No matter what your views on cryptocurrencies might be, the project is extremely interesting. The model is built about financially rewarding its users, which encourages more usage, and increases the financial rewards to its users and so on and so forth. Still by far the most “rational” model for valuing bitcoin, is the stock-to-flow model popularised by Plan B. In essence, it compares the stock of asset (how much of its has been produced before) to its flow (how much is being added to this stock annually). This allows you to compare the market capitalisation of bitcoin to the market capitalisation of other forms of money such as silver and gold. In the chart below, gold and silver are the large dots to the top right, while all the other dots are bitcoin over time, where its’s supply has fallen over time (halving as it is called). This model is very bullish for bitcoin as supply naturally tends to zero, giving potentially unlimited upside.

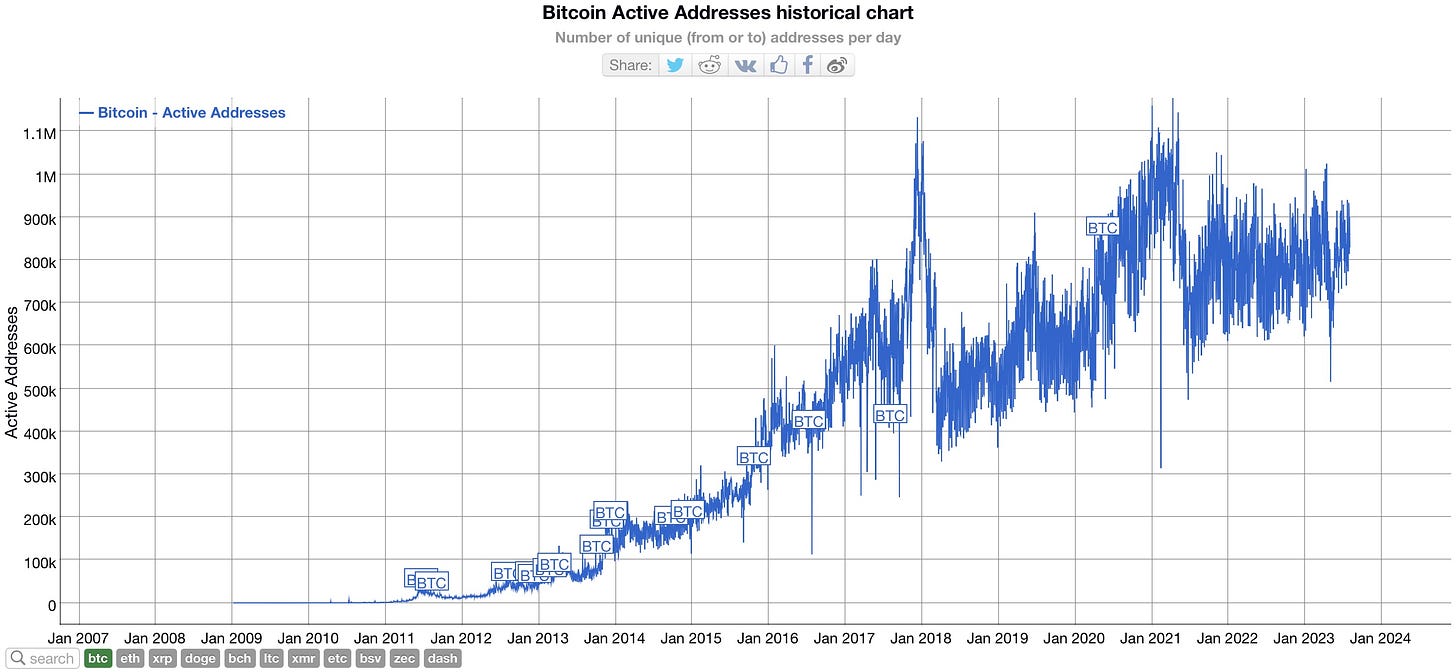

There are of course two huge caveats to the bitcoin bull story. Firstly, it has to be THE cryptocurrency that people use. It has to beat off other competing privately launched cryptocurrencies, of which there are many. And it has to be preferred to the government backed cryptocurrencies that are in the process of being launched. For the hard core believers in crypto, the idea that government backed crypto could replace bitcoin is fanciful, but for corporates and the average user, lack of government support to outright hostility is something of a concern. That bitcoin active addresses has stagnated in recent years should be a concern to bitcoin believers.

