As mentioned in a previous post, when I have looked at previous right to left, and left to right political swings, they seem to happen globally, and they seem to happen roughly at the same time. A global shift left happened in the 1930s, and kept shifting until 1970s, when it began to shift back to the right. We are now well into a shift back to the left, that began in 2016. As also highlighted, modern democracies are filled with checks and balances to slow political shifts, but they still happen. China, with less checks and balances, can move much more quickly - and offers us view on the future here in the west. President Xi has proclaimed a policy to stop housing being used for speculation. Chinese policy has not been a happy policy for Chinese property developers.

I was talking to a friend in London, whose landlord was asking for 50% increase in rent. I asked how they justified such a big increase, and he said that the landlord needed rent to rise that much to pay their mortgage. As they had owned this property for a number of years, the implication was that the landlord was using the rent to pay an interest only mortgage and spending the rest. Searching Tiktok for “renting in london” will produce a stream of angry videos. The problem is that if you look at UK house prices, and compare to rent CPI, you can see that ever lower interest rates have acted to keep rent CPI under control.

To put it another way, rising mortgage rates create rising rents. The US National Association of Realtors calculate a qualifying income, that is the minimum income you need to qualify for a mortgage. With rising house prices and now rising mortgage rates, the qualifying income has risen from USD50,000 to over USD90,000 in two years.

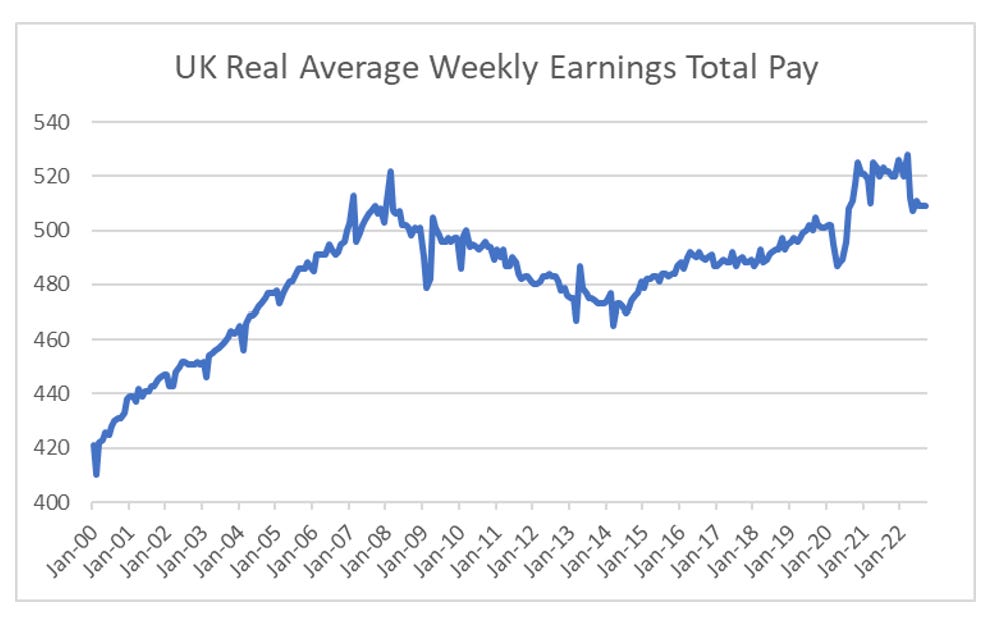

Part of me looks at this and says well this is very bullish for landlords. Alot of potential homebuyers will be priced out of the market, and will need to become tenants, and rents will need to rise - which is what we are already seeing in London. The problem of course is that real incomes in the UK have not risen since 2007. Asking more rent from people that have not seen a wage increase in 15 years seems politically toxic to me.

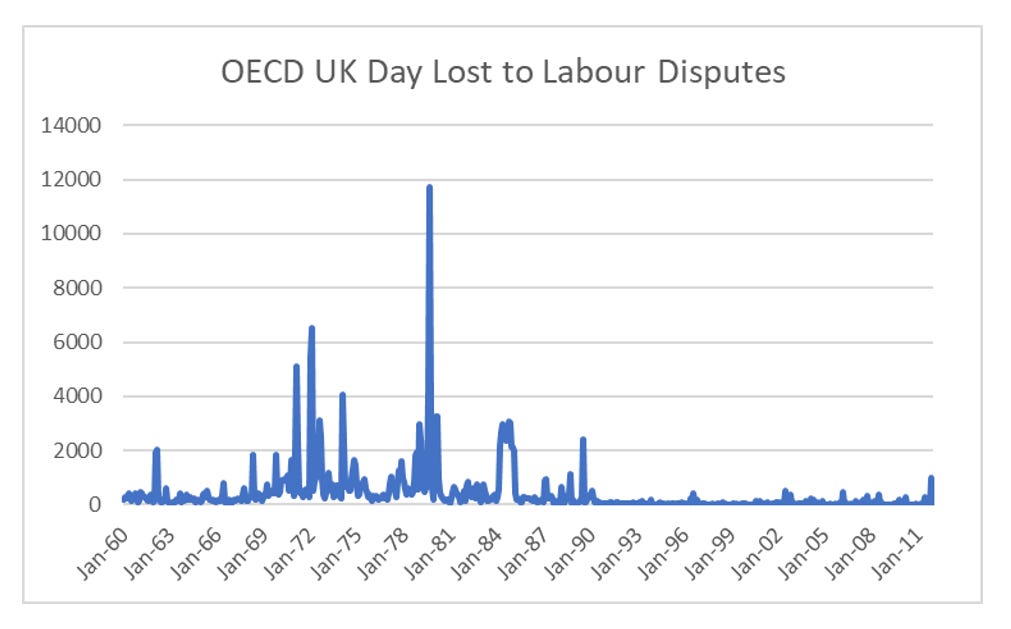

The current UK government is hoping to adopt the austerity policies of the Cameron era, that is to push real wages down, to make the UK more competitive and to keep interest rates down. There are what I would call pro-capital policies, and I would suggest they are dead in the water. Nurses, postal service and train drivers have all announced strike actions, and personally I don’t blame them. How big is this strike action going to be? The OECD used to keep a track of days lost to industrial disputes but stopped publishing the data in 2011. The units are thousands - so peak strikes in 1979 cost nearly 12 million working days in September of 1979. How does current proposed strikes compare? The UK has 5.7 million public sector workers, with 1.88 million in the NHS alone. Assuming 20% participation, and with a seven-day strike, you easily get numbers seen in the early 1970s, with more than 7 million working days (of course a larger population now makes it not a perfect comparison), but we are talking big numbers.

Politicians being politicians will do whatever they need to do to stay in power. Berlin has had rent controls in place since 2015 which has survived numerous legal challenges. Mayor of London, Sadiq Khan has spoken positively of rent control. Given that rising interest rates are actually pushing up rents - the opposite of the Bank of England’s intention, new policies are required. Rent control seems a vote winner to me, which makes it likely. Or in other words - fuck landlords.