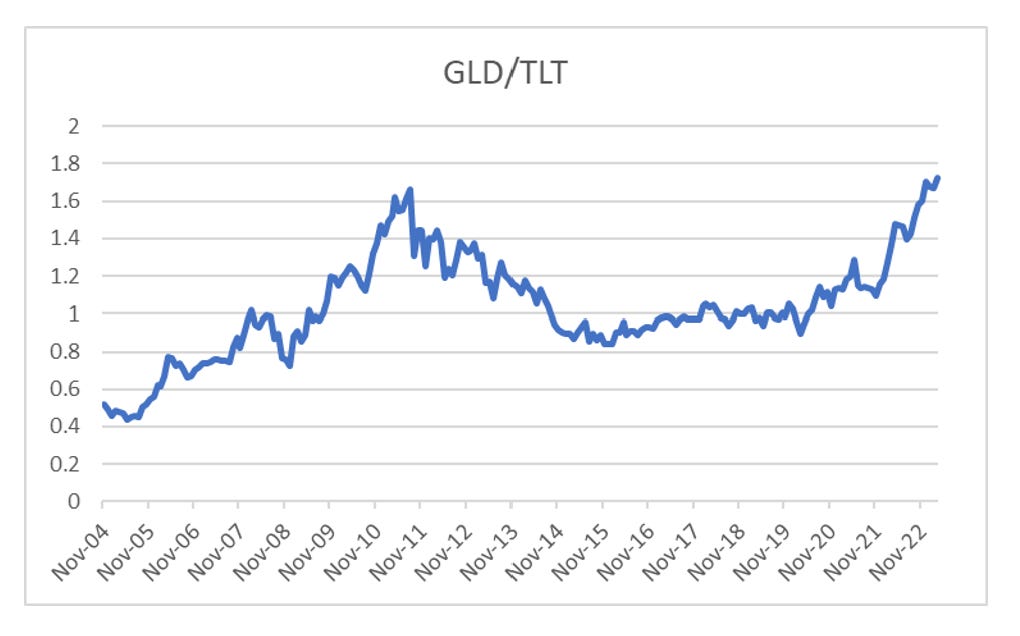

My preferred trade for the last few years has been long GLD/short TLT - for me it represents the trade off facing western central bankers. Either destroy the bond (and assets) market, or face inflationary pressure. I have been surprised at how well this trade has held up in the face of an oil price falling from USD 120 to USD 80.

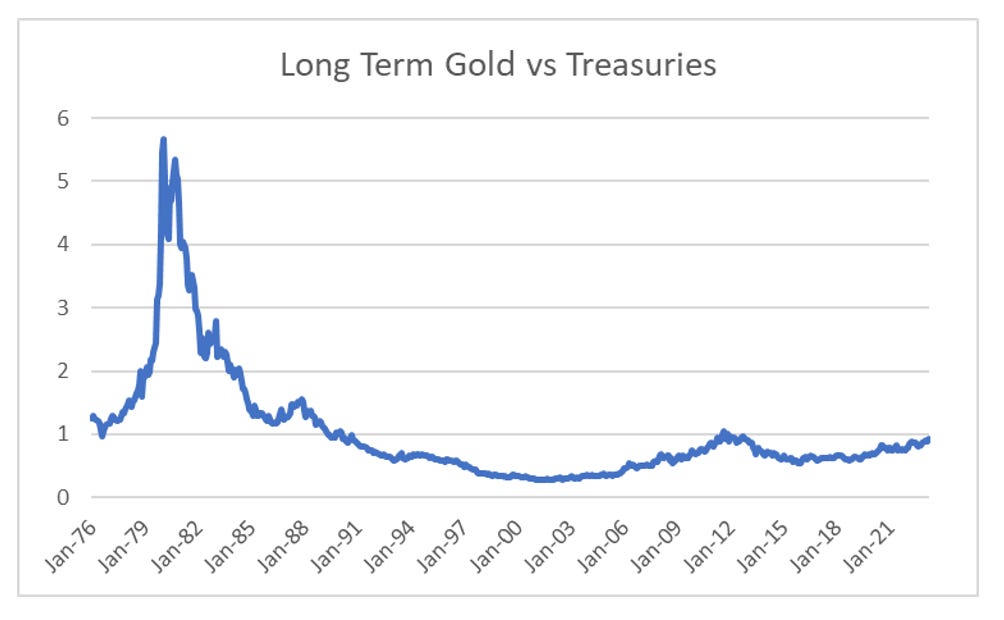

But the GLD/TLT trade also has a significant political element to it. When we look at the very long graph (replacing TLT with a long dated treasury index), we can see the spike in the late 1970s. The sell off in the 1970s, represented the failure of the US. Its currency was very weak, treasuries had lost significant value, the Vietnam war had been lost, and the preceding decade had seen three major leaders assassinated, JFK, Bobby Kennedy and MLK. Ronald Reagan survived an attempted assassination in 1981. As an old New Yorker told me, in 1970s it felt like the US was a failed state. At that time, in confrontation with the USSR, soaring oil prices was a win for the Soviets and a loss for the US. The best thing about the US (and democracy in general), is that voting public do not like losers and losing policy, and Thatcher and Reagan were elected to change that, and move policy to pro-capital, a policy that is essentially deflationary.

