DID CHINESE OUTFLOWS CREATE THE CRYPTO BOOM?

Bitcoin has been used to circumvent monetary controls since it was introduced.

Bitcoin has been rising in value for many years before it suddenly burst in to the mainstream investing conscious in 2016/7. After a 3 year bear market, it has once again soared to new highs. Currently bitcoin’s market capitalisation is over 1 trillion US dollars.

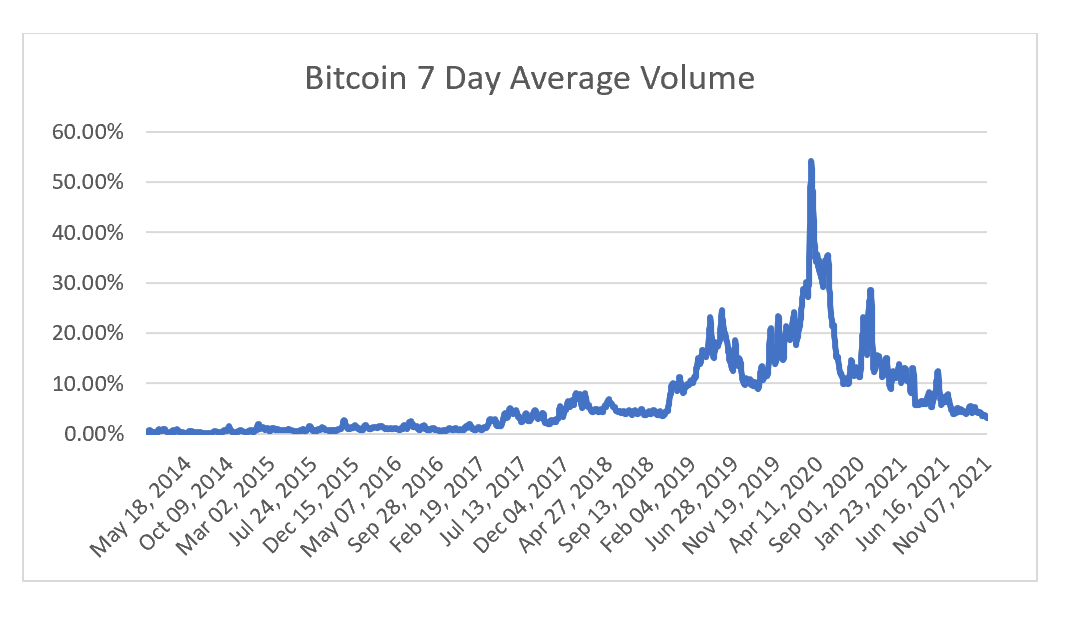

Using data from www.coinmarketcap.com, the volume traded of bitcoin relative to market capitalisation used to be very low, less than 1% of outstanding bitcoin, in line with its illiquid and novel nature. But starting in 2015, the volume traded began to rise, reaching 8% in late 2017 before slowly dropping off. The bull market of 2019/20 has seen 50% of market capitalisation being traded before dropping back to very low levels recently.

Since 2014, China has seen capital outflows. Looking at Chinese foreign reserves and the trade balance can give us an idea of the amount of capital that is leaving China. Peak outflows coincided with the first increase in trading volume seen in 2016/7. And renewed outflows have coincided with another increase in trading volume in recent years.

Until recently, China was the main bitcoin mining country. The PBOC has also recently banned all cryptocurrency transactions. This potentially makes bitcoin a China devaluation play, just as gold was a US devaluation play in 1970s. Intriguingly, recent strength in Chinese Yuan has coincided with a drop off in volume traded. If bitcoin is a China devaluation play, then the performance of bitcoin is less dependant on the Federal Reserve, and more dependent on the PBOC and Chinese investors perception of the risk of a Chinese devaluation.