As an investor, the idea of creating artificial scarcity causing the value to soar is a well defined business model. As someone who has seen the value of sports cars, watches, handbags, Pokémon playing cards, sneakers, London property among other things soar in value in recent years, the stock to flow model obviously works. The issue with it is that you are reliant on two things. First that the producers continue to control supply, that is new competitors do not enter the market, and that existing producers resist the urge to dump stock even as prices rise. This was certainly not the case with cryptocurrencies.

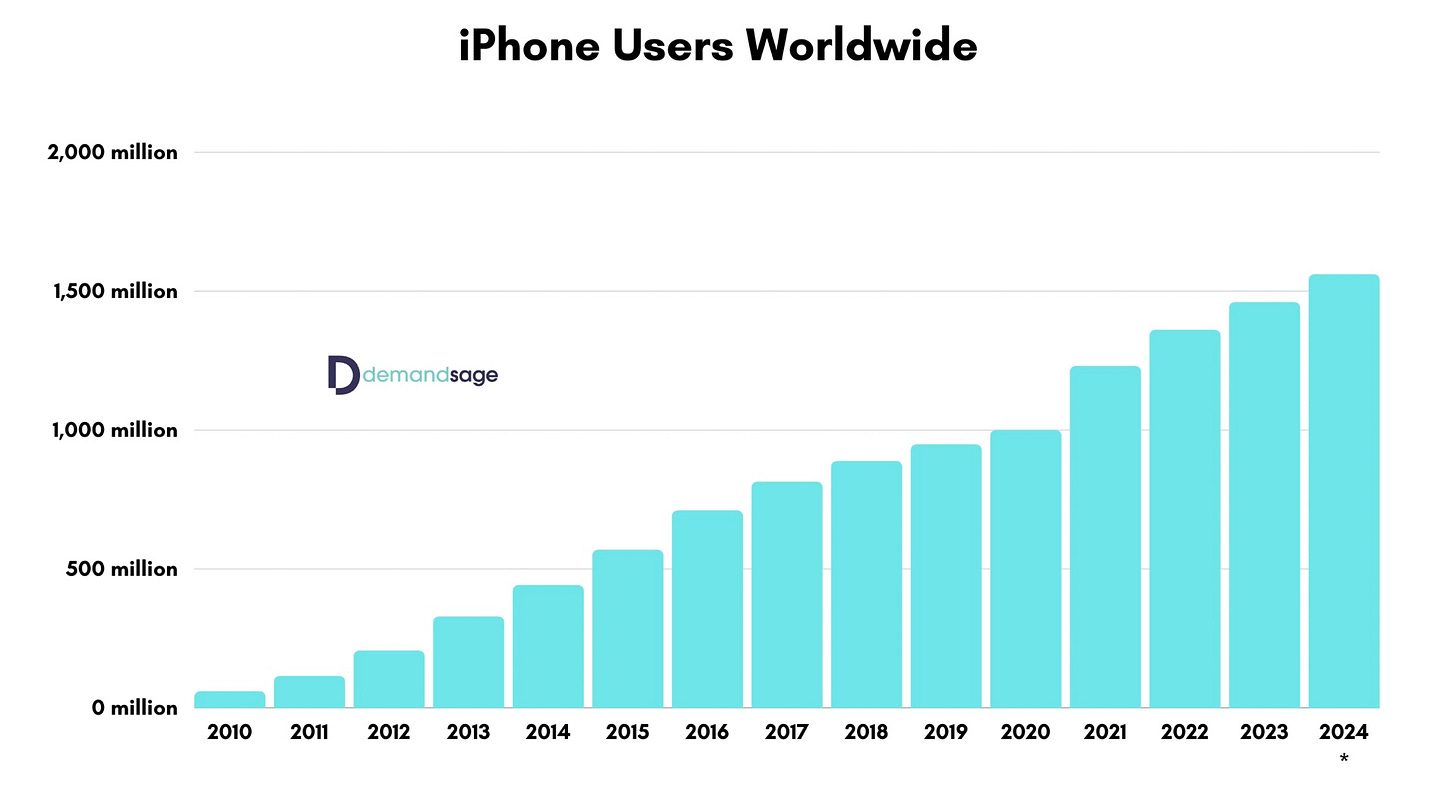

Apple, the largest company by market capitalisation, has largely achieved a huge increase in valuation by solving the problems faced by bitcoin. First of all, while bitcoin active addresses has stagnated, Apple iPhone installed base continues to climb. And with the opening of retail stores in India, we can probably expect this installed base to continue to grow for a few more years at least.