China is not the USSR. China has a functioning stockmarket, has the second most billionaires in the world, and is one of the largest markets globally for luxury goods (all decidedly un-communist features). As the largest importer of oil, rising oil prices are not a win like it was for the USSR. However, it is very much in China’s interest to see treasuries dislodged as the reserve asset for the global monetary system. China has been selling down its treasuries, and after the US froze Russian central bank holdings, who could blame them.

Falling treasury holdings in China could be seen as deflationary. Certainly when total foreign reserves were falling in China in 2015, was a deflationary period that saw treasuries outperform gold. Now we see Chinese foreign reserves hold up, while its treasury holdings are falling.

Another big change in last two years is that US inflation has been much higher that the China.

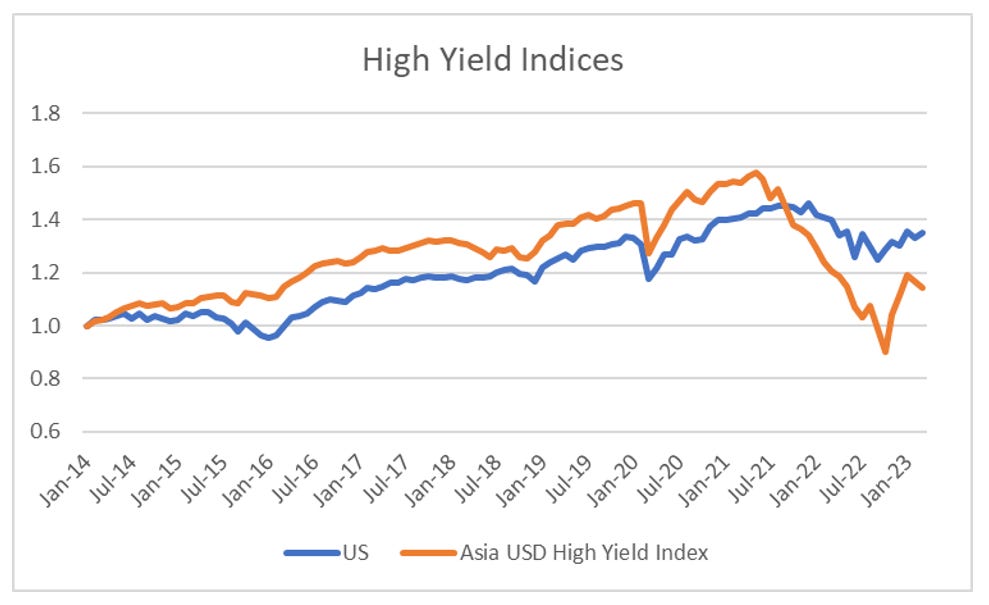

One of my arguments is that when governments run pro-labour policies, inflation will be much stronger. To keep inflation in check, financial conditions need to be much tighter. Another way to think about it, is that you need to keep rich people spending in check, while the spending of the poor rises. China has been much “better” in making life tougher for rich people. Using USD High Yield indicies in Asia and the US, Asian (mainly Chinese) high yield market has been much weaker.

And here is the problem, the US is trying defeat China, while not making any true sacrifices. Financial conditions were much tighter through the 1980s than they are today, which is what drove the treasury bull market, and its acceptance as a reserve asset. Now the US is trying to hold on to this privilege while offering negative real interest rates and bail outs.

Perhaps the various trade and technology sanctions that the US has place on China will work, and China will devalue and collapse. But when I look at the recent performance of Chinese luxury consumption stocks like Hermes and Louis Vuitton, I am somewhat unconvinced the China growth model is in decline.

I like GLD/TLT as it represents government policy to favour workers over capital. But it has a geopolitical angle - do foreigners want to keep the USD as the reserve currency? Obviously China and Russia would prefer not. And I wonder whether India would also like to be subject to US control on its trade policy? I doubt it. If the US really wants to retain reserve currency status, its going to have to learn how to make rich people suffer - a tough ask in a political systems where elections cost billions.