Generally speaking, it has been better to be short the average bank over the last twenty years or so. There are of course some exceptions to the rule, but in general the average bank has been pretty poor. It is not hard to understand why banks have been such bad businesses. Lending is a commodity, and you can really only compete on prices. The real value of banks historically has been the ability to raise cheap deposits, but with central banks essentially getting into the business of directly lending, having a large safe deposit base has been generally worthless. Japanese banks, who have spent a generation with low bond yields have been value trap for as long as I have been an investor (although I was long of them in 2004/5 period)

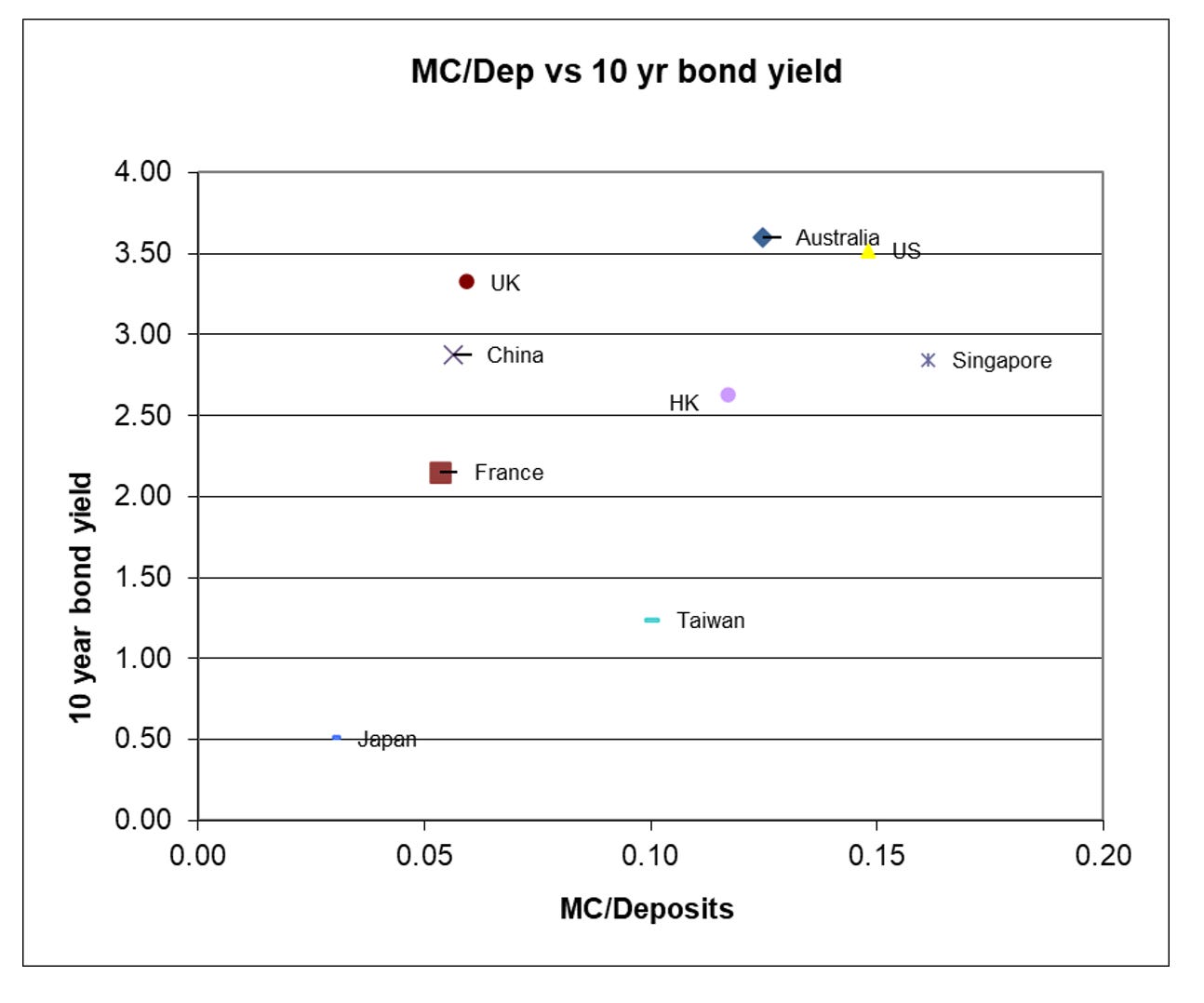

Japanese banks are cheap on my favoured measure, which is market cap to deposits. The problem is that they make a very low return on assets. I have tried to show this through a cross country comparison

Low bond yields and a low valuation for deposits go broadly together.

Perhaps a better way of looking at is the relative performance of Japanese banks, and the movement in JGB yields.

Japanese banks have been driven by very low inflation, and very low bond yields. My working view is that higher food prices and wages move together. I am not sure about causation, but if they do not move together governments risk significant political pressure. In Japan, we have begun to see food inflation, and we have suddenly seen a change in policy at the BOJ. My view is that food inflation is structural, so I expect to see wages rise, and inflation to continue to rise for the foreseeable future. In 1990 Japanese restaurants were the most expensive in the world. These days they are among the cheapest - so I expect more upward bias here.

From a foreigners perspective, buying Japanese banks also allows you to buy Japanese domestic assets at very cheap levels.

So are Japanese banks a buy? Probably yes, but your biggest risk is that China changes policy, and devalues, creating a deflationary wave. But from what I can see at the moment, risk reward looks good.