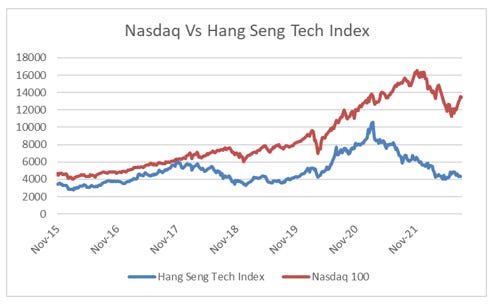

While most macro trades tend to look at broad indices, like the Nikkei or the Hang Seng to express a view, I have never been a big fan of shorting indices. Indices by construction will always be promoting winners, while cutting losers, and so over time will tend to win. To be bearish on an index, you need to be bearish on many of its largest components. These days almost all investors are only concerned with the US equities, so that is the area I will look at. So if I was looking for specific stocks to short, I look for areas with high retail participation, and very speculative assets. The ARKK ETF was probably the poster child for this in 2020. In late 2021, and early 2022 it offered an attractive risk reward, but at current levels, this risk reward for shorting is greatly reduced. The outperformance of Nasdaq 100 is noticeable.

Again looking at the tech space, the best shorts tend to be in areas where competition is rising, and taking market share. A good example of this is Netflix, and its other start up competitor Roku, who have come under severe pressure from existing media companies like Disney, Comcast and others. Both have seen their share prices give up 2020 gains and more.

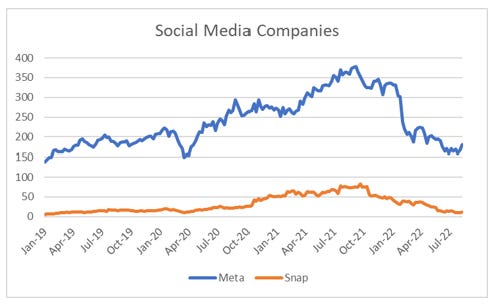

In social media we have seen the upstart Tiktok come in and destroy even the might Meta (aka Facebook) and Snapchat.

Meta and Netflix were particularly popular holdings in the market, so I am surprised that their weakness has not been more negative for the market. If we take Chinese tech, where leading stocks like Alibaba and Tencent have suffered problems, the Hang Seng Tech Index is trading at 2015 levels. The Nasdaq 100 Index is 3 times higher than is 2015 level.

Why is the Nasdaq 100 so strong, when Chinese tech, ARKK, social media and streaming names have all been destroyed?