If I look at markets through the lens of financial history from 1970 onwards, I should be telling you to buy bonds. As Raoul Pal would say, “Buy bonds, wear diamonds” . Why? Well basically, buying treasuries has rarely lost you money. 2022 definitely stands out at a weak year for US treasury investing, but only after very strong returns during the Covid crisis.

Bonds have been a fantastic asset over the years. Good returns, with limited drawdowns. The financial market view, and one seemingly endorsed by central banks, is that central bank independence and vigilance was the cause of falling inflation and bond yields. The corollary of this view, was less central bank independence and less vigilance would eventually cause inflation, and rising bond yields. So if you were going to be bearish on bonds, then Japanese bonds were the bonds most fund managers chose to short. This was of course very wrong, and most of these funds and fund managers have left the industry, which is why short JGBs trade earned the moniker “widowmaker”.

What I think this has taught most fund managers and investors is that it really doesn’t matter what governments and central banks do, bonds will do well. And bonds are seen as a good diversification away from equity markets. If we look at the long term performance of the S&P 500 versus the Bloomberg Treasury Index, then most fund managers would be of the view, to sell S&P 500 and buy treasuries.

So far we have a pretty good story to buy bonds. If history was guaranteed to repeat, then I would be short S&P and long treasuries here. However I am now of the view that deflation has been a political policy, not a timeless economic truth. After the Depression and World War II, policy (driven by political demands) was set not to repeat that era, and in particular to guarantee income growth and full employment. But like all policies in the late 1970s, it reached an extreme, and voters demanded change. Looking at 10 year average per capita income growth in the US, is peaked in 1970, and falling ever since.

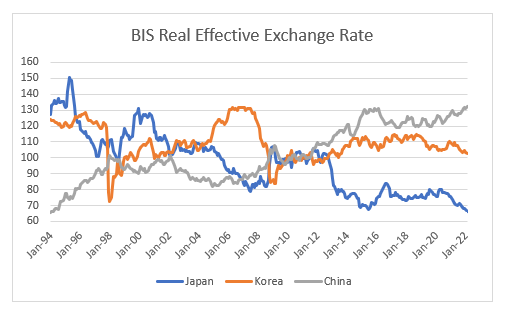

The era of free markets was an era of levelling of wages globally. This constrained commodity prices, and kept real wages low, but allowed financial prices to soar. But at its core was the idea that a country could or should devalue to make its workforce more competitive. With stagnant wages globally, and currency markets adjusting to keep wages in line globally, it became possible for single nations to achieve inflation (eg Argentina) but much difficult for the world to achieve inflation. The system that has more less existed since the 1980s seems to have come to an end in 2016, when China faced capital outflow and currency pressure, and chose to close its capital account and keep the Yuan strong. The Yuan has traded very differently to the Korean Won or the Japanese Yen.

The risk, as we are seeing this week, is that China suddenly chooses to devalue. But the political question is why would they do this? China already faces tariffs on an array of export products, and any large devaluation would likely cause higher tariff rates to be placed on it, reducing the appeal of devaluing. China is a large importer of commodities, so devaluing would worsen domestic living standards. No doubt the Chinese Communist Party noted that the large currency devaluations in Asia in the 1990s led to significant political change. The question is whether China can grow GDP without devaluing. With a GDP per capita at Malaysian levels, its looks to me that China could grow without devaluing.

What I am saying, is that deflation and low interest rates had very little to do with central bank policy, and everything to do with free trade, flexible exchange rates and a political system that favoured capital over labour. What I am now saying is that the pendulum is swinging back the other way, and that governments will actually begin to run tighter monetary policy to keep exchange rates and real wages strong, which will cause inflation to run hot. So yes, just like Goldfinger, I expect Mr Bond to Die.