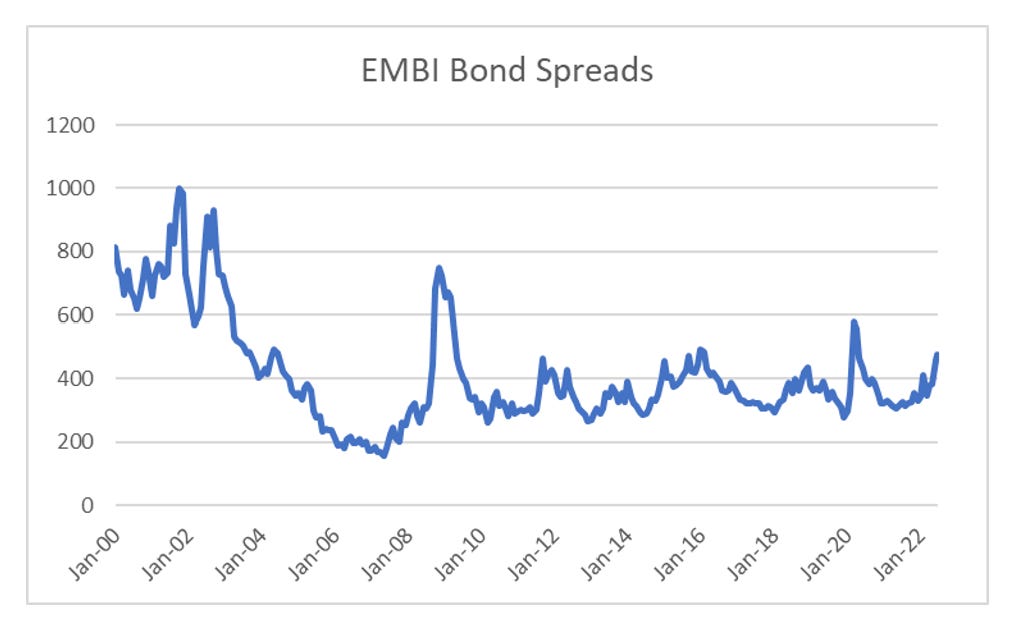

On a number of traditional measures, buying “risk” assets is beginning to look good. EMBI bond spread at close to 500 has normally been a good entry point in the post GFC world. Of course if your world view is of the imminent China collapse, 800 to 1000 would be more likely entry point.

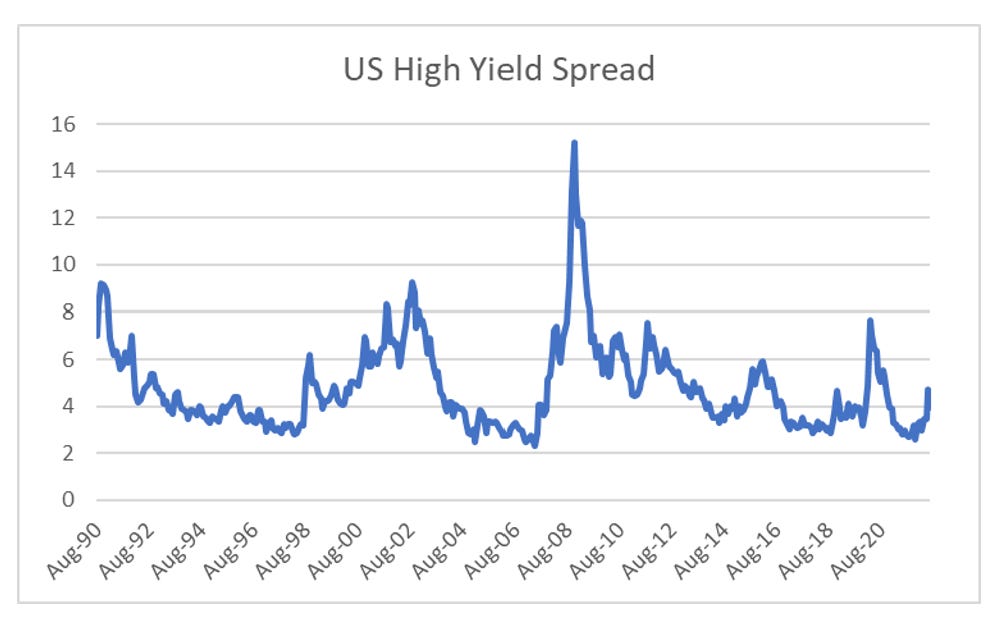

US High Yield spread touched 5% last month, but the latest print is 4%. This for me is neither here or there.

The problem with both these analysis is that they are spreads relative to treasuries.