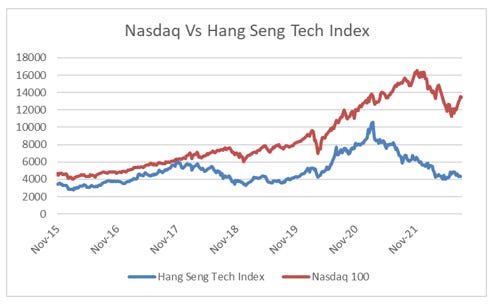

Ever since the Chinese government decided to go after its domestic tech industry in 2021, I have been thinking more and more about how politics affects markets. Looking at the huge difference in returns between Chinese tech and US tech, probably most investors should also be thinking about this.

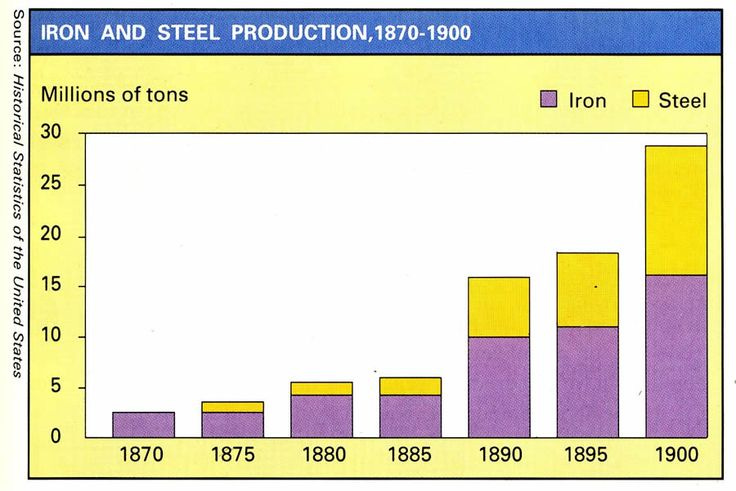

In my mind there are three distinct periods of American capitalism and equity investing, a classical period, a pro-labour period, and a neo-classical period. The classical period, which essentially began with industrialisation, believed in the free market pricing of all goods, services and wages. This period ran from late 1800s to 1939. This was a period of tremendous growth. The US then was the China of the world today.

There would be brief periods of slowdown, but growth would soon return. The governments of the time tended to be extremely laissez faire, allowing markets to adjust the prices of good and wages according to supply and demand. Sudden periods of oversupply would cause market crashes and panics, in both 1873, 1893, 1907 and a Depression in 1920-21. The US Dollar was also pegged to gold. The upshot of this small government, hands off approach was that the politically important food inflation was non existent.

From an investing perspective, it was possible for businesses to grow at a very rapid rate, but there was always the risk of deflationary bust. It was the era that created the wealth of the Rockefellers, Carnegie, Ford and other industrial titans. Financially two figures have endured in the financial market hive mind - John Pierpont Morgan and that most famous of short sellers, Jesse Livermore. It was a period that offered no guarantees to either labour or capital, but swings between extremes.

