Dry January seem like a good time take on some BDSM (bonds - do some math). I would say market consensus is that a recession is coming, or even over due, and that the interest rate increases of the last year would be enough to tip the economy into recession. This leads to a bullish view on bonds. If we look at the treasury market, both the two year yield and the thirty year yield have flatlined, or even beginning to move lower, which we saw in 2007, and in 2018, just before buying long dated bonds was a winning trade.

Many commentators will talk about yield curve perversion inversion as a sure fire indicator for imminent recession. This is not strictly true. The maths of bonds markets means that yield curve inversion implies that short term interest are likely to be lower in the future. As you can see in 2018, short term interest rates fell even though there was no recession. Retail investors have really bought into the idea that inversion is a signal to buy long dated bonds. TLT has seen large retail buying, even as it was one of the worst major asset classes of 2022 (large institutions buy treasuries directly).

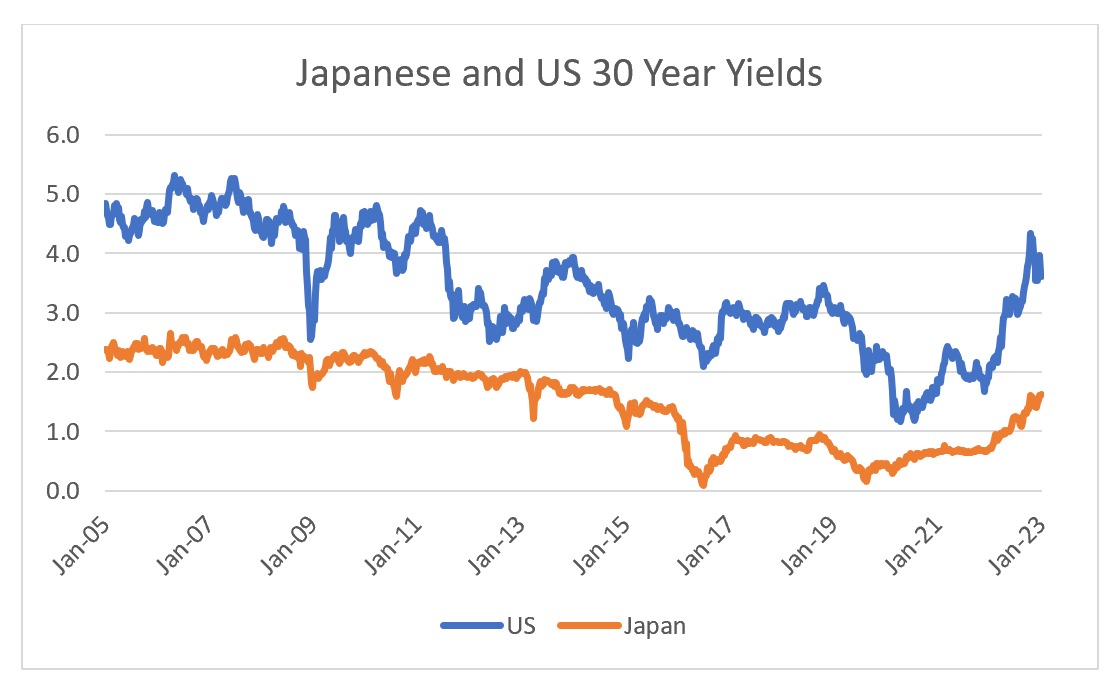

But there are a few problems with buying treasuries here. Japan is one of the largest buyers of treasuries, in fact in many ways she is the dominatrix of bond markets globally. Where Japan gives orders, everyone pretty much follows. Historically, JGB yields have led US treasury yields, and you have needed a decent yield pick up on treasuries to entice Japanese investors. Long dated JGBs still seem to be selling off, which has normally been bad for treasuries, and the yield pick up on treasuries to JGBs is okay but not great.

