Ever since the GFC, hedge funds have been itching to short Australian property. If we use OECD measures of house price to income, Australian property has continued to rise continuously since the 1980s. It is also clear that Australian banks recovered from the GFC in a way that both American and Japanese banks failed to do so.

For anyone who grew up or has lived in Australia, the current property market feels very expensive. I recently made aware of a house being sold for AUD 10 million is a small seaside town of Mollymook (15 Shipton Crescent) which is basically a 3-hour drive from either Sydney or Canberra. Population of Mollymook and nearby Ulladulla is maybe 50,000 people. While Mollymook beach is lovely, Australia has many lovely beaches, making this price very hard to understand. The problem is that when we look at big macro indicator of OECD house price to income ratios from the 1970s, we are confronted with the idea not that how expensive Australian property is now, but how cheap it was in 1990s. The real conclusion seems to be that since 2000, property markets have become globalised, and cheap markets like Australia have been pushed up to world prices. This makes more sense to me. It is surprisingly difficult to be bearish on a single housing market such as Australia without getting bearish on all of them.

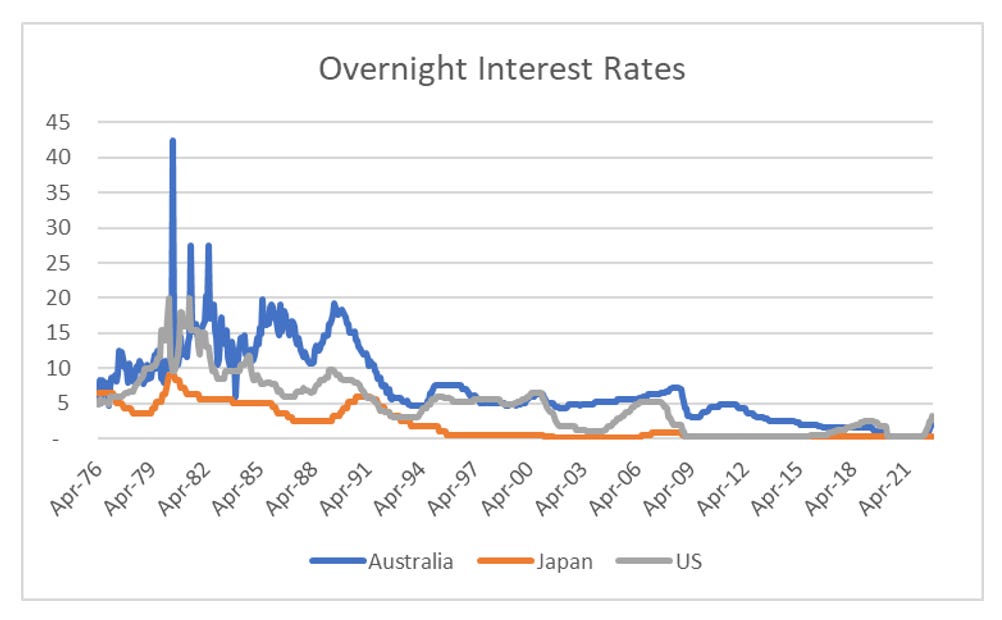

The differences in house prices are direct reflection of differing interest rates. While most investors talk of very high interest rates in the 1970s, Australian interest rates remained high until the early 1990s (Paul Keating’s “the recession we had to have”). The conclusion that since 2000 we have been living in an era of globalised interest rates and globalised property market is hard to shake.

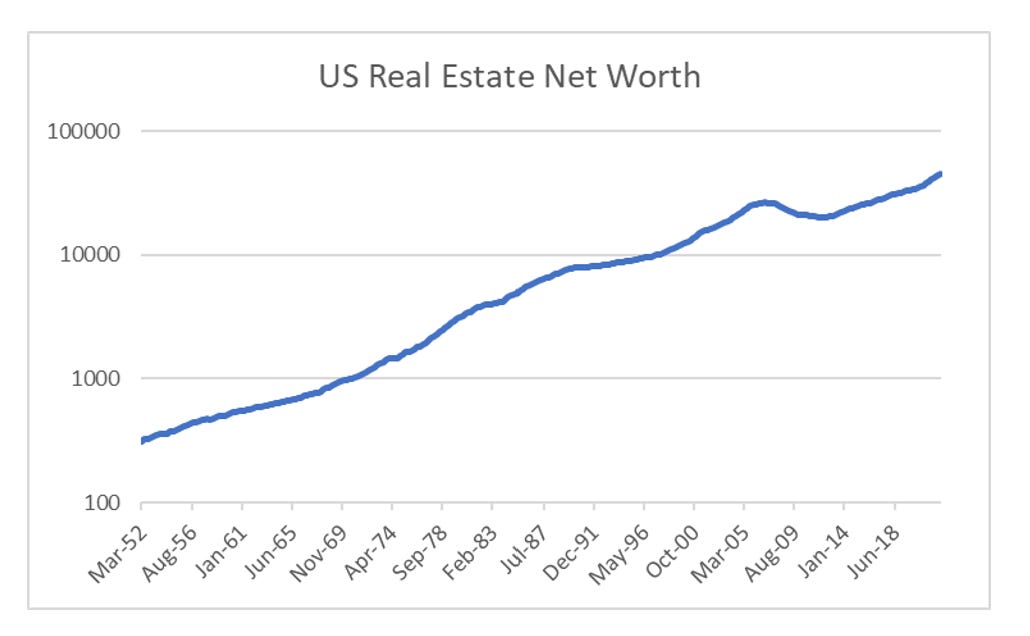

My base view is that inflation is returning as policy makers are forced to make policy pro labour instead of pro capital. And this will be a globalised event. Instinctively we believe higher interest rates implies lower property prices. But in an age of rising incomes (ie pro labour policies) property prices are unlikely to fall. Using the Federal Reserve Net Worth index, we can see that despite it feeling like house prices have risen a lot in the last 20 years or so, they are nothing like the increase we saw during the pro labour period from 1950 to 1980.

In a pro labour period, interest rates rise to try and restrain growth, not support it. It makes me suspect that banks are not a good inflation trade. If I look at the long-term performance of two key Australian banks, WestPac and ANZ, what is surprising is how much they have underperformed Australian property over that time. From 1974 to 2022, most Australian property has probably risen 50 times. Banks have paid out dividends, but property also pays rent, so I will ignore both for simplicity.

What does it all mean? In a pro labour world, avoid financial assets, and buy real assets like land and commodities. Banks are likely to relatively underperform. Or in a pro-labour world, rich people are really going to struggle to find strategies that generate “real” returns.