What about competition? Well Apple did face competition from Chinese manufacturers, including Huawei, Oppo and Xiaomi. While these brands continue to dominate in China, and offer not only lower priced handsets, also lower costs for developers to use their App stores (typically 15% compared to Apple’s 30%), these producers have been effectively banned from Apple’s core markets in the US and Western Europe. Apple, in contrast to bitcoin, operates with the full support of the US government.

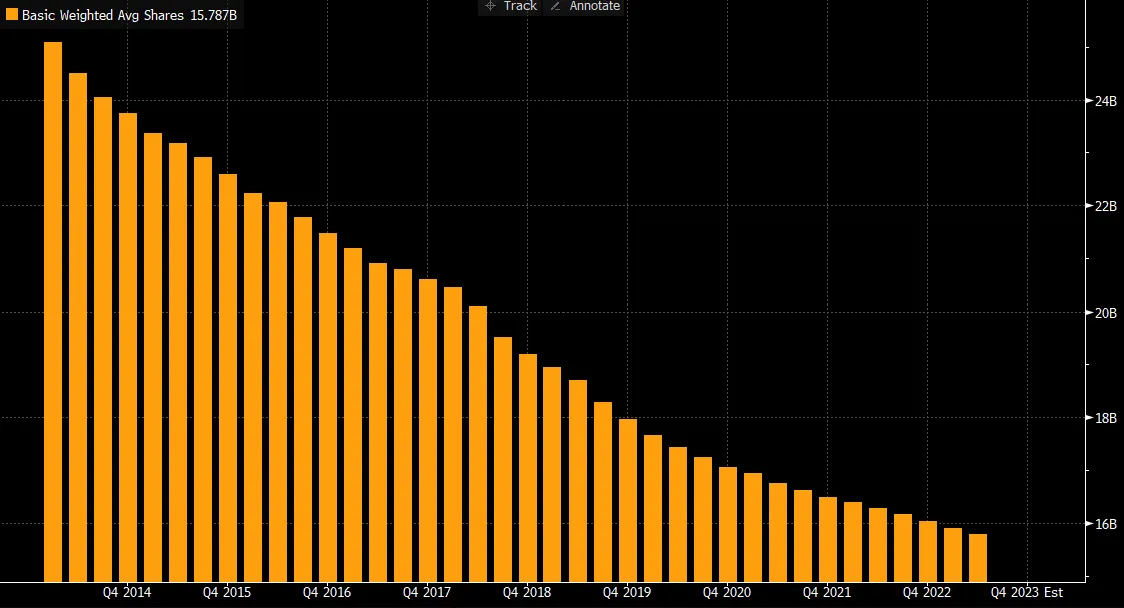

Finally, share buybacks by Apple creates scarcity to Apple shares. In the stock-to-flow model Apple has a negative flow - which is even better than bitcoin. This makes it theoretical valuation unlimited as well.

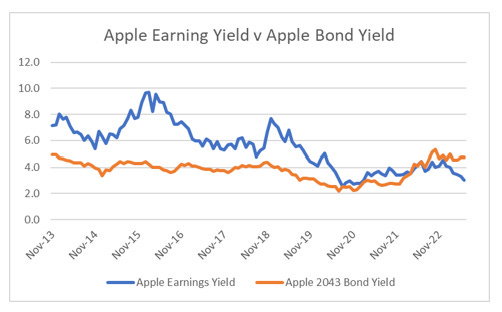

Bitcoin supporters would argue that bitcoin is programmed to reduce supply (halving) while Apple could choose to increase supple of shares as the stock gets more valuable. However, share buybacks are beginning to look as automatic as bitcoin halving. Originally, I thought share buybacks was an arbitrage play by Apple, where its bonds were yielding well below the earning yield on Apple shares very attractive to buyback. But in 2023, buybacks have continued even as the earnings yield have risen, and now makes no sense from a capital allocation point of view.

So what are the risks to Apple stock? A worldwide recession would of course damage revenue. So would the rise of a competitor that could eat into it installed base, but with China largely locked out of the developed world, that risk is limited at the moment. Given the political focus on spending to avoid recessions, I also think recession risks are limited. If you like bitcoin, you should love Apple.