A large number of economic thinkers that I respect are calling for peak inflation, and that interest rates increases have topped out. With oil prices down from USD 120 a barrel to USD 77 today, this would be a strong indication of reduced inflation pressure. For “peak inflationistas” the cherry on the top would be this week’s cover of the Economist, warning that inflation will be harder to contain than people think. The Economist has a long and illustrious career as a “contra” (a contra is somewhere who gets market calls consistently wrong). Peak inflationistas even have the benefit of financial markets agreeing with them, with US 2/10 year yield curve as inverted as it gets. Inversion really is the markets way of saying that they don’t believe central banks will raise interest rates any further.

Is the Economist wrong again? Just looking at US CPI YoY, it already peaked out and started falling, and with the bond market in inversion, it does like the Economist leader writers have proven why they are writers and not hedge fund managers.

But, these days I place politics as more important than economics in doing financial analysis. From this perspective, I do not see central banks, and particularly the Fed going dovish until they get food inflation under control. Rising food prices are political dynamite. So lets us look at the most recent US CPI data from a food inflation perspective. On a year over year basis it is still rising at 10%, and even though it is slowing a little, it still doing 10% on high comps from a year ago.

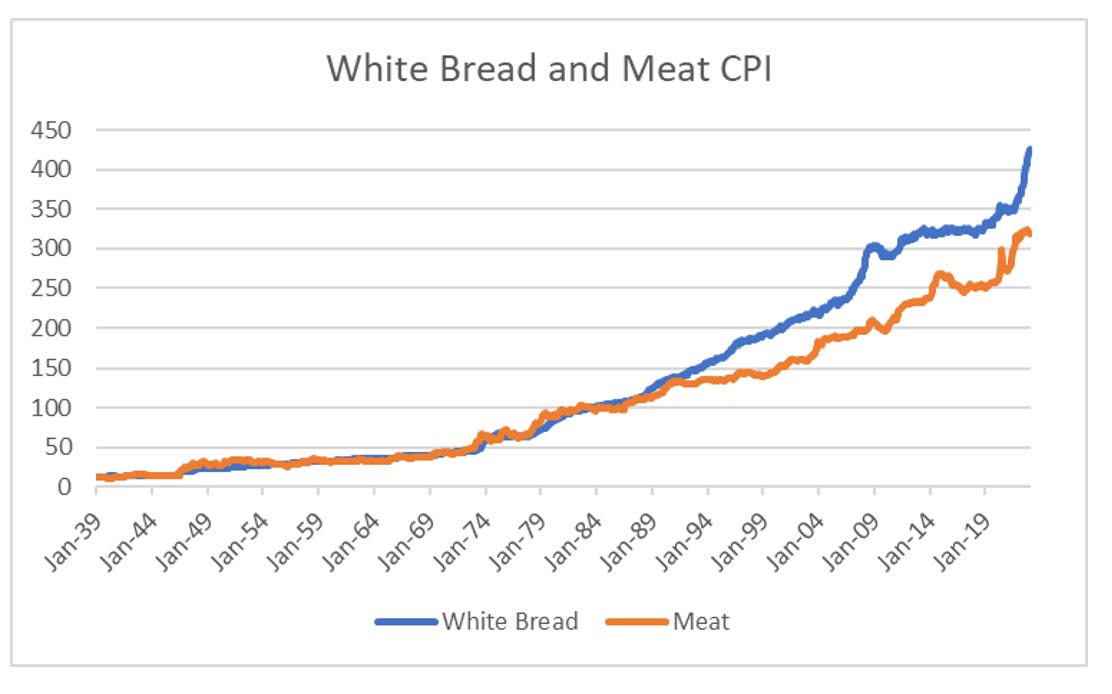

What I really like about food inflation is that it is universal and easily understandable. A Birkin bag or a Panerai costing 30% more is not inflation that matters to most people. But the price of bread and meat? That matters to everyone. What is really great about the US CPI data is that it breaks down white bread and meat CPI back to pre World War II. White bread CPI is still rising at nearly 20% year on year, while meat CPI is back to 2% year on year.

