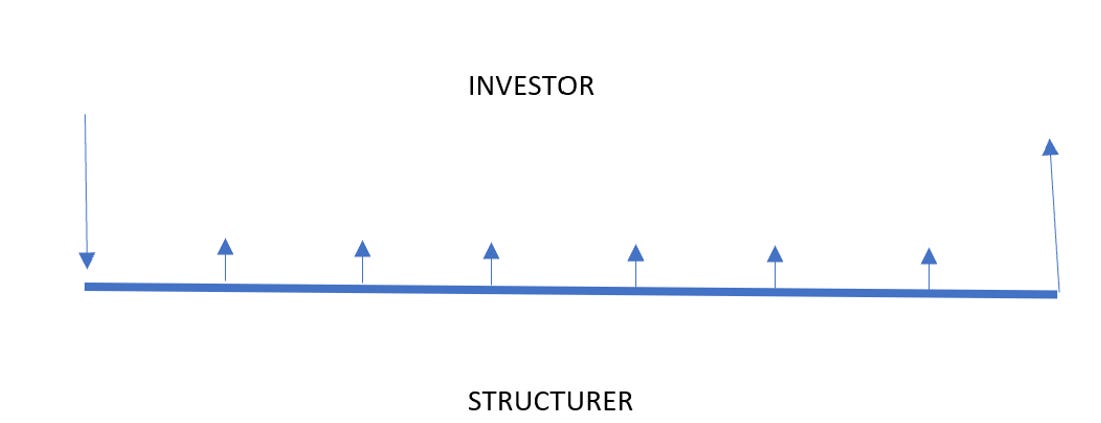

Whenever you ask bank or dealers about autocallables and its effect on implied volatility, the answer will be either -”it depends”, or a very long discussion about gamma and delta hedging. As I am not a options expert, I am going to give you my observations. Not all of this is provable, but it makes sense to me. The first thing you need to remember is that autocallables represent a liability to the bank. However each coupon payment and principal payment is a contingent liability, that is the payment of the coupon and principal will depend on the underlying movement in the index. Forgive my wonky graphic design work.

The problem with autocallables is that they are being constantly issued, and their knock in and knock out prices will vary according to where markets are currently pricing, and what sort of yield the investor wants. That makes working out where a big market barrier that might cause implied volatility to trade funny. However, we know three things about autocallables that help. First the knock in barrier tends not to be too far above recent all time highs. Secondly, typically nice round numbers are used as barriers. And thirdly, most autocallable structures are rolled over when they get called. Autocallable volume only declines when they get knocked in and investors lose capital. We can use these details to then examine the one market where autocallables were definitely knocked in - HSCEI in 2016.

HSCEI had been trading in a range between 9000 and 12500 since 2011. relatively high dividend yield and implied volatility made this a very popular market for Korean autocallables. VHSCEI tagged a very low level of 15 during 2014 when issuance was strong. In late 2015, the Chinese government announced a program to try and boost Chinese stocks, and the HSCEI suddenly broke out of its range to trade above 14000. My working assumption is that the most of all outstanding autocallables issued in the 2012 onwards would have been knocked out, and then restruck. You can see how VHSCEI actually rose when the 14000 barrier was passed, as suddenly a huge amount of principal moved back to retail, and needed to be repriced.

Given the very successful experience investing in HSCEI autocallables, and government support of the market, I suspect most knocked out autocallables were restruck at the 14000 level.