When I was at school, I often lost marks in exams for failing to show working. I have a bad habit of seeing the evidence, and then jumping to the conclusion (I find it time efficient). I can tell from my recent posts on auto inflation that I have skipped out some of the workings, so I am going to take it right back to the beginning…. 2016. As soon as I say 2016, most people will think that I am going to talk about Trump or Brexit. But I am not. I am going to talk about China.

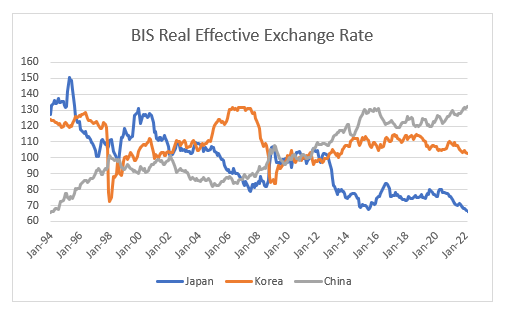

In a free market, globalising world, the policy of choice by central banks and governments the world over was currency devaluation. It made your companies more competitive, while pushing up domestic assets value, helping to deal with any debt problems. In 2016, China faced an overburdened property market, an uncompetitive exchange rate, and capital outflow. If it had followed the example of Japan or South Korea, it would have devalued. Instead, it kept its exchange rate strong, and continues to do so.

But keeping its exchange rate strong was not the only policy response.

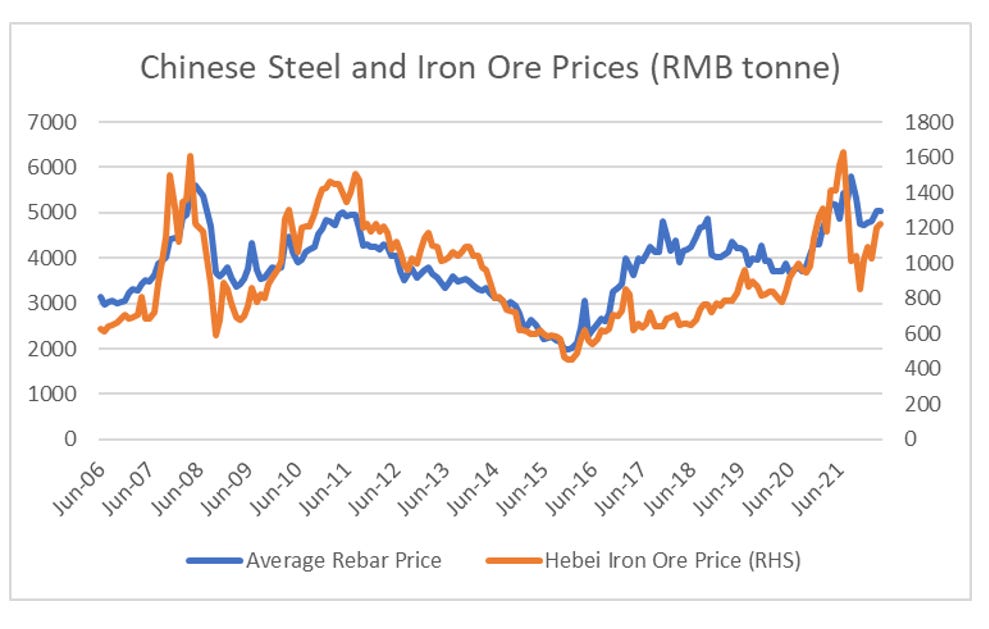

China announced at the time a large fiscal expansion, AND, capacity closures of a number of steel and iron ore mines. The combination of these policies forced up steel and iron ore prices that were collapsing under a mountain of oversupply.

Both iron ore and steel prices are at near all time highs, but Chinese steel production is now falling. In 2013/4 when Chinese steel production flatlined, prices collapsed. But now production can actually decline without causing a collapse in prices, unlike in 2008 or in 2015.