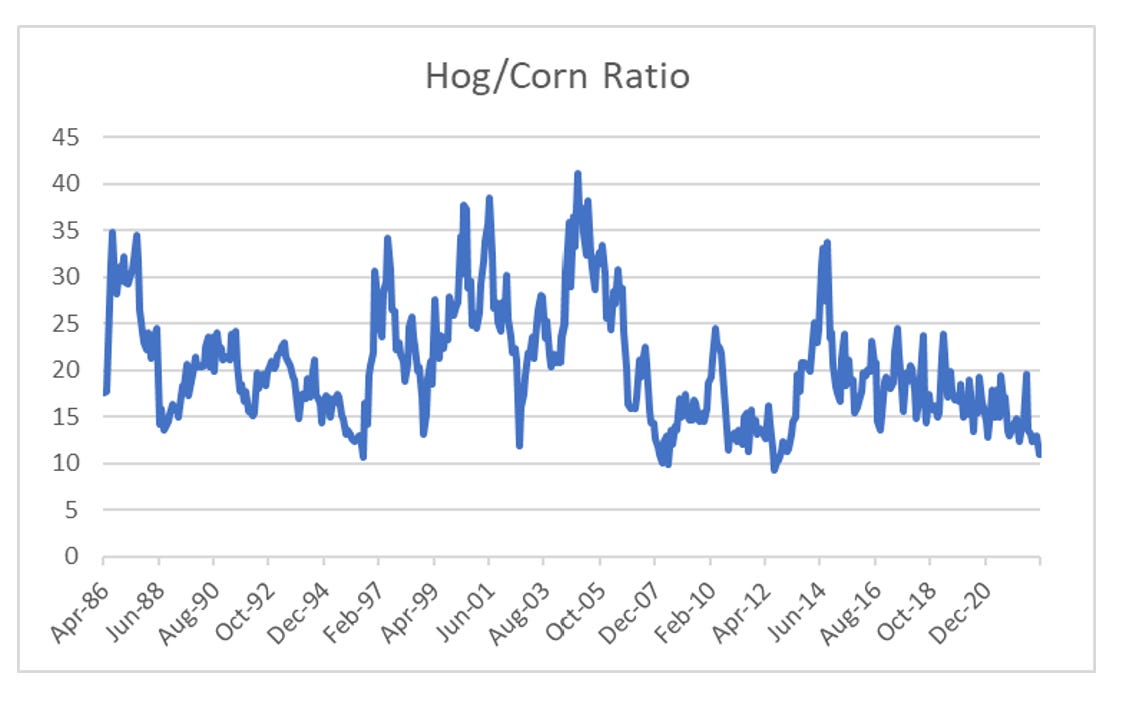

For CPI calculations, food CPI is given a total weight of 13.5%, with bread having a weight of 0.2% and meat having 1% weight. This means that soaring bread prices should not really be that important to Federal Reserve and other western central banks. But soaring bread prices are very important to politicians - certainly more than the CPI weightings given above. For me the question comes down to whether the meat index is right, or the bread index is right. Or in other words, will bread prices fall back, or will meat prices spike? One of the best things about free market capitalism, is that incentives are transparent. For US pork farmers are currently disincentivised to farm pigs. The price of hogs relative to corn are at close to 40 year lows, meaning that hog prices are not covering the cost of feed (which is mainly corn).

With hog farmers disincentivized to farm hogs, then one of two things must happen - corn prices must fall, or hog prices will rise. When we look at the corn market, we see that China has become a major buyer of US corn.

This is despite the Chinese placing tariffs on corn imports that have meant that Chinese corn prices are much higher than US prices.

In other words, geo-politics has driven China to have high food prices, which it now exporting back to the rest of the world. Just as we have seen with Covid, it is possible for the Chinese to change policies, but self sufficiency in food production seems to be a key policy for China. With Chinese activity picking up, my guess is that corn prices globally will remain high, which means feed prices will stay high, and meat inflation will catch up to bread inflation. In my view food inflation is still ongoing, and hence central banks will keep raising rates.