In recent posts, I have been pushing the idea of long gold, short bonds (GLD/TLT) as a long term trade. One of the questions I was asked it what do I think of gold miners then? Instinctively, we think gold mining must be great. English speakers often refer to a lucrative undertaking as a gold mine. But one minute of research such as looking at the performance of a gold miners index such as NYSE ARCA Gold Bugs Index (it has a longest price history of gold miners), should tell you that always buy gold, and never buy gold miners.

Gold mining bulls tend to focus on the period from 2001 to 2008 when gold miners rose 10 times, while gold itself only rose 4 times as reason enough to be invested in gold miners.

The real question investors should be asking is why do gold miners lag the price of gold so much over a cycle. The answer has to do with the very nature of gold. Its value comes from being difficult to mine. Not only are upfront capital costs substantial, the operating costs tend to eat most of the profits. My sons were watching the quality TV show “Aussie Gold Hunters”, and at the end of the day the prospectors would proudly declare they had found USD 1,000 worth of gold. The narrator would then explain they have spent USD 700 of diesel in operating the earthmover, and when you added in living expenses etc, you quickly realised the prospectors were losing money. Newmont mining, which is the biggest and best gold miner shows how hard it is to remain profitable as a gold miner, with profits swinging wildly between losses and profits.

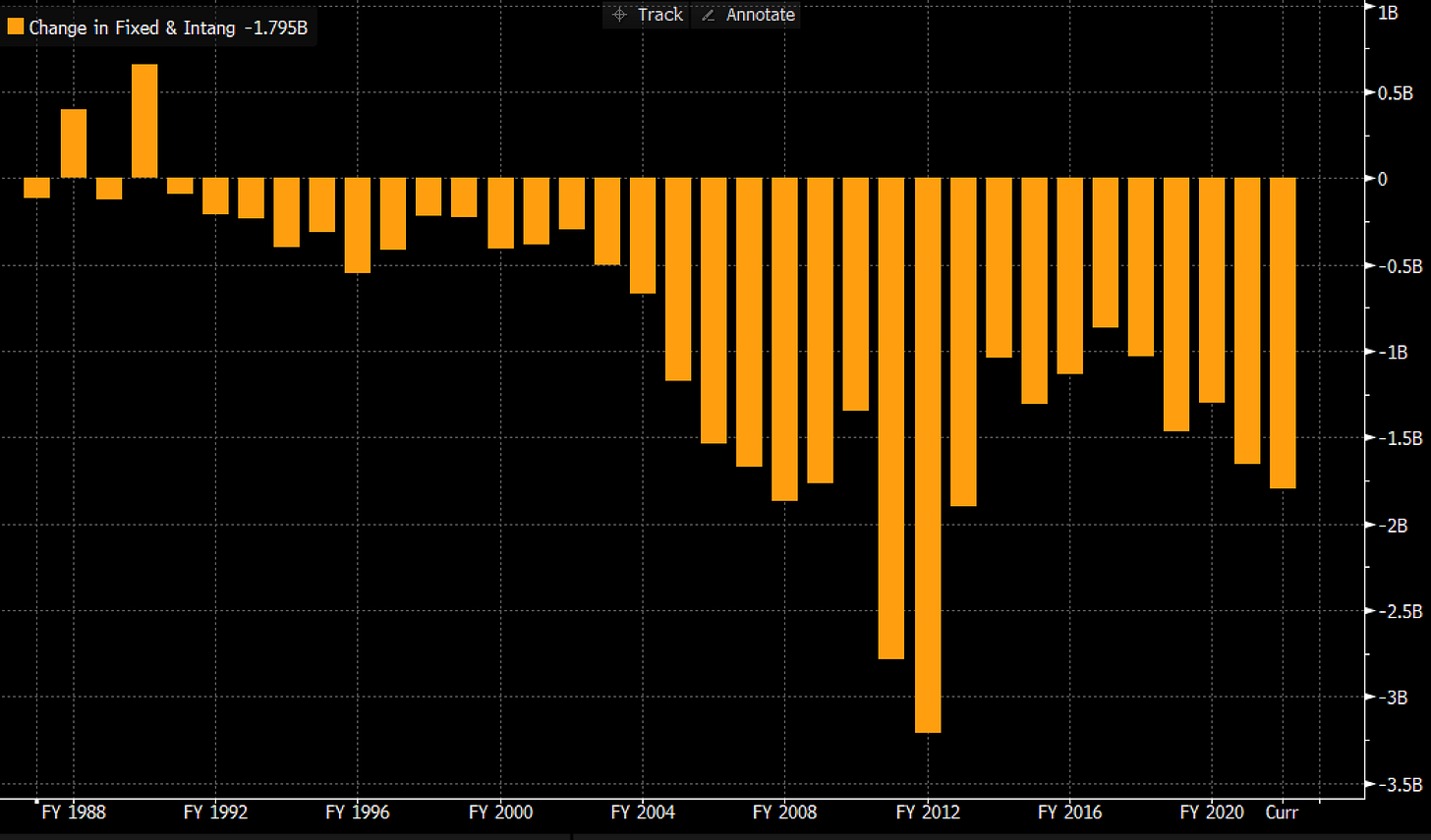

So is there a “good” time to rent gold miners? My best best would be when the industry has been starve of capital investment for some time. Looking at the history of Newmont net cash from investing activities, the 1990s saw very little investment, but even today investments remain strong.

I would suggest looking for more capital discipline from the sector before “renting” gold miners.