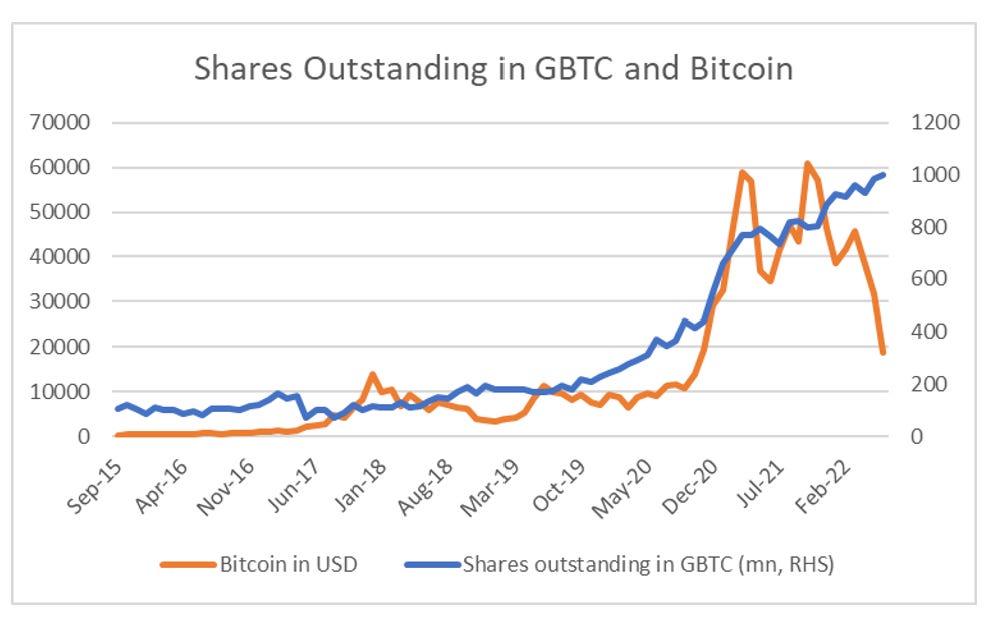

A long time ago (this IS Part 7!) I noticed that bitcoin traded more like a speculative asset than a store of value. In particularly, I noticed that Bitcoin traded much better when people were bearish of it, rather than bullish. So I started publishing this note on positioning. The first graph is shares outstanding in the Greyscale Bitcoin Trust (GBTC) versus bitcoin itself. Unlike previous bear markets in bitcoin, investors have continued to buy the dip in bitcoin.

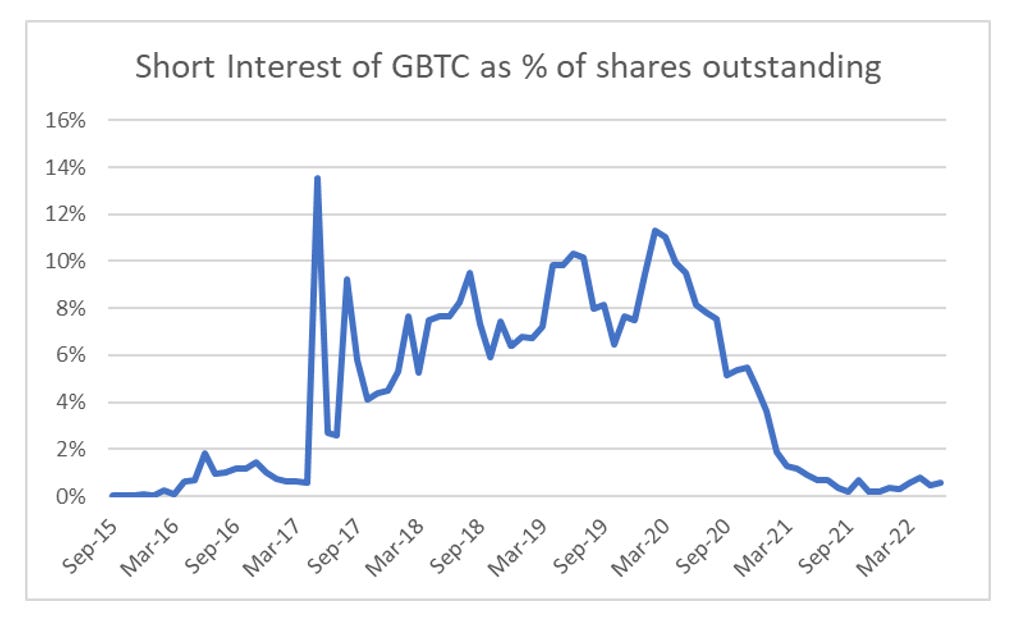

Short interest in GBTC has also collapsed, meaning the risk of a short squeeze in bitcoin is still small.

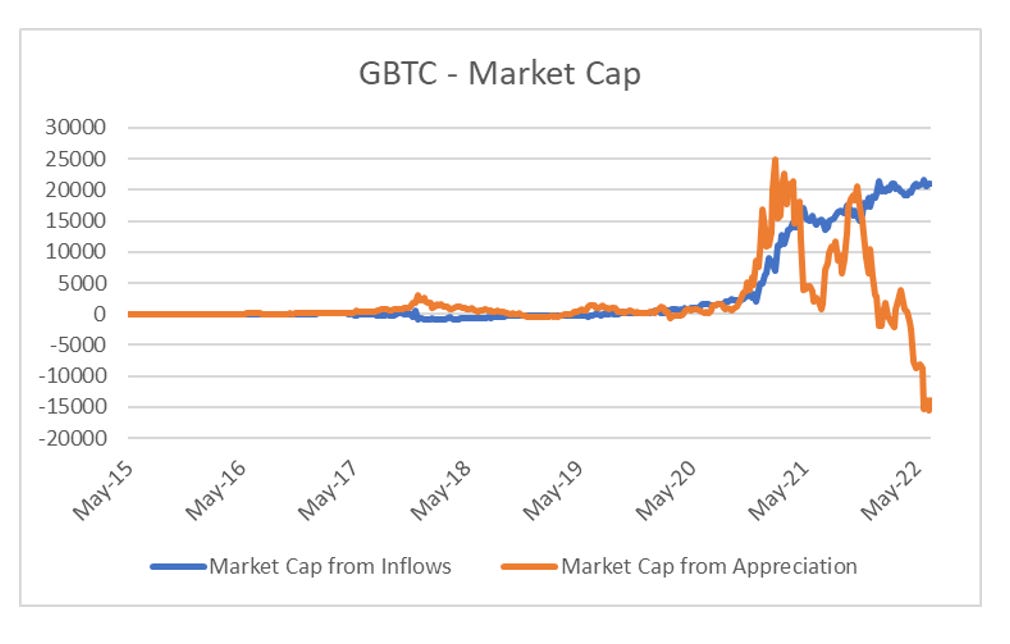

Another novel feature for the GBTC is that the average investors is sitting on a substantial loss. That is the market cap of the fund is substantially below the inflows from investors. Back in the day this was a good sign of “slope of hope” investing.

And finally, we have yet to see CME positioning in Bitcoin turn negative yet, as it did in 2020.

Bitcoin MIGHT not be a speculative asset. But at the moment it is trading LIKE a speculative asset. The bad new for Bitcoin bulls, is that positioning is very long still, despite the bear market, which for a asset that is trading like a speculative assets means more downside is likely.

BITCOIN UPDATE - PART 7