COULD WE SEE A NATURAL GAS SHORTAGE IN THE US?

Small declines in natural gas production can have an outsize effect on supply in the peak winter season

The emergence of shale drilling (fracking) has caused US natural gas production to rise dramatically.

This has caused natural gas prices to fall dramatically, but to also dampen seasonal volatility.

As US domestic natural gas production has grown, demand from the electricity sector has also grown. Consumption has doubled in the last 20 years.

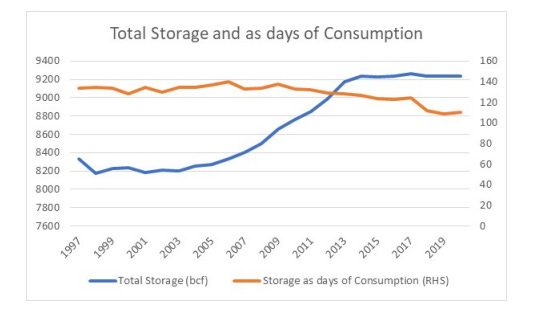

The reduced volatility of natural gas prices had disincentivised increases in storage capacity. Capacity as a number of days of consumption has been in decline.

However, the key gas basin, the Appalachia basin has stopped growing production. Using SU Energy Information Administration (EIA) data, we can see that it now has sizable legacy decline that is hard for new production to overcome.

The falling new production and rising legacy decline, has led production to be already at 2bcf below peak production, but with further falls possible.

Small declines in production can have an outsized effect on supply in the peak winter season. In late 2018, prices of natural gas spiked from USD2.8 to USD5 in December. Worldwide natural gas prices tend to be more volatile when peak storage is around 3500 bcf, compared to a peak of 4000 bcf. Over a full year of production, this implies only a daily fall of 1.5bcf is needed to tighten the market. Appalachia production has already fallen by this much.

Winter is coming, and so are higher natural gas prices.