For many years, the key to playing US markets correctly has been to buy the market when the corporate bond yields begins to fall. I show the KDP High Yield Index below, but you can use ETFs such as HYG or LQD for this as well.

Just eyeballing the above index, you could make the argument that high yields have sold off enough to buy the dip. However most money managers tend to look at spreads versus treasuries, rather than the absolute level of high yield. Typically, when high yield is selling off treasuries are rallying (i.e. yields are falling) but that is not happening this time. That is high yield bonds have sold off inline with the movement in 5 year treasuries. Spreads remain close to all time tight levels.

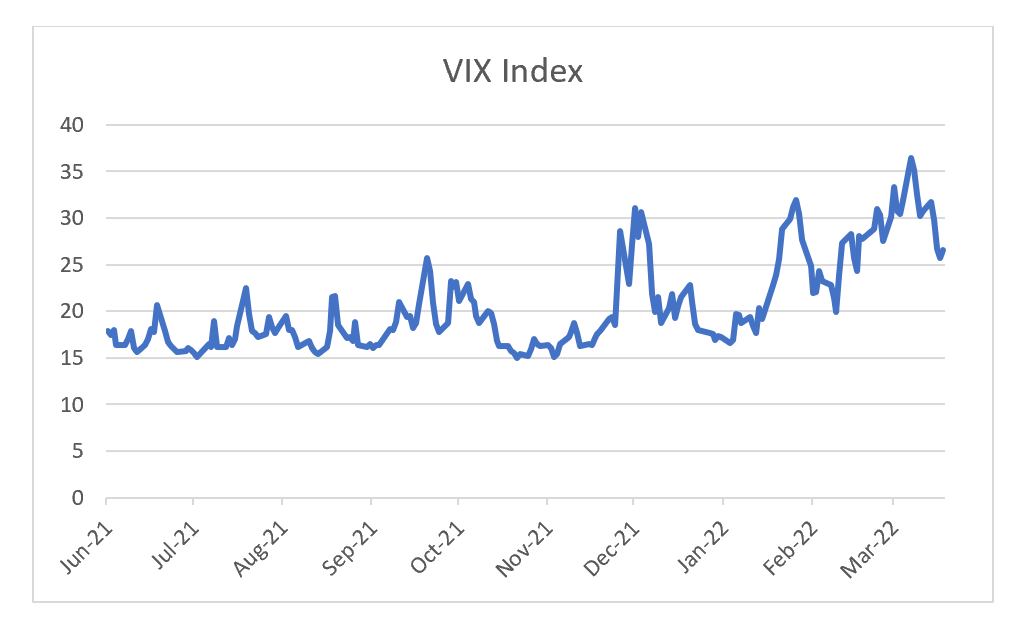

I personally also have a problem with the yield on US 5 year treasuries, which makes me think you are better off selling the rip, but treasuries will be the subject of another post. So why are markets rallying? Well my view is that markets are very sensitive to movements in VIX, which has declined from 36 to 26 today.

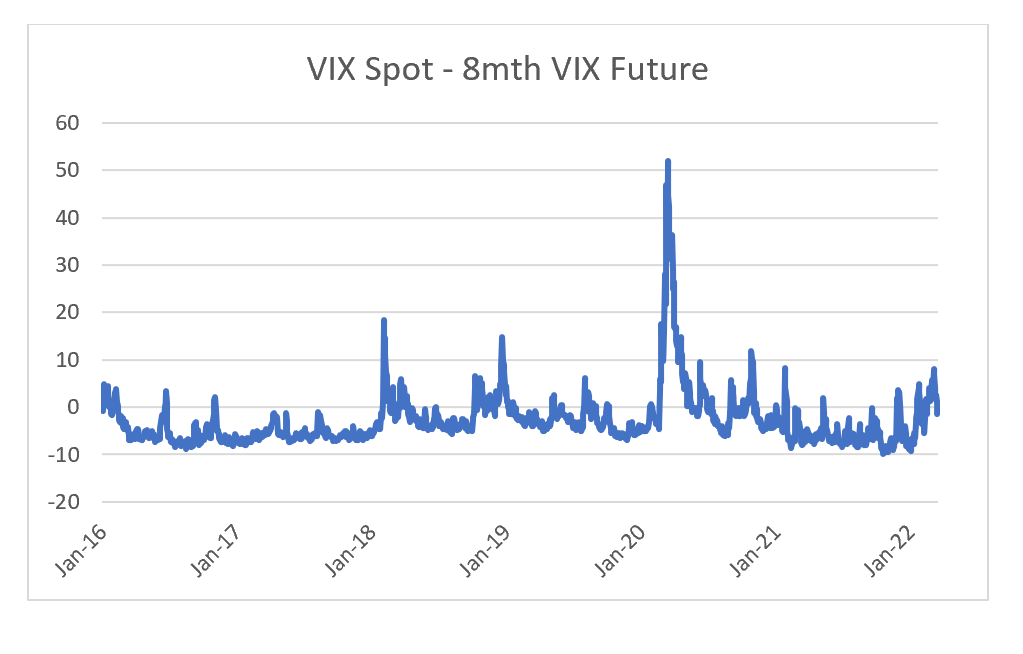

Why has VIX fallen? The VIX curve usually has longer dated VIX (8mth forward in this case) trading above spot. There are very good structural reasons for this (subject of another post). In early March, spot reached 4 points above long dated VIX, but is now back to be slightly lower than UX8.

So markets in the US are pricing in no further sell of in treasuries, and high yield spreads staying flat? My working assumption is that when food prices are rising, central banks will be less accommodating. Food prices have blasted through all time highs with the invasion of Ukraine.

In my view, unless you have some inside knowledge that Russia is about to withdraw from Ukraine, or Putin is about to meet an untimely end, it still looks like a sell the rip market to me.

BUY THE DIP OR SELL THE RIP II