My investing career started in the 1990s, and after seeing the Asian Financial Crisis, the dot-com bust, the GFC, the Euro-crisis, and various emerging market crises, I paid very careful attention to capital flows and asset markets (hence the title of this substack). Since 2016, I have felt markets have changed. And I have tried to understand this change, so I could judge how much risk I was taking. I came up with two reasons for why markets were trading so differently. The first reason was the prolonged period of commodity deflation had allowed central banks to do whatever they wanted. The second was that moving from banks pricing market risk to clearinghouses pricing risk had profoundly changed markets. Both seemed to be good reasons to me, but the Russian invasion of Ukraine were ideal circumstances to test these theories. If correct, they should have led to severe weakness in equities. That did not happen so we need to look elsewhere.

Long time readers will know I believe that Japan occupies a special role in the financial world. Uniquely among all nations, the Japanese government, households and corporates are all net lenders to the world. What is far more typical is for most countries to have only one or none of the sectors being a lender to the world. So as the previous post showed, the US private and public sector are net borrowers from the world.

In contrast, Japan has run a very large surplus NIIP in both private and public NIIP. And these flows have accelerated as its bubble economy deflated during the 1990s and 2000s. So this would argue that Japan is the main provider of capital globally.

I had assumed that a spike in food price would cause financial distress, as the move higher in 1996, 2007 and 2011 had preceded the Asian Financial Crisis, the GFC and the Eurocrisis respectively.

The big difference between now and the previous spikes in commodity prices is that BOJ was trying to normalise interest rates to some degree. So in 1997, 3 month TIBOR rates touched 1% up form 0.6%, before the Asian Financial Crisis. The BOJ also kept 3m TIBOR rates above 0% until 2016, when markets have become more distorted in my view. One nice feature of this analysis is that BOJ also tried to raise interest rates in 2000, when the Dot Com bust occurred but was a period of falling commodity prices.

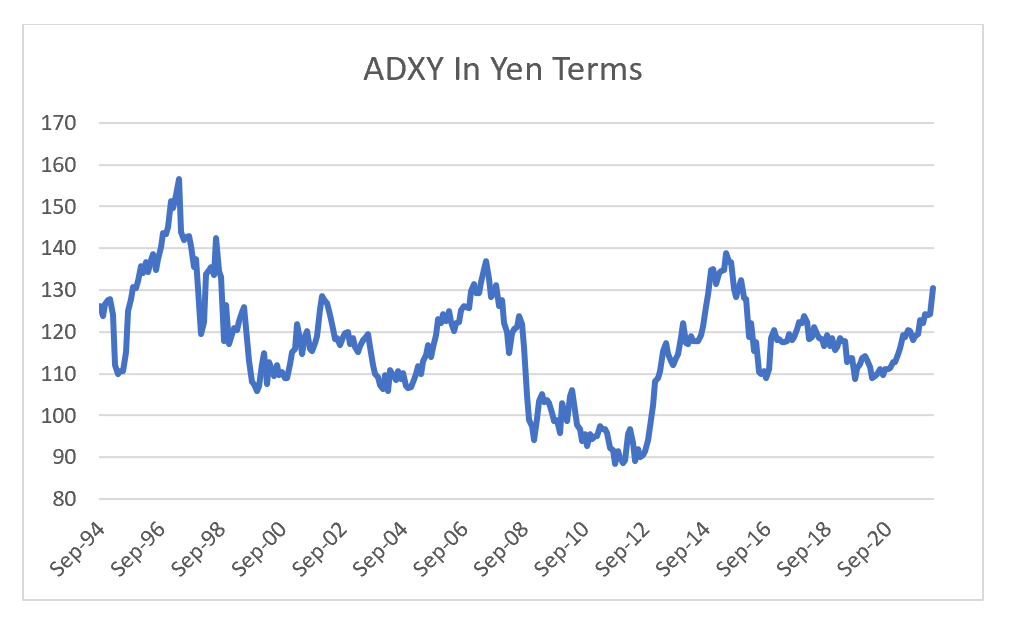

Finally, the weakness of Asian currencies can be explained away by looking at the performance of Asian currencies in Yen terms. “Risk off” can be seen when ADXY is falling, such as in 1998, 2002, 2008 and 2016. Recent moves of ADXY in Yen terms are clearly “risk on”.

Moving from looking at the Federal Reserve policy as driving markets, which is increasingly hawkish, to the BOJ, which remains resolutely dovish, clears up much of the mystery of recent market moves in my view. The big question is when does the BOJ get hawkish?