After working out that a large part of the NIIP distortion was being driven by tax policies, I have been taking a closer look at what could bring this to an end. Changes put forward by the OECD could potentially be one driver. The OECD have managed to get broad agreement to implement some policies to reduce base erosion and profit shifting (BEPS). There are essentially two policies. The first is that tax is based on where the revenue is earned, and the second is that a top up tax is to be charged to bring the minimum tax to 15%. OECD believes that this will generate an additional USD 150bn in tax revenue. Ireland, which is the centre of most BEPS, in its most recent NTMA presentation, estimate the first policy will cost them EUR 2bn. The second pillar directly attacks the Irish tax model, by reducing the incentive to set up in Ireland, but the NTMA has provided no estimate of reduction in tax base.

The UK government provides an estimate of raising more than GBP 2bn from the OECD tax changes from 2026 onwards. As Ireland is often a European headquarters, you would assume that other European nations would be likely to see increase tax collection, and Ireland reduced income going forward. This makes the Irish estimates seem oddly low.

Irish data would suggest that US multinationals have some confidence that BEPS is not going to go away. Changes forced on Ireland by the EU in 2014 after the Apple scandal has seen Irish tax collections explode. Previously Ireland allowed profits to be sent to recognised tax havens such as Bermuda, but recent changes have meant profits have stayed in Ireland. This means that Ireland now collects a lot of tax on a per capita basis. The UK with a population of 60 million people, and home to various multinationals such as BP, HSBC, GSK, and Diageo is expected to take in £82bn in corporation tax in 2023/4. Ireland with a population of 5 million people, is expected to take in corporate tax of 23bn Euros. The UK and Ireland are both modern economies, with strong links to the US. On a per capita basis, Ireland is collecting 3 times as much corporate tax than the UK. Corporate tax receipts are been driven higher by the 10 largest companies.

Ireland has used tax policy to promote growth and investment in Ireland, but as the case with Apple shows, this policy is now producing extreme results. Again using the NTMA presentation, due to a policy change, multinational profits in Ireland have risen from maybe Euro 10bn to EUR 150bn in recent years.

Why has there been a big shift to Ireland? As mentioned before, Ireland now allows the ability for intellectual property assets to be written down, and generate a capital allowance (CAIA). This has driven a huge flow of intangible assets and profits to Ireland (see chart below). I suspect that this CAIA is going to be highly resistant to BEPS changes that the OECD are introducing, which would explain the rush of activity, and makes me suspect tax collection estimates are going to be far lower than expected. That is Irish estimates are more likely to be correct than the UK.

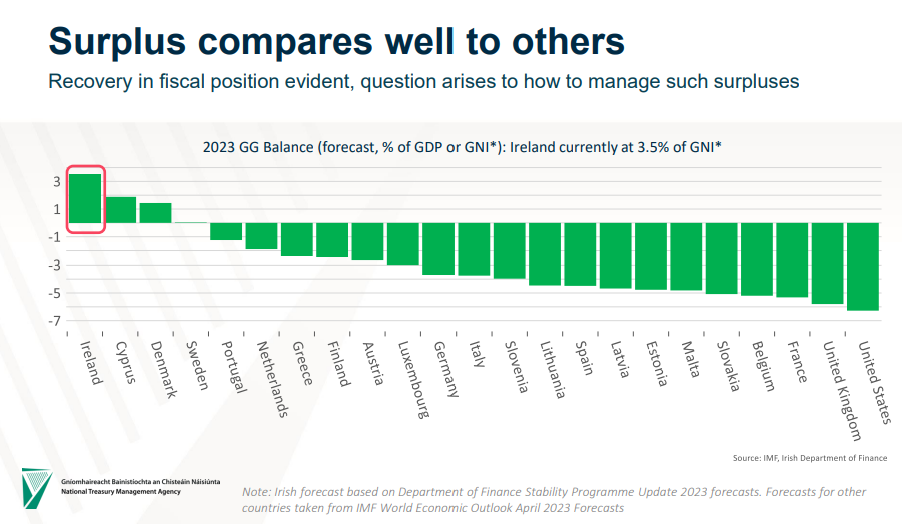

Ireland has always used tax policy as a development policy. Politically, this was hard to argue against, as Ireland was for many year economically undeveloped, and after the Eurocrisis, technically bankrupt. However, with the huge investment in intellectual property in to Ireland, and other tax changes, means that almost uniquely, Ireland is forecast to run a budget surplus in 2023. Forward projections show Ireland with lowest levels of government debt to GDP in Europe.

It should be pointed out that Ireland is not a member of NATO, so is making only a small contribution to Ukraine and its resistance to Russia. While Ireland has embraced neutrality, the Russian invasion of Ukraine has as much to do with EU as it does with NATO. It has also been a long time since Ireland was a poor member of the EU. As a member of EU, it is hard to make the case that Irish tax policy which reduces tax take for other members of the EU is justifies in anyway.

Ireland has many positive attributes. Acting as a tax haven for US multinationals should no longer be one of them - particular when the rest of EU is paying for the defence of European ideals. Time for Ireland to grow up.