To pour hot wax on an already bad set up for treasuries is that Japanese investors often look at hedged returns. A simple, but these days not entirely correct way to look at hedged returns is to look at the difference between 30 year and 2 year bonds yields. So a Japanese investors could buy a 30 year bond offering a 1.5% pick up over short dated bonds, or could buy a 30 year treasury, and hedge it for 2 years, and get a negative return. With current yield curves, 30 year US treasuries hedged look unattractive to Japanese investors.

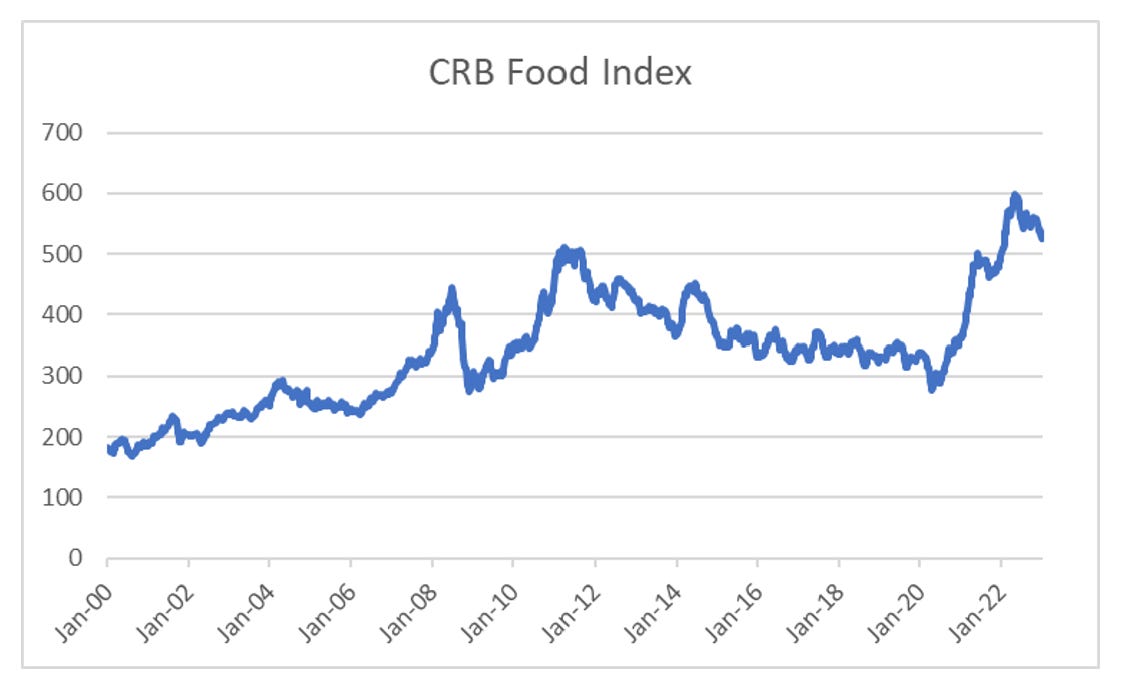

To me the basic maths of treasuries looks unattractive. But having listened to a bond bull this week, the argument was that we were through the worst of the inflation, and it was likely to drop back to the 2 to 3% range, allowing central banks to ease up, and hopefully stop beating the market down. As I have argued in previous posts, the central banks are total simps when it comes to food inflation. If food prices are weak, they can do whatever they want, but when food prices are rising, you are better off assuming they will be very active. Looking at CRB Food Index, it has weakened somewhat lately, but it has only given back a small amount of the increase we have seen in recent years.

What has the food spike meant in US food inflation terms? Well the last print was 10.4%, down from a recent peak of 11.4%. But we are looking at the highest levels of food inflation since the 1970s. Maybe that is peak pain, but I am not so sure.

Putting it all together, what do I think? I think that buyers of TLT US and 30 Year treasuries are hungry for punishment. And I am pretty sure the market is going to dish it up for them.

BONDS - DO SOME MATH