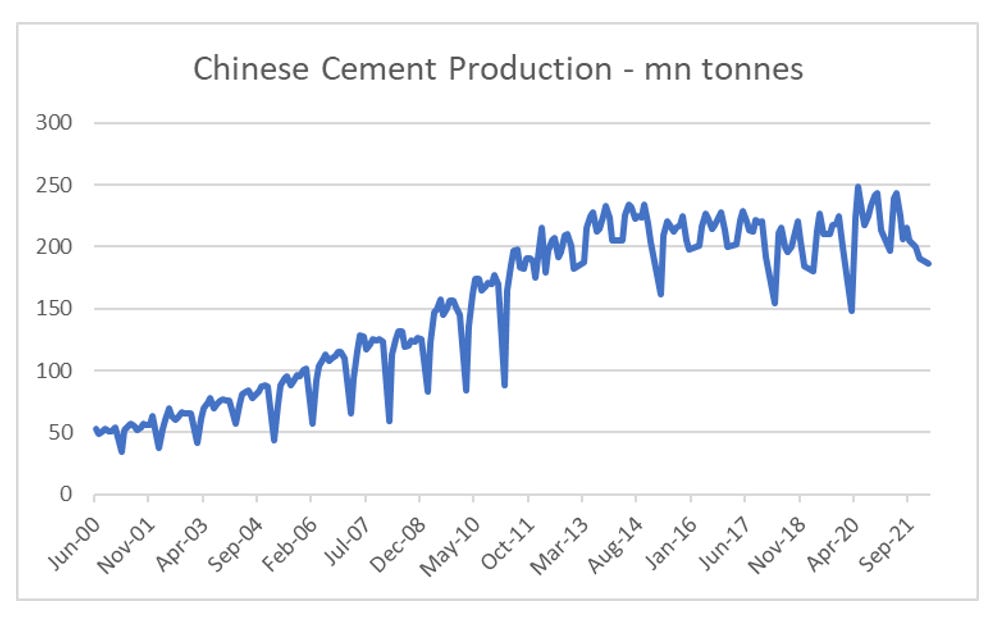

Another area where China is curtailing production, but keeping prices high is cement. China is 60% of all global cement production. But cement production has been flatlining to declining for many years now.

Again Chinese cement prices have matched the experience of steel and iron ore. Rising, when back in 2016 prices declined when production fell.

For someone like me, who has grown up in a free trade globalising world, the idea that a government would act to keep commodity prices higher seems odd. I tried to get an idea of what a Chinese economic planner might be thinking, and so I went and read the Communist Manifesto. Key sentences are:

In these crises there breaks out an epidemic that, in earlier epochs, would have seemed an absurdity - the epidemic of overproduction.

The price of a commodity, and therefore also of labour, is equal to its cost of production

The way I interpret this is that capitalism seeks to keep the cost of all inputs as low as possible to maximise profits. Labour is also seen as an input, hence capitalism also seeks to reduce labour wages as much as possible. The crisis of overproduction, or a recession, is the fruit of capitalism, and acts to keep input costs low. Thus to offset the deflationary pressure on wages, production must be controlled, with the aim of raising all prices. This is line with FDR policies, and seemingly inline with Chinese policies since 2016.

What my food inflation, and now auto inflation note is saying, is that these inflationary policies had their greatest effect on very Chinese industries such as steel and cement, where China is over 50% of global demand, but now these policies are spreading to other industries such as autos.

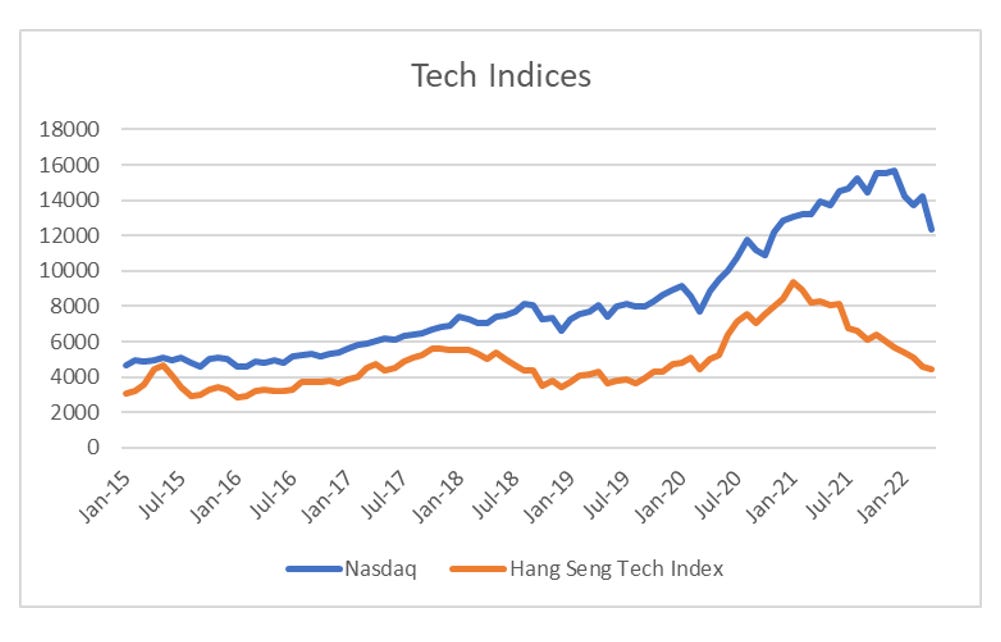

The implication is that the return to capital will decline, and a look at the relative performance of the Nasdaq to Hang Seng Tech Index bears that out. Chinese capital has suffered relative to the US.

I now understood why we had weak returns from Chinese stocks, despite rising commodity prices which had typically been associated with an rising Chinese activity and better growth. Chinese policy had changed to pro-labour, which restricts the returns Chinese corporates can generate. The question was how was that change in Chinese policy going to effect the rest of the world. It looks to me that global inflation is now secular, not cyclical. Time to Die, Mr Bond.

I EXPECT YOU TO DIE, MR BOND - PART II