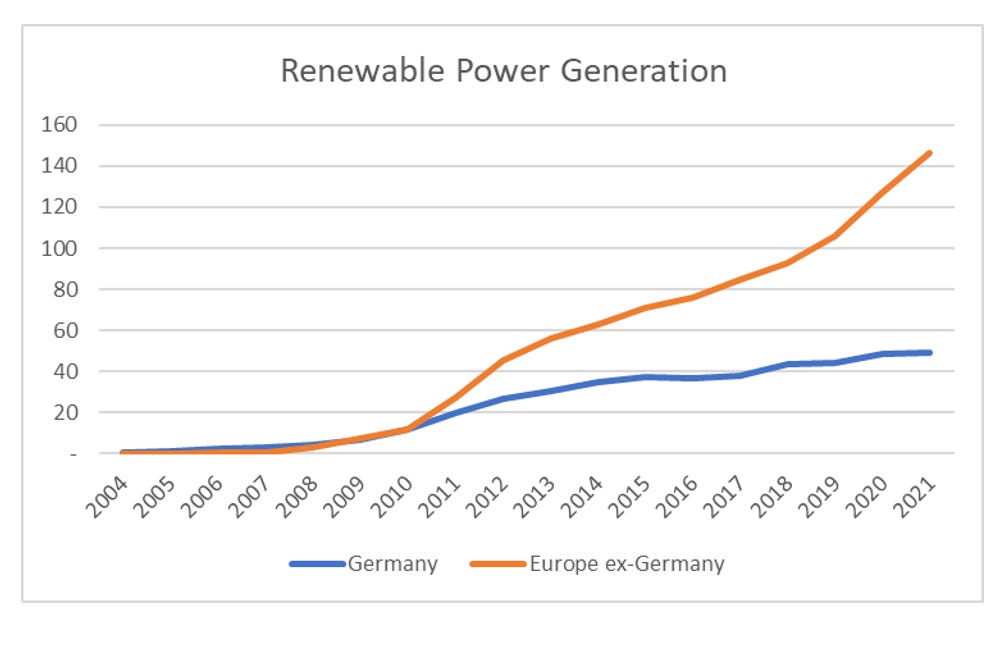

Some people vehemently disagreed with my analysis of European energy policy, so I thought I should elaborate on why I think it has been sensible, and how it is likely to become even more so. Germany has been the leader in renewable energy in Europe. Until 2010, Germany was producing as much renewable energy as the rest of Europe. Even though it has slowed its growth, it is still the largest renewable energy producer in Europe by some way.

As mentioned before, the growth in renewable energy meant that on occasion this cause German electricity prices to move negative.

You would think negative energy prices would be unalloyed positive for German industry and consumers. This was not the case. To grow renewable energy required the German government to offer guaranteed feed in tariffs (that is a fixed price to producers) and to upgrade its electricity grid to transfer power to where it was needed. All of this was expensive and was reflected in higher electricity costs.

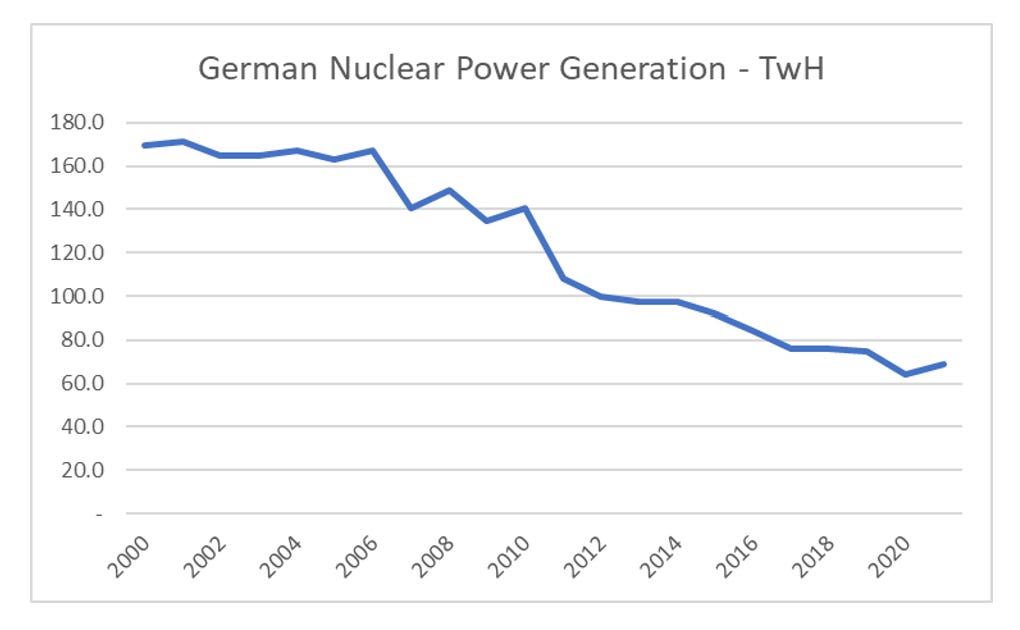

The German government faced a quandary. Low prices meant they needed to pay large subsidies to renewable power generators to continue to add capacity, but they also needed to subsidise nuclear power, as negative baseload prices would bankrupt this industry. Industry wanted more competitive energy prices. And it was under pressure from its neighbours to reduce its reliance on Russian gas. In the end the voting public wanted more renewable energy and less nuclear energy. As foreigners don’t vote, Germany chose to cut nuclear energy use and rely more on natural gas.

With nuclear power generation is down, and renewable generation is stagnating, natural gas consumption had to rise. in 2021, German natural gas consumption was back at close to all-time highs.

It is true that this made Germany more reliant on Russian natural gas, but the rise of both Australia and the US as large LNG exporters, makes relying more on natural gas as an energy source was not strategically illogical.

The point I am trying to make is that European energy policy and German energy policy was logical from a policy perspective. It wants to grow renewable energy, which financially makes nuclear untenable. Natural gas market was becoming more competitive with new entrants so being reliant on natural gas was not illogical. And choosing to cut off Russian gas would have been electoral suicide. Now that Russia has made that choice for the German government, we can see what is likely to come next. Europe will greatly increase renewable energy investment. And RWE, Enel and Iberdola have all announced exactly that. Russia tried to hold Europe hostage to energy prices, but in the end it has accelerated its move to renewable, and unified European energy policy. And as shown above increasing renewable energy generation makes negative baseload energy prices more likely.