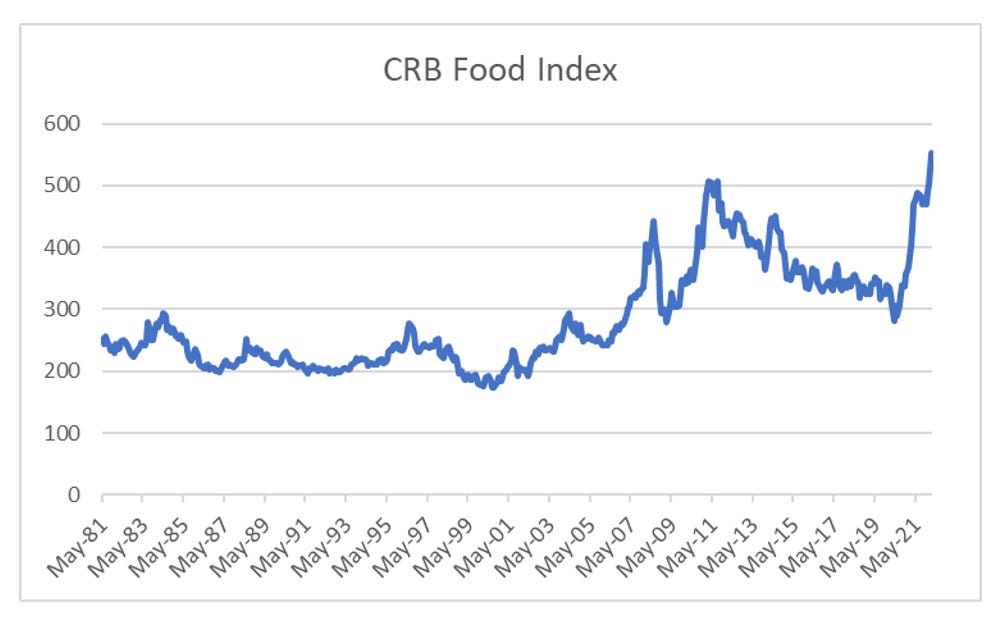

Food prices have recently touched all time highs. The speed of the increase has also been very noteworthy.

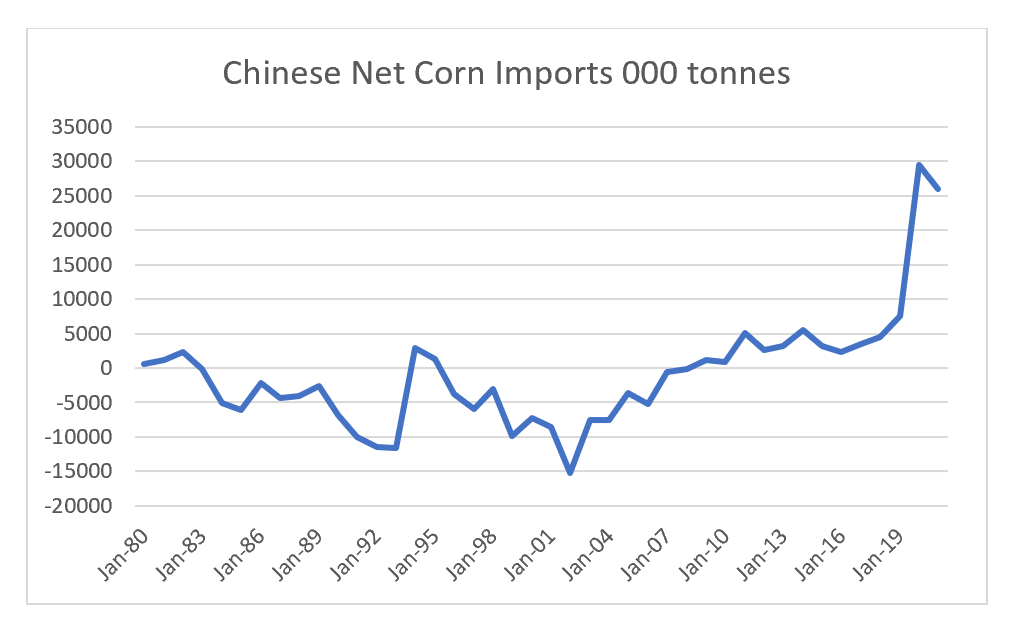

The move higher in food prices so far, has been driven by two shocks. The first shock was African Swine Flu, which decimated Chinese pig herds in 2019, but have been rebuilt since then.

The collapse in the pig herd caused Chinese pork prices to rise dramatically. At its peak it was 6 times higher than US prices.

Pork farmers tend to look at pork/corn ratio as a guide to profitability. This spiked to all time high in China in 2020

If you think of a pig, as a store of grain (4 kg of grain is needed for 1kg of pork), Chinese needed to rebuild inventory. The upshot was that China has moved to becoming a very large corn importer.

While this has been very bullish for grain, as the pork to corn ratio highlights above, pig farming in China is now loss making. So Chinese demand for grain cannot be taken for granted. But just as demand destruction was becoming a concern for grain prices, the Russian invasion of Ukraine has created a supply shock. As pointed out earlier for Chinese demand for coarse grain (corn, sorghum and barley) is more than the combined exports of Russia and Ukraine.

Historically speaking, at this level of food price inflation, demand destruction has normally taken hold, and short agricultural commodities has been the better trade. But I think we are transitioning to a new political environment, which suggests food inflation and rising agricultural prices are here to stay. This will be the subject of my next post.