DIGITAL REAL ESTATE INVESTING

Or is the market really that expensive?

A couple of years after the dot com bust - Scott McNealy, CEO of Sun Microsystems, had this to say about the dot com bubble:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

On a price to sales metric, the S&P 500 is far beyond anything seen in the dot com period.

The obvious difference to 2000 is the much lower interest rate environment that exists now. But I have also wondered about changing composition of the market. Even when the S&P 500 was “cheap” in 2011, and just over 1.2 times sales, the REIT (real estate investment trust) sector was trading at 5 times sales. Today is close to 9 times sales, and has spent most of the last decade at 6 times sales. This metric is expensive, but you do not hear people talk of REITS being in a bubble, as the valuation of REITS represent the value of the underlying asset - real estate. The point being is that a price to sales metric does not really work when valuing a landlord.

I am wondering if there is a “digital real estate” market? And if there is, does it also deserve the same multiple that we attach to physical landlords? When ever I looked at Facebook or Google, I used to look at them as advertising companies. Facebook (now Meta Platforms) and Google were not included in the S&P Media Industry classification until 2018, but I have added their market capitalisations in from when they were listed to show how the value of “online advertising” businesses have transformed the value of media businesses.

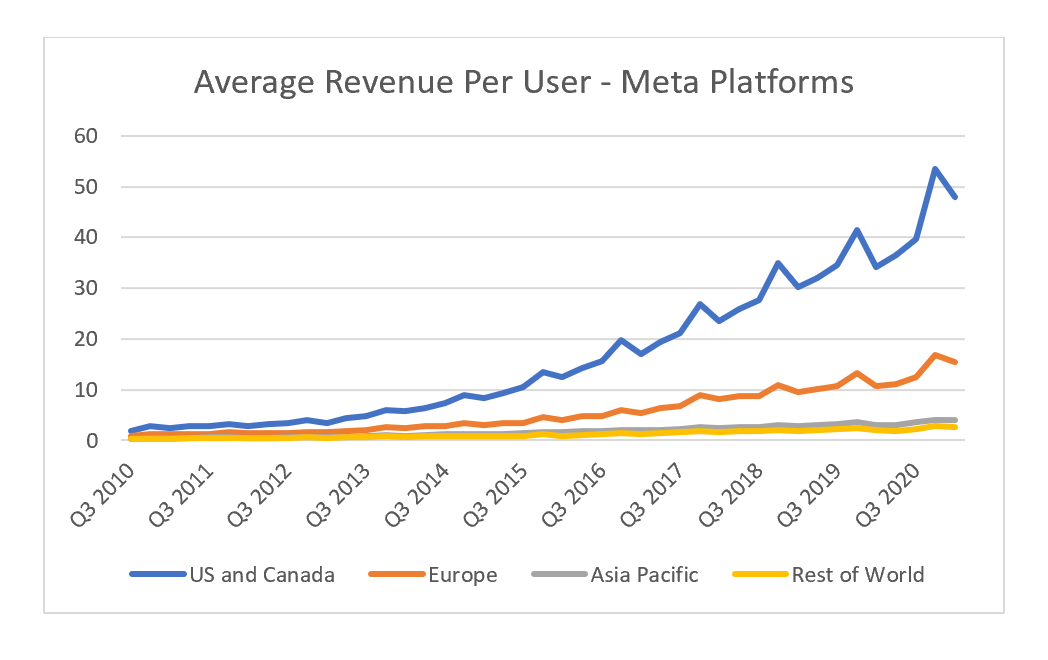

The best comparison of the big tech companies to physical real estate companies are Japanese rail companies, or French hypermarket operator Carrefour. In both cases, they provide a marginal profitable business, but then make money by being a landlord to smaller business located around their infrastructure. As long as the user base for the infrastructure is increasing, then rent can be increased. Facebook (Meta Platforms) provides the best data on users. Facebook has nearly every adult in Europe and US as a user. Growth is in emerging markets.

Just like a train station that serves every commuter, or the only hypermarket in 20 miles, Facebook can then lift rent inline with economic growth.

Like physical real estate, it is very possible to overbuild in the digital world. This was arguably what happened in the dot com downturn, when banner advertising rates collapsed as more and more inventory became available. It used to be easy to show a chart with falling “clicks per impression” prices. That data is hard to come by now. But, Twitter does show its possible for physical real estate to go into decline. When Donald Trump - the number one twitter star from 2016 to 2020 - was banned, ARPU at Twitter fell.

Thinking of “platform” stocks as landlords makes more sense, and also justifies their high valuations. It also helps to explain Chinese government antipathy to Alibaba and Evergrande. The Chinese Communist Party has a long history of being unkind to landlords and rent-seekers, with Alibaba acting like a digital landlord, and Evergrande a physical landlord.

The question then becomes can the dominant positions in the digital world owned by these landlords ever be challenged? If the big tech names that control the flow of the digital economy are entrenched, then their valuations could well be justified. But as China shows, it is also possible for governments to takedown landlords and rent-seekers if they choose. But I would suggest being bearish on markets due to valuation - as the Scott McNealy quote from above encourages you to do - is not a good idea.

Thank you Russell for sharing your thoughts over the years, there is a lot of value in it.

Interesting analogy. Obviously some "real estate" is more valuable than others, but I wonder how one differentiates the effectiveness of the "real estate?" Using your examples, Twitter is used extensively, but their advertising has never been effective. One only has to see how their ads interrupt the flow of news, and are not remotely compelling to click on, that you can extrapolate their ineffectiveness to the advertiser (I've often thought that intersting comparison for Twitter is the old AM radio in the US. Tons of ads during the key drive times literally drove listeners to the FM stations). Compare that to Instagram or Tik Tok or Pinterest, and the ads seem more native and part of the flow and ultimately effective.