BITCOIN UPDATE 3

An update on short positioning in bitcoin

The original note on bitcoin looked at how short interest in bitcoin had fallen, and “Bitcoin Update 2” noted how the relationship between stablecoins and bitcoin has seemed to change. Some of the data I use for short interest in bitcoin only updates at month end - and as I was travelling last week, this is my first opportunity to look at it. The biggest bitcoin “ETF” - the Greyscale Bitcoin Trust (GBTC) - has continued to see inflows, even as bitcoin has been lackluster last few months.

Despite the sideways movements in bitcoin, there has been no increase in short interest in GBTC - which remains at virtually zero.

This increased “long” flow in GBTC, and with no short interest has meant that the discount to NAV for GBTC has blown out to its largest discount NAV of over 20%.

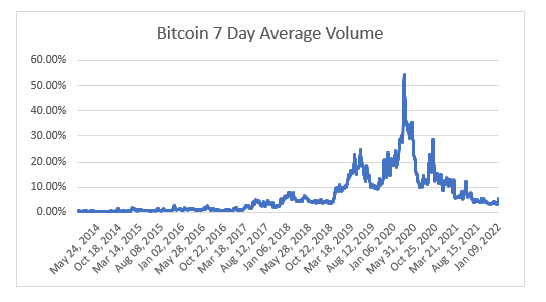

The volume traded in bitcoin (according to coinmarketcap.com) continues to fall.

This combination of falling short interest, increased retail participation, and negative market technicals reminds me very much of the negative set ups I have seen in the gold price over the years. While long term, gold has always risen, it has suffered long bear markets, from 1980 to 2000 and 2012 to 2016. I will talk more about gold in the podcast that has been released simultaneously with this note.