IS CHINA MANAGING CURRENCY PRESSURE VIA THE COMMODITY MARKET?

Even since China faced devaluation pressure in 2015, commodity markets have been more volatile than currency markets.

China came under severe devaluation pressure in 2015/16. At the time, China saw foreign reserves drop by USD 1 trillion. Since then foreign reserves have only partially been rebuilt.

What is most unusual about Chinese foreign reserves is that China has been posting large trade surpluses over the last 5 years, something you would normally associate with the building of foreign reserves.

If we make a simplifying assumption that growth in foreign reserves is equal to trade surpluses plus capital flow, we can model Chinese capital inflows and outflows. As you would expect, China had fairly strong capital inflows until 2015, when they turned to consistent outflows.

Since the Covid boom began, Chinese exports and imports have begun to grow again after years of stagnation.

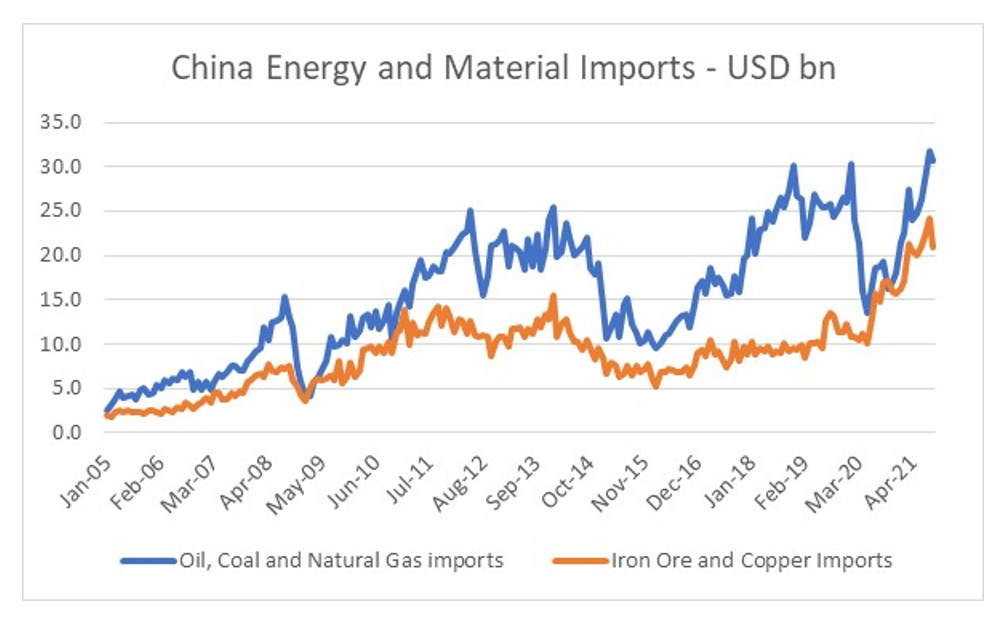

Looking more closely at the surge in Chinese imports, it has largely been driven by surging imports of commodities.

Surging iron ore and copper imports would suggest rising production, but in reality China has been implementing severe steel production cuts in the face of rising iron ore prices.

We have also seen a steep fall in Chinese oil imports in 2021

One interpretation is that China manages its economic activity to maintain a trade balance, with the implication that rising cost of energy imports leads to the government to reduce industrial activity. If this is true, we should see falling currency volatility and rising commodity volatility. China is not a truly free floating currency, but USD Japanese Yen 1m implied volatility has been at very low levels (with the exception of the Covid shock in 2020) for 5 years now.

And we also see that the relationship between LNG prices and iron ore prices have taken on a distinctively negative relationship in recent years.

China managing its commodity demand to maintain a trade surplus is a novel policy. Is it a policy driven by necessity, to counter outflows? Or is it a policy designed to bolster Chinese yuan as an alternative to the US dollar? Whichever the answer is, it will have huge implications for all asset markets.