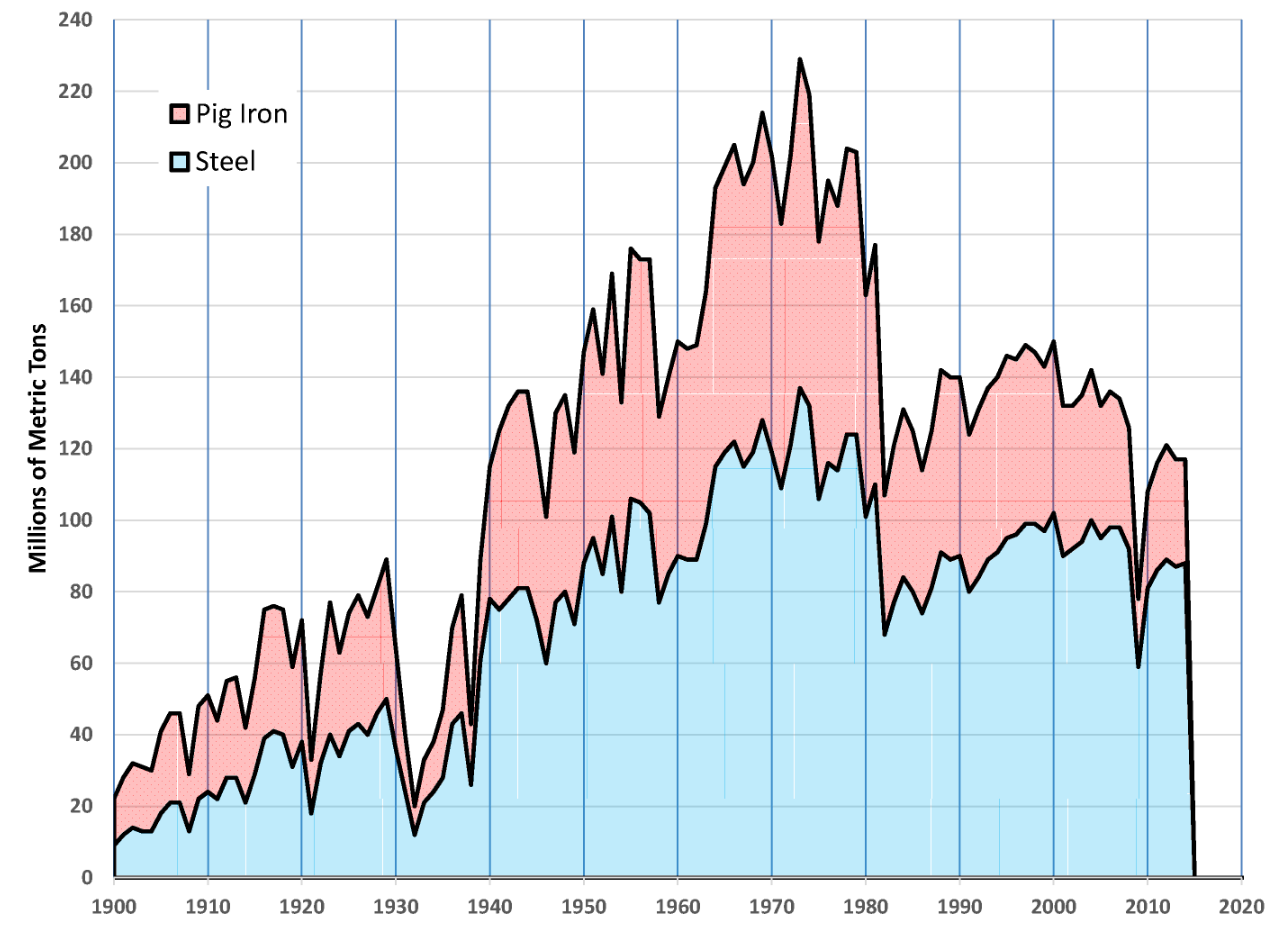

The Great Depression as well as the deprivations of World War II created the political impetuous for huge political changes. And we then entered the second period of American capitalism - a big government pro labour era. Government policy focused on full employment and rising wages. This period ran from 1939 through to 1979. In essence, FDR offered businesses a government mandated cartel which would allow companies to raise prices, if and only if, the cartel members also raised wages. This was the era of pro labour, big government. Rising wages created rising inflation.

Wage growth led policy was very successful in banishing the depression era, and US industrial activity surged. Physical activity finally recaptured highs not seen since the late 1920s.

From an investing perspective, long commodities and short bonds were the stand out trade. Farmland, a commodity proxy, outperformed the S&P over this period for example.

The third period is from 1980 through to 2016. This is the neo-classical period. Markets were used to set prices of all things, and real wages were able to fall, sometimes dramatically. Efficiency was prized over social equity. If it was cheaper to source cars and steel in Japan, then that was welcomed. It was also accompanied by a dramatic slow down in government spending. We can see how dramatic the slowdown was in the 1980s, and how large the increase has been in recent years.

The post 1980s period has many similarities to the classical period. The opening up and industrialisation of the world has been wonderful for large corporates, but has also been a period of collapsing prices. Think of lost decades of Japan, Asian Financial Crisis, the dot com bust, the GFC and Eurocrisis. Warren Buffett has been the J.P Morgan of this era. Holding cash, and buying the market when necessary. While the Jesse Livermore of this period has been George Soros. Both have been phenomenally successful.

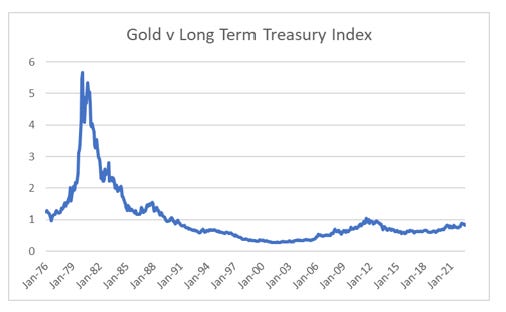

Coming back to the original graph, showing the outperformance of US tech versus Chinese tech, is being driven by China moving away from neo-classical and back to a pro-labour big government policy. This means increasing restrictions on what corporates can and can not do. Increasing share of wealth being redistributed to labour, through higher taxes and bigger transfers. What is happening in China is spreading globally in my opinion. As China focuses on real wages, this is pushing up commodity prices - particularly food prices - encourage voters elsewhere to support pro-labour governments. This is already happening. If we take a long term graph of US treasuries vs gold, we can see the trend change back towards inflationary assets (gold) and away from deflationary assets (bonds).

The implication is that it will be very difficult to make money in equities, either long or short. Rising prices is good for equities, but rising bond yields and tax rates are negative. I suspect the next 10 to 20 years will see neither the emergence of a new Warren Buffett or George Soros, but perhaps we will see a new Goldfinger….