CORNSWAGGLED

“When China turned from an exporter of oil and iron ore in the early 2000s, it transformed both markets. It seems that China becoming a net importer of corn could also potentially transform grain

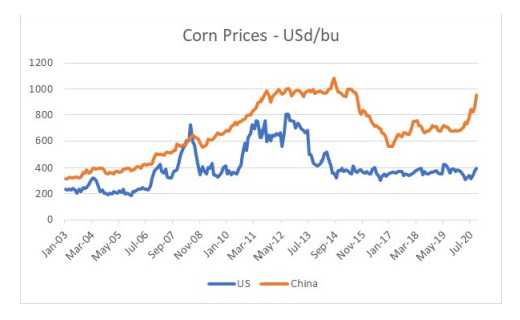

African Swine Flu (ASF) is creating a spike in Chinese demand for corn and driving Chinese corn prices higher.

However, the shock of ASF is also exposing a much more fundamental shortage of corn in China. The spike in world corn prices in 2011 caused China to implement a price floor for corn, to stimulate production. The corn price floor was very successful and reported Chinese stocks of corn grew and became very large. To put this in context, Chinese stocks of corn are over 60% of all known stocks, and four times larger than the US stocks.

Much of the increase in Chinese corn production came from northern provinces, Heiliongjiang (HLJ) in particular. Acres dedicated to corn rose by some 50%. As the floor price of corn was removed in China acreage for corn has fallen back again.

The problem is that as HLJ increased corn production, it also increased industrial processing of corn. Corn is processed into a variety of products, including starch and ethanol. Industrial demand of corn in HLJ increased from 7.5m tonnes in 2016 to 18.8 in 2019.

As production has fallen in HLJ, this has greatly reduced the available corn to export to the rest of China. In China, corn is grown in the north, to send to the south for pig farmers. Even though HLJ is still the largest producer of corn, it is now only the third largest exporting province in China.

We do not have data for the current harvest, but in July there was an update on provincial corn storage in the northern provinces. Storage in HLJ has fallen by half this year as reported in July, and reports indicate that all storage may well be exhausted now.

If Chinese corn provinces have exhausted their stores of corn, and Chinese pig farmer demand for corn is rising, which is confirmed by increasing pig stocks, then the Chinese will need recourse to world market for corn. We are now seeing Chinese buying of US corn has soared to a new record.

While it seems possible for HLJ and other northern provinces could add corn acreage if they need to, it seems more likely that China will become a structural importer of corn.

When China turned from an exporter of oil and iron ore in the early 2000s, it transformed both markets. It seems that China becoming a net importer of corn could also potentially transform